Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a.) Seasoned system analysts will always start by conducting feasibility studies of the project at hand. Why? b.) Consider the following case then answer

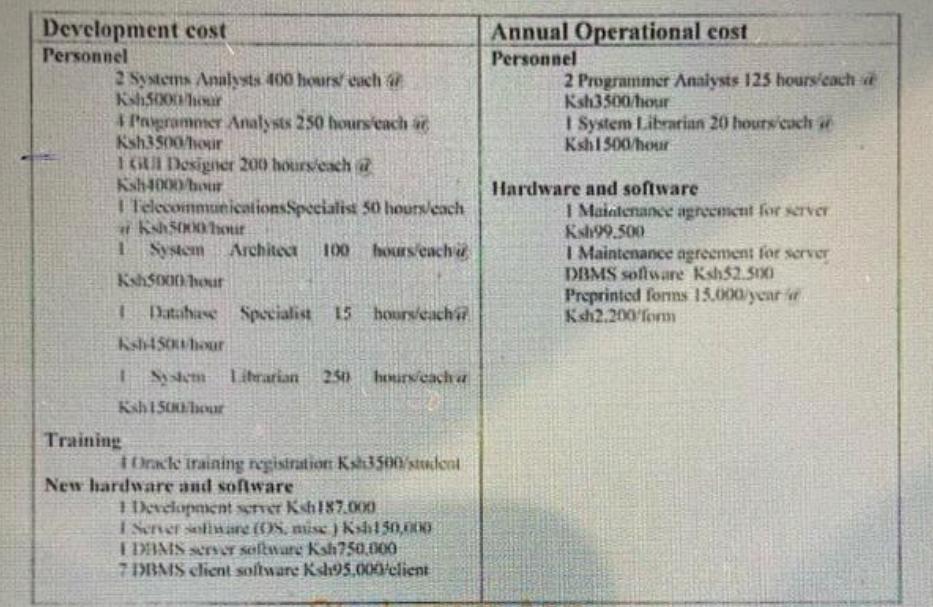

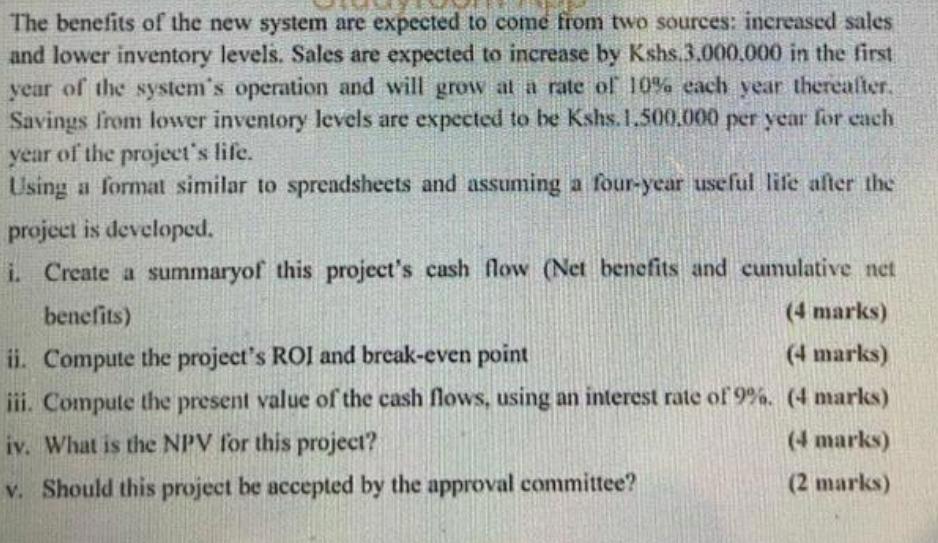

a.) Seasoned system analysts will always start by conducting feasibility studies of the project at hand. Why? b.) Consider the following case then answer the questions below it (i to v) (2 marks) Nyambati is working to develop a preliminary cost-benefit analysis for a new client- server system. He has identified a number of cost factors and values for the new system, summarized in the following tables: Development cost Personnel 2 Systems Analysts 400 hours each Ksh5000/hour Training 4 Programmer Analysts 250 hours each ar Ksh3500/hour 1 GUI Designer 200 hours/each @ Ksh4000/hour 1 TelecommunicationsSpecialist 50 hours/each Ksh5000 hour 1 System Architect 100 hours each Ksh5000 hour 1 Database Specialist 15 hours/cach Ksh4500/hour 1 System Librarian 250 hours each a Ksh 1500/hour Oracle training registration Ksh3500/student New hardware and software 1 Development server Ksh187,000 I Server sollware (08, misc) Ksh150,000 IDBMS server software Ksh750,000 7 DBMS client software Ksh95.000/client Annual Operational cost Personnel 2 Programmer Analysts 125 hours/cache Ksh3500/hour 1 System Librarian 20 hours/cach Ksh1500/hour Hardware and software I Maintenance agreement for server Ksh99.500 I Maintenance agreement for server DBMS software Ksh52.500 Preprinted forms 15,000/year Ksh2.200 Torm The benefits of the new system are expected to come from two sources: increased sales and lower inventory levels. Sales are expected to increase by Kshs.3.000.000 in the first year of the system's operation and will grow at a rate of 10% each year thereafter. Savings from lower inventory levels are expected to be Kshs.1,500,000 per year for each year of the project's life. Using a format similar to spreadsheets and assuming a four-year useful life after the project is developed. i. Create a summaryof this project's cash flow (Net benefits and cumulative net benefits) ii. Compute the project's ROI and break-even point (4 marks) (4 marks) iii. Compute the present value of the cash flows, using an interest rate of 9%. (4 marks) iv. What is the NPV for this project? v. Should this project be accepted by the approval committee? (4 marks) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started