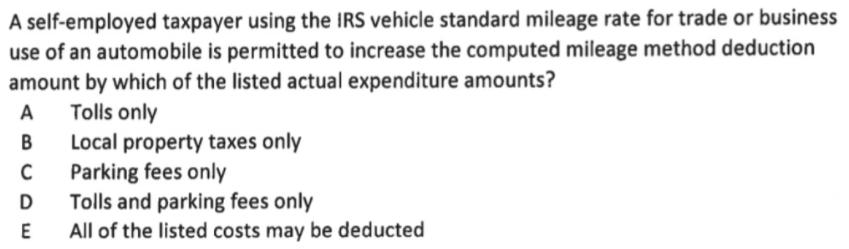

A self-employed taxpayer using the IRS vehicle standard mileage rate for trade or business use of an automobile is permitted to increase the computed

A self-employed taxpayer using the IRS vehicle standard mileage rate for trade or business use of an automobile is permitted to increase the computed mileage method deduction amount by which of the listed actual expenditure amounts? A Tolls only B C D E Local property taxes only Parking fees only Tolls and parking fees only All of the listed costs may be deducted Do not assume that a taxpayer makes an IRC 179 election or uses bonus depreciation unless a problem so states. For each question you answer, insert in the appropriate space on the separate answer sheet the letter which indicates the correct response. Please note than all final answers have been rounded to the nearest $10.

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer A Tolls only Selfemployed taxpayers may increase the computed mileage method deduction amount by the amount of tolls only This means that tolls may be subtracted from the total cost of the trip ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started