Question

a. Set up the Security Market Line (SML) for any portfolio and explain its location and slope. Distinguish the SML from the capital market line.

a. Set up the Security Market Line (SML) for any portfolio and explain its location and slope. Distinguish the SML from the capital market line.

b. Use your results from subtask a) to classify the following two concepts: Quantity of market risk Price of market risk

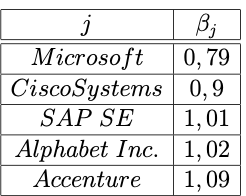

c. The time series gives rf = 0.02 for the risk-free interest rate and r m = 0.05 for the expected return on the market portfolio. The following data is also available to you:

For all five stocks, determine the expected return according to CAPM.

d. A portfolio manager compiles an (inefficient) portfolio from the five stocks from subtask c). All stocks are equally weighted in the portfolio, i.e. w1 = w2 = = w5. Determine the portfolio beta.

e. Is the following statement true or false? Justify your answer in a maximum of two sentences.

An inefficient portfolio can have a low beta and a high sigma (high volatility) at the same time.

f. Briefly explain how a commercial bank turns an uncertain loan portfolio into a safe deposit portfolio.

j B; Microsoft 0,79 CiscoSystems 0,9 SAP SE 1,01 Alphabet Inc. 1,02 Accenture 1,09Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started