Answered step by step

Verified Expert Solution

Question

1 Approved Answer

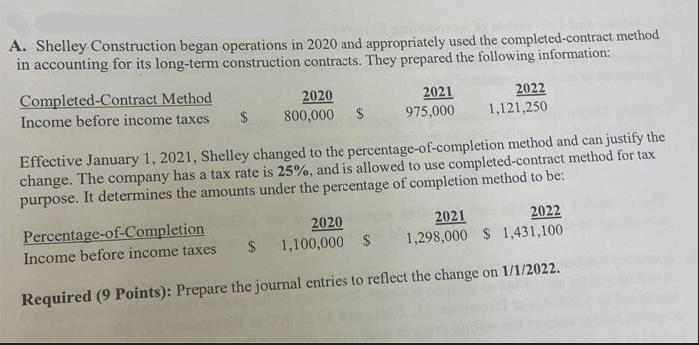

A. Shelley Construction began operations in 2020 and appropriately used the completed-contract method in accounting for its long-term construction contracts. They prepared the following

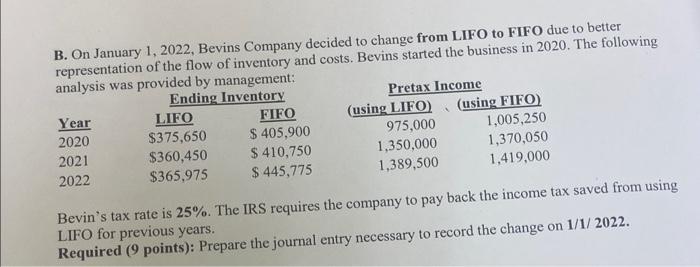

A. Shelley Construction began operations in 2020 and appropriately used the completed-contract method in accounting for its long-term construction contracts. They prepared the following information: Completed-Contract Method Income before income taxes 2020 800,000 $ Percentage-of-Completion Income before income taxes 2021 975,000 Effective January 1, 2021, Shelley changed to the percentage-of-completion method and can justify the change. The company has a tax rate is 25%, and is allowed to use completed-contract method for tax purpose. It determines the amounts under the percentage of completion method to be: 2020 $ 1,100,000 $ 2022 1,121,250 2022 2021 1,298,000 $1,431,100 Required (9 Points): Prepare the journal entries to reflect the change on 1/1/2022. B. On January 1, 2022, Bevins Company decided to change from LIFO to FIFO due to better representation of the flow of inventory and costs. Bevins started the business in 2020. The following analysis was provided by management: Ending Inventory Year 2020 2021 2022 LIFO $375,650 $360,450 $365,975 FIFO $ 405,900 $ 410,750 $445,775 Pretax Income (using LIFO) 975,000 1,350,000 1,389,500 A (using FIFO) 1,005,250 1,370,050 1,419,000 Bevin's tax rate is 25%. The IRS requires the company to pay back the income tax saved from using LIFO for previous years. Required (9 points): Prepare the journal entry necessary to record the change on 1/1/2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the journal entries to reflect the change in accounting method from the completedcontract method to the percentageofcompletion method on January 1 2022 you need to follow these steps Step 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started