Question

A self-employed taxpayer may be eligible to deduct amounts paid for medical insurance for themselves and for their families. To claim this deduction, a

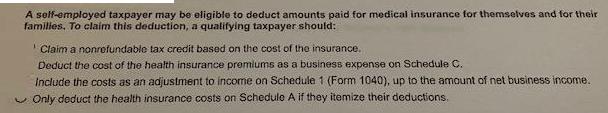

A self-employed taxpayer may be eligible to deduct amounts paid for medical insurance for themselves and for their families. To claim this deduction, a qualifying taxpayer should: 1 Claim a nonrefundable tax credit based on the cost of the insurance. Deduct the cost of the health insurance premiums as a business expense on Schedule C. Include the costs as an adjustment to income on Schedule 1 (Form 1040), up to the amount of net business income. Only deduct the health insurance costs on Schedule A if they itemize their deductions.

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To claim a deduction for health insurance premiums as a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Elementary Linear Algebra with Applications

Authors: Howard Anton, Chris Rorres

9th edition

471669598, 978-0471669593

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App