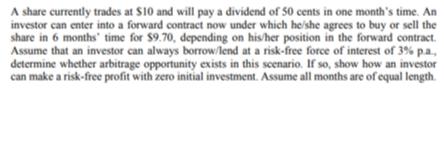

Question

A share currently trades at $10 and will pay a dividend of 50 cents in one month's time. An investor can enter into a

A share currently trades at $10 and will pay a dividend of 50 cents in one month's time. An investor can enter into a forward contract now under which he'she agrees to buy or sell the share in 6 months' time for $9.70, depending on his/her position in the forward contract. Assume that an investor can always borrow/lend at a risk-free force of interest of 3% pa, determine whether arbitrage opportunity exists in this scenario. If so, show how an investor can make a risk-free profit with zero initial investment. Assume all months are of equal length.

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

STEP 1 A An arbitrage opportunity is like a technique wherein a pers...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Economics

Authors: Paul A. Samuelson, William Nordhaus

19th edition

978-0073511290, 73511293, 978-0073344232, 73344230, 978-007351129

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App