Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Santasi and Patasi are in partnership sharing profits and losses in the ratio 3:2. They decided to amalgamate their firm with that of another

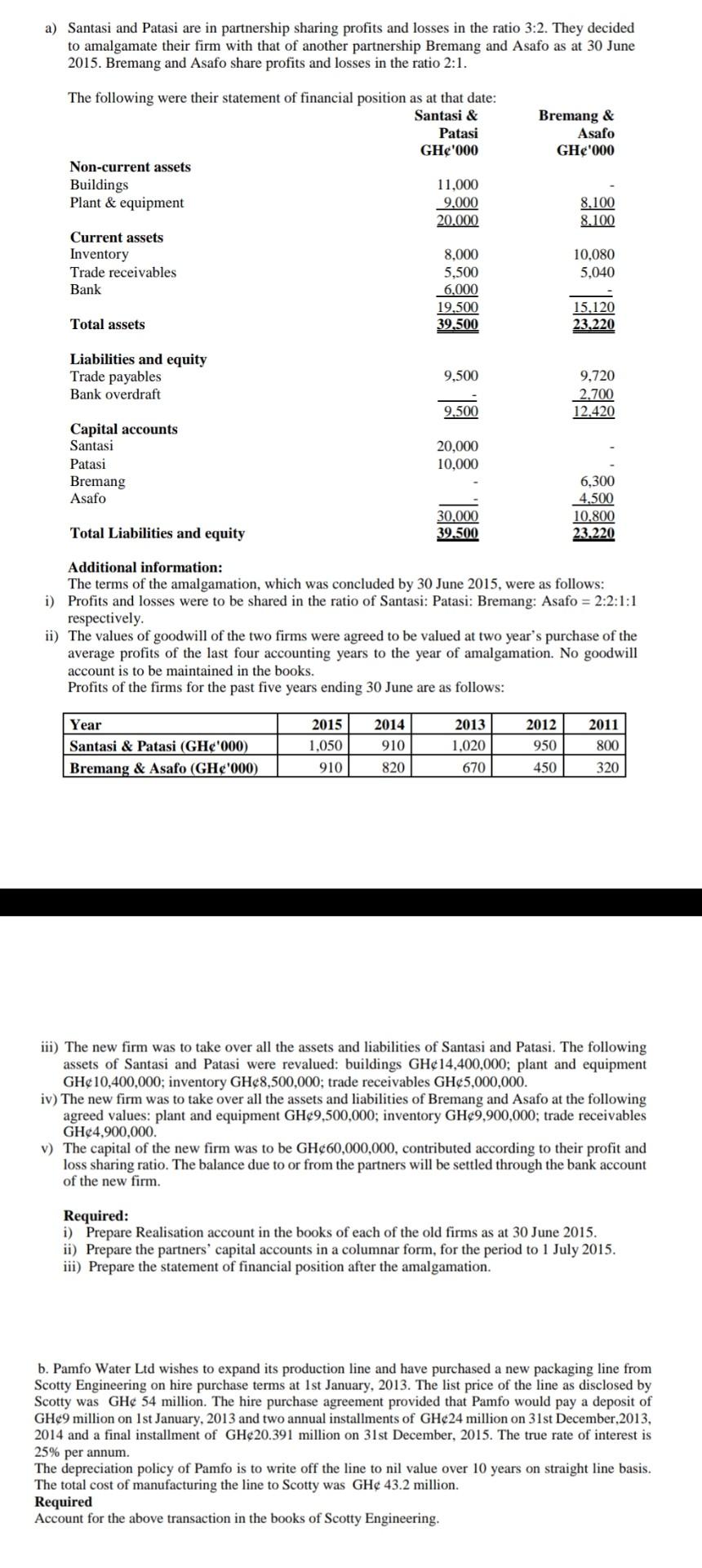

a) Santasi and Patasi are in partnership sharing profits and losses in the ratio 3:2. They decided to amalgamate their firm with that of another partnership Bremang and Asafo as at 30 June 2015. Bremang and Asafo share profits and losses in the ratio 2:1. Bremang & Asafo GH'000 The following were their statement of financial position as at that date: Santasi & Patasi GH'000 Non-current assets Buildings 11,000 Plant & equipment 9,000 20.000 Current assets Inventory 8,000 Trade receivables 5,500 Bank 6.000 19.500 Total assets 39,500 8.100 8.100 10,080 5,040 15.120 23.220 Liabilities and equity Trade payables Bank overdraft 9,500 9,720 2.700 12.420 9.500 Capital accounts Santasi Patasi Bremang Asafo 20,000 10,000 6,300 4,500 10.800 23.220 Total Liabilities and equity 30,000 39.500 Additional information: The terms of the amalgamation, which was concluded by 30 June 2015, were as follows: i) Profits and losses were to be shared in the ratio of Santasi: Patasi: Bremang: Asafo = 2:2:1:1 respectively. ii) The values of goodwill of the two firms were agreed to be valued at two year's purchase of the average profits of the last four accounting years to the year of amalgamation. No goodwill account is to be maintained in the books. Profits of the firms for the past five years ending 30 June are as follows: Year Santasi & Patasi (GH('000) Bremang & Asafo (GH('000) 2015 1,050 910 2014 910 820 2013 1,020 670 2012 950 2011 800 450 320 iii) The new firm was to take over all the assets and liabilities of Santasi and Patasi. The following assets of Santasi and Patasi were revalued: buildings GH14,400,000; plant and equipment GH10,400,000; inventory GH8,500,000; trade receivables GH5,000,000. iv) The new firm was to take over all the assets and liabilities of Bremang and Asafo at the following agreed values: plant and equipment GH9,500,000; inventory GH9,900,000; trade receivables GH4,900,000. v) The capital of the new firm was to be GH60,000,000, contributed according to their profit and loss sharing ratio. The balance due to or from the partners will be settled through the bank account of the new firm. Required: i) Prepare Realisation account in the books of each of the old firms as at 30 June 2015. ii) Prepare the partners' capital accounts in a columnar form, for the period to 1 July 2015. iii) Prepare the statement of financial position after the amalgamation. b. Pamfo Water Ltd wishes to expand its production line and have purchased a new packaging line from Scotty Engineering on hire purchase terms at 1st January, 2013. The list price of the line as disclosed by Scotty was GH 54 million. The hire purchase agreement provided that Pamfo would pay a deposit of GH9 million on 1st January, 2013 and two annual installments of GH24 million on 31st December 2013, 2014 and a final installment of GH20.391 million on 31st December, 2015. The true rate of interest is 25% per annum. The depreciation policy of Pamfo is to write off the line to nil value over 10 years on straight line basis. The total cost of manufacturing the line to Scotty was GH 43.2 million. Required Account for the above transaction in the books of Scotty Engineering

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started