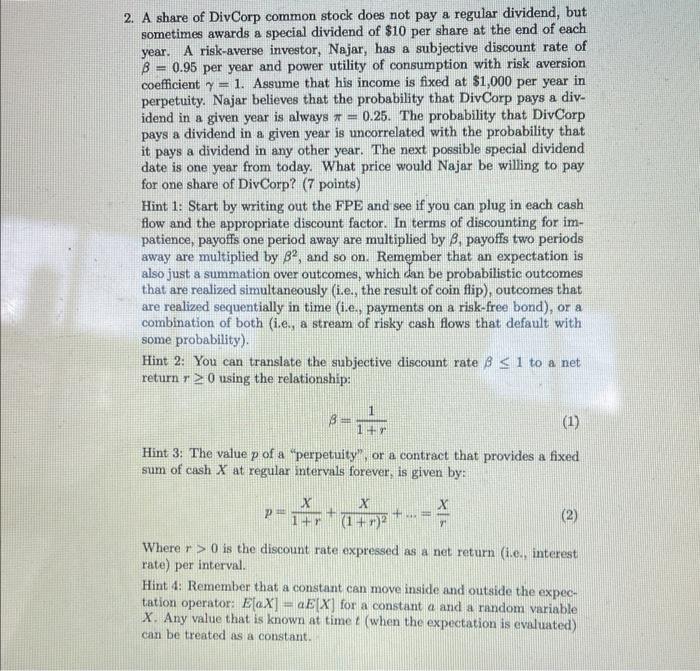

A share of DivCorp common stock does not pay a regular dividend, but sometimes awards a special dividend of $10 per share at the end of each year. A risk-averse investor, Najar, has a subjective discount rate of =0.95 per year and power utility of consumption with risk aversion coefficient =1. Assume that his income is fixed at $1,000 per year in perpetuity. Najar believes that the probability that DivCorp pays a dividend in a given year is always =0.25. The probability that DivCorp pays a dividend in a given year is uncorrelated with the probability that it pays a dividend in any other year. The next possible special dividend date is one year from today. What price would Najar be willing to pay for one share of DivCorp? ( 7 points) Hint 1: Start by writing out the FPE and see if you can plug in each cash flow and the appropriate discount factor. In terms of discounting for impatience, payoffs one period away are multiplied by , payoffs two periods away are multiplied by 2, and so on. Remember that an expectation is also just a summation over outcomes, which dan be probabilistic outcomes that are realized simultaneously (i.e., the result of coin flip), outcomes that are realized sequentially in time (i.e., payments on a risk-free bond), or a combination of both (i.e, a stream of risky cash flows that default with some probability). Hint 2: You can translate the subjective discount rate 1 to a net return r0 using the relationship: =1+r1 Hint 3: The value p of a "perpetuity", or a contract that provides a fixed sum of cash X at regular intervals forever, is given by: p=1+rX+(1+r)2X+=rX Where r>0 is the discount rate expressed as a net return (i.e., interest rate) per interval. Hint 4: Remember that a constant can move inside and outside the expectation operator: E[aX]=aE[X] for a constant a and a random variable X. Any value that is known at time t (when the expectation is evaluated) can be treated as a constant. A share of DivCorp common stock does not pay a regular dividend, but sometimes awards a special dividend of $10 per share at the end of each year. A risk-averse investor, Najar, has a subjective discount rate of =0.95 per year and power utility of consumption with risk aversion coefficient =1. Assume that his income is fixed at $1,000 per year in perpetuity. Najar believes that the probability that DivCorp pays a dividend in a given year is always =0.25. The probability that DivCorp pays a dividend in a given year is uncorrelated with the probability that it pays a dividend in any other year. The next possible special dividend date is one year from today. What price would Najar be willing to pay for one share of DivCorp? ( 7 points) Hint 1: Start by writing out the FPE and see if you can plug in each cash flow and the appropriate discount factor. In terms of discounting for impatience, payoffs one period away are multiplied by , payoffs two periods away are multiplied by 2, and so on. Remember that an expectation is also just a summation over outcomes, which dan be probabilistic outcomes that are realized simultaneously (i.e., the result of coin flip), outcomes that are realized sequentially in time (i.e., payments on a risk-free bond), or a combination of both (i.e, a stream of risky cash flows that default with some probability). Hint 2: You can translate the subjective discount rate 1 to a net return r0 using the relationship: =1+r1 Hint 3: The value p of a "perpetuity", or a contract that provides a fixed sum of cash X at regular intervals forever, is given by: p=1+rX+(1+r)2X+=rX Where r>0 is the discount rate expressed as a net return (i.e., interest rate) per interval. Hint 4: Remember that a constant can move inside and outside the expectation operator: E[aX]=aE[X] for a constant a and a random variable X. Any value that is known at time t (when the expectation is evaluated) can be treated as a constant