Answered step by step

Verified Expert Solution

Question

1 Approved Answer

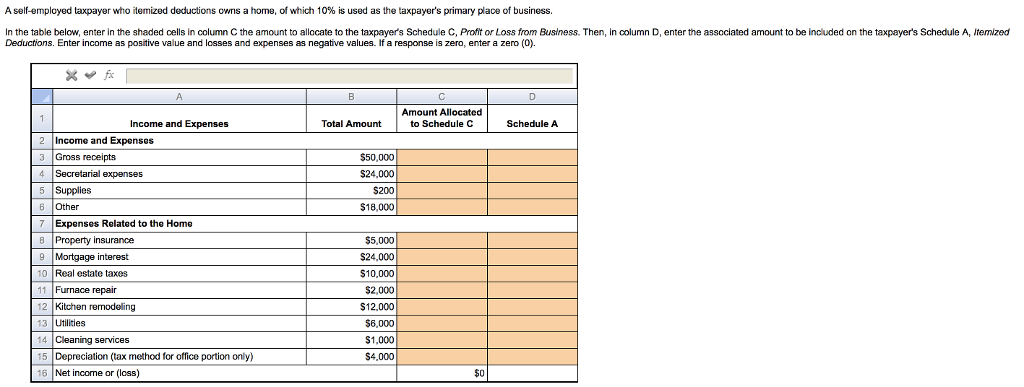

A self-employed taxpayer who itemized deductions owns a home, of which 10% is used as the taxpayer's primary place of business. In the table below,

A self-employed taxpayer who itemized deductions owns a home, of which 10% is used as the taxpayer's primary place of business. In the table below, enter in the shaded cells in column C the amount to allocate to the taxpayer's Schedule C, Profit or Loss from Business. Then, in column D, enter the associated amount to be included on the taxpayer's Schedule A, Itemized Deductions. Enter income as positive value and losses and expenses as negative values. If a response is zero, enter a zero (0)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started