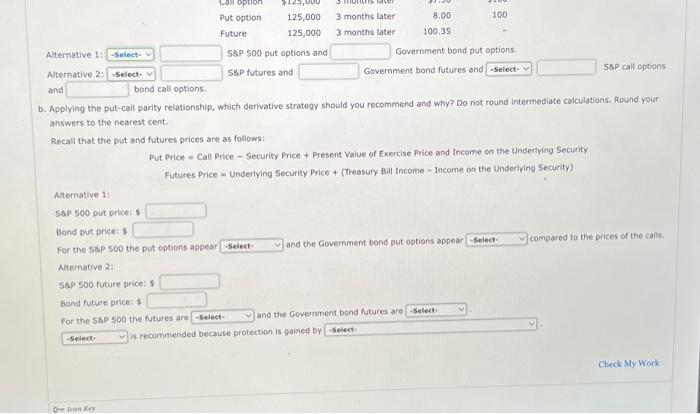

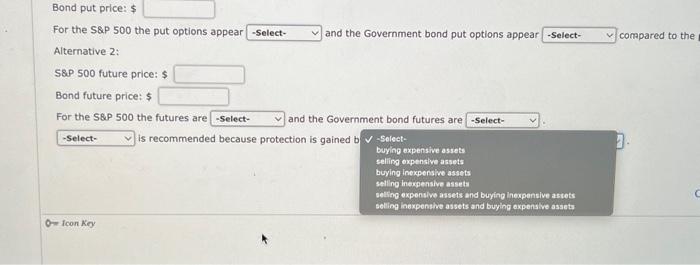

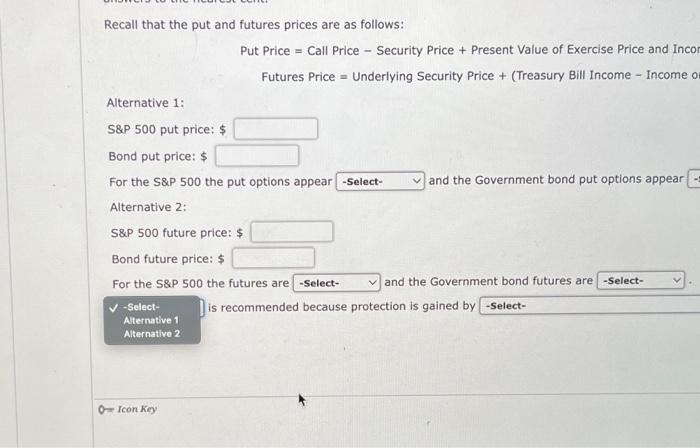

Question: A selects: buy or sell B selects: undervalued or overvalued For the S&P 500 the put options appear and the Government bond put options appear

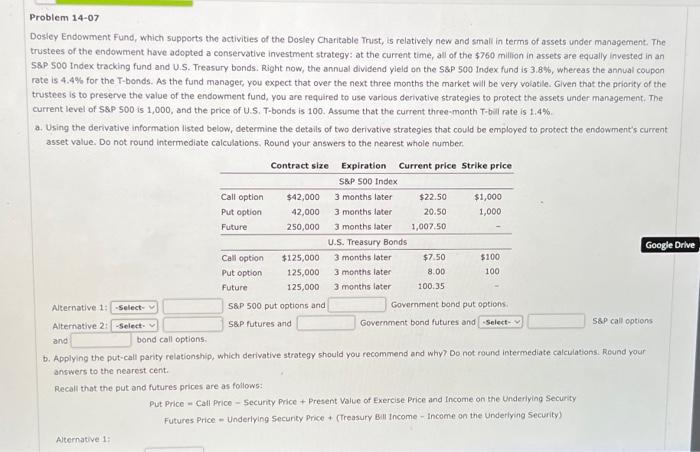

For the S\&P 500 the put options appear and the Government bond put options appear compared to the Alternative 2: S8P 500 future price: $ Bond future price: $ For the S\&P 500 the futures are and the Government bond futures are is recommended because protection is gained b Dosley Endowment Fund, which supports the activities of the Dosley Charitable Trust, is relatively new and small in terms of assets under management. The trustees of the endowment have adopted a conservative investment strategy: at the current time, all of the $760 million in assets are equally invested in an S8P. 500 Index tracking fund and U.S. Treasury bonds. Right now, the annual dividend yield on the S8P 500 Index fund is 3.8%, whereas the annual coupon rate is 4.4% for the T-bonds. As the fund manager, you expect that over the next three months the market will be very volatile. Given that the priority of the trustees is to preserve the value of the endowment fund, you are required to use various derivative strategies to protect the assets under management, The current level of SAP 500 is 1,000, and the price of U.S. T-bonds is 100. Assume that the current three-month T-bal rate is 1.4%. a. Using the derivative information listed below, determine the details of two derivative strategies that could be employed to protect the endowment's current asset value. Do not round intermediate calculations. Round your answers to the nearest whole number. answers to the nearest cent. Recall that the put and futures prices are as follows: Put Price = Call Price 5ecunty Price + Present Value of Exereise Price and Income on the Underiying Secunty Futures Price - Underlying Secunty Price + (Treasury Bull Income - income on the Underlying Security) Recall that the put and futures prices are as follows: PutPrice=CallPriceSecurityPrice+PresentValueofExercisePriceandIncoFuturesPrice=UnderlyingSecurityPrice+(TreasuryBillIncomeIncome0 Alternative 1: S\&P 500 put price: $ Bond put price: \$ For the S\&P 500 the put options appear and the Government bond put options appear Alternative 2: S\&P 500 future price: $ Bond future price: $ For the S\&P 500 the futures are and the Government bond futures are is recommended because protection is gained by Aiternative 1: Sse 500 put price: $ Bond put price: 5 for the 58P 500 the put options appear and the Government bond put options appear compared to the prices of the calls. Aternative 2: S8p 500 future price: $ Bond future price: 5 For the SAP 500 the futures are and the Government bond futures are is recommended because protection is gained by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts