Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A senior vice president of the ABC Construction Company is facing a decision problem. He hired you as a consultant to help him analyze

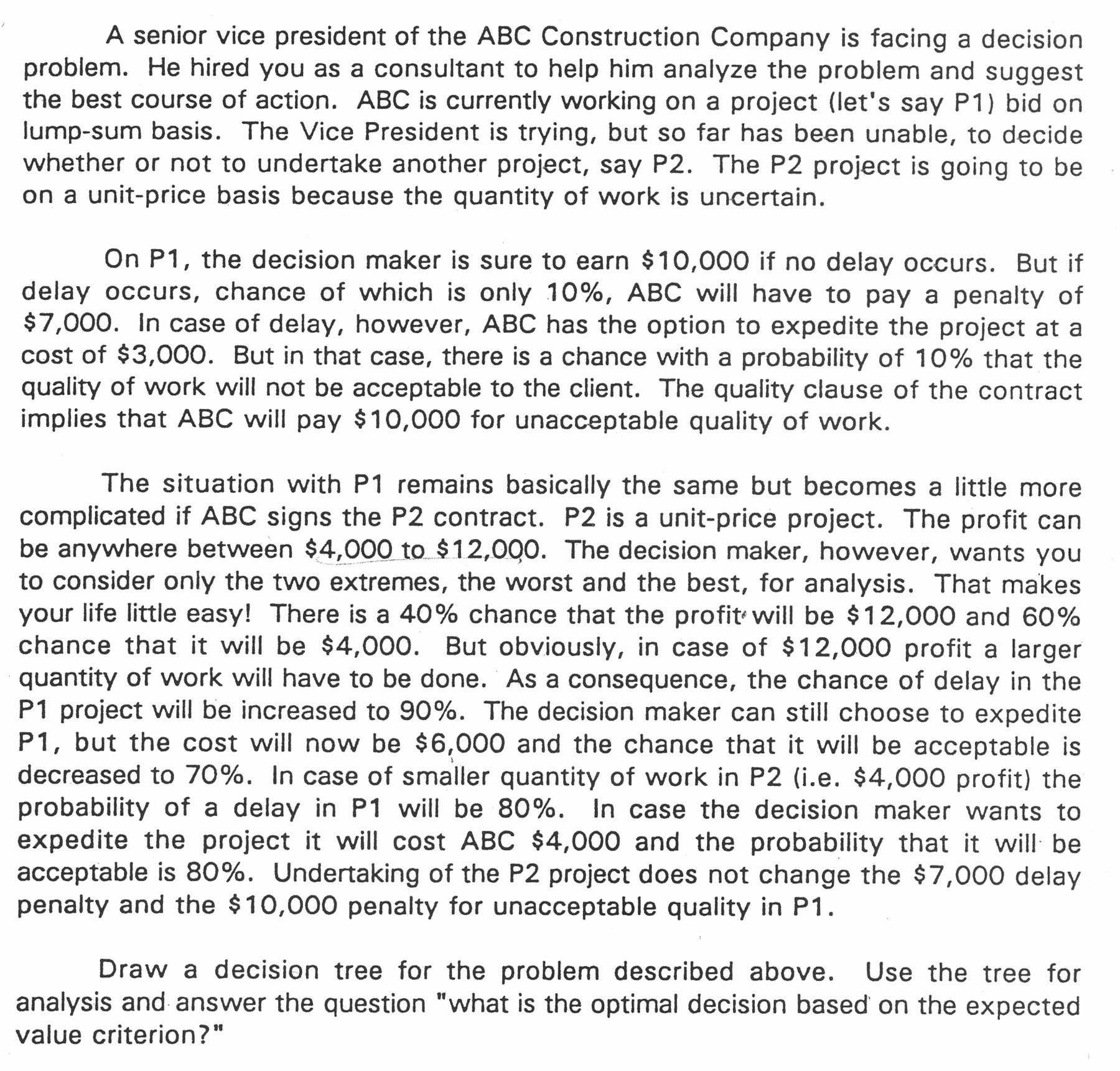

A senior vice president of the ABC Construction Company is facing a decision problem. He hired you as a consultant to help him analyze the problem and suggest the best course of action. ABC is currently working on a project (let's say P1) bid on lump-sum basis. The Vice President is trying, but so far has been unable, to decide whether or not to undertake another project, say P2. The P2 project is going to be on a unit-price basis because the quantity of work is uncertain. On P1, the decision maker is sure to earn $10,000 if no delay occurs. But if delay occurs, chance of which is only 10%, ABC will have to pay a penalty of $7,000. In case of delay, however, ABC has the option to expedite the project at a cost of $3,000. But in that case, there is a chance with a probability of 10% that the quality of work will not be acceptable to the client. The quality clause of the contract implies that ABC will pay $10,000 for unacceptable quality of work. The situation with P1 remains basically the same but becomes a little more complicated if ABC signs the P2 contract. P2 is a unit-price project. The profit can be anywhere between $4,000 to $12,000. The decision maker, however, wants you to consider only the two extremes, the worst and the best, for analysis. That makes your life little easy! There is a 40% chance that the profit will be $12,000 and 60% chance that it will be $4,000. But obviously, in case of $12,000 profit a larger quantity of work will have to be done. As a consequence, the chance of delay in the P1 project will be increased to 90%. The decision maker can still choose to expedite P1, but the cost will now be $6,000 and the chance that it will be acceptable is decreased to 70%. In case of smaller quantity of work in P2 (i.e. $4,000 profit) the probability of a delay in P1 will be 80%. In case the decision maker wants to expedite the project it will cost ABC $4,000 and the probability that it will be acceptable is 80%. Undertaking of the P2 project does not change the $7,000 delay penalty and the $10,000 penalty for unacceptable quality in P1. Draw a decision tree for the problem described above. Use the tree for analysis and answer the question "what is the optimal decision based on the expected value criterion?"

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started