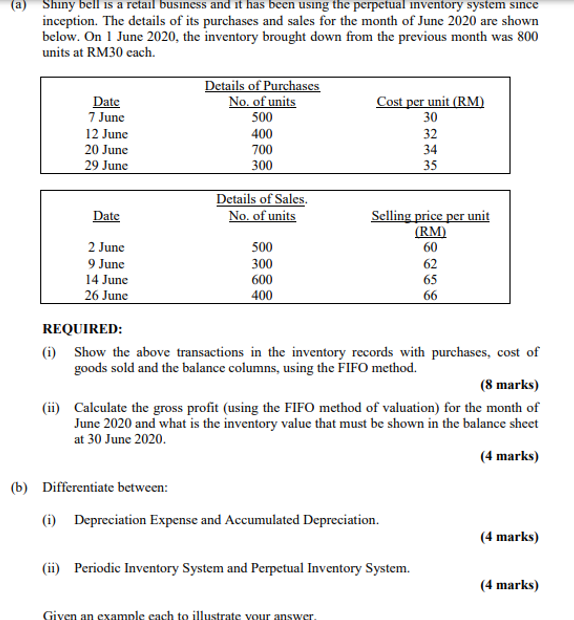

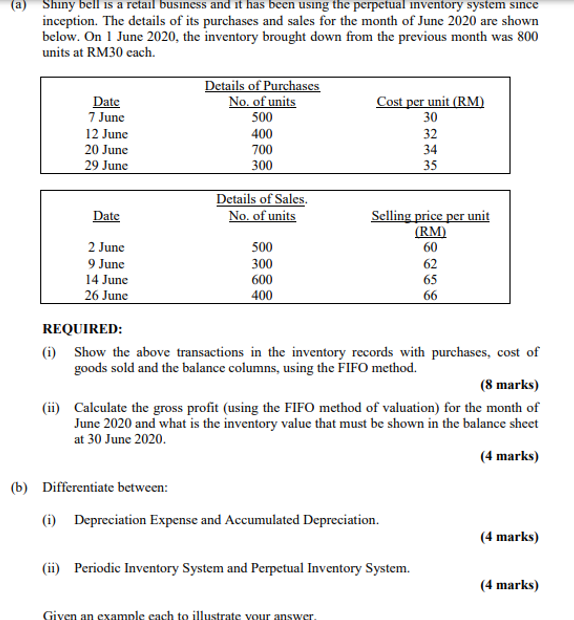

(a) Shiny bell is a retail business and it has been using the perpetual inventory system since inception. The details of its purchases and sales for the month of June 2020 are shown below. On 1 June 2020, the inventory brought down from the previous month was 800 units at RM30 cach. Date 7 June 12 June 20 June 29 June Details of Purchases No. of units 500 400 700 300 Cost per unit (RM) 30 32 34 35 Date Details of Sales No. of units 2 June 9 June 14 June 26 June 500 300 600 400 Selling price per unit (RM) 60 62 65 66 REQUIRED: (i) Show the above transactions in the inventory records with purchases, cost of goods sold and the balance columns, using the FIFO method. (8 marks) (ii) Calculate the gross profit (using the FIFO method of valuation) for the month of June 2020 and what is the inventory value that must be shown in the balance sheet at 30 June 2020. (4 marks) (b) Differentiate between: (1) Depreciation Expense and Accumulated Depreciation. (4 marks) (i) Periodic Inventory System and Perpetual Inventory System. (4 marks) Given an example cach to illustrate your answer. (a) Shiny bell is a retail business and it has been using the perpetual inventory system since inception. The details of its purchases and sales for the month of June 2020 are shown below. On 1 June 2020, the inventory brought down from the previous month was 800 units at RM30 cach. Date 7 June 12 June 20 June 29 June Details of Purchases No. of units 500 400 700 300 Cost per unit (RM) 30 32 34 35 Date Details of Sales No. of units 2 June 9 June 14 June 26 June 500 300 600 400 Selling price per unit (RM) 60 62 65 66 REQUIRED: (i) Show the above transactions in the inventory records with purchases, cost of goods sold and the balance columns, using the FIFO method. (8 marks) (ii) Calculate the gross profit (using the FIFO method of valuation) for the month of June 2020 and what is the inventory value that must be shown in the balance sheet at 30 June 2020. (4 marks) (b) Differentiate between: (1) Depreciation Expense and Accumulated Depreciation. (4 marks) (i) Periodic Inventory System and Perpetual Inventory System. (4 marks) Given an example cach to illustrate your