Answered step by step

Verified Expert Solution

Question

1 Approved Answer

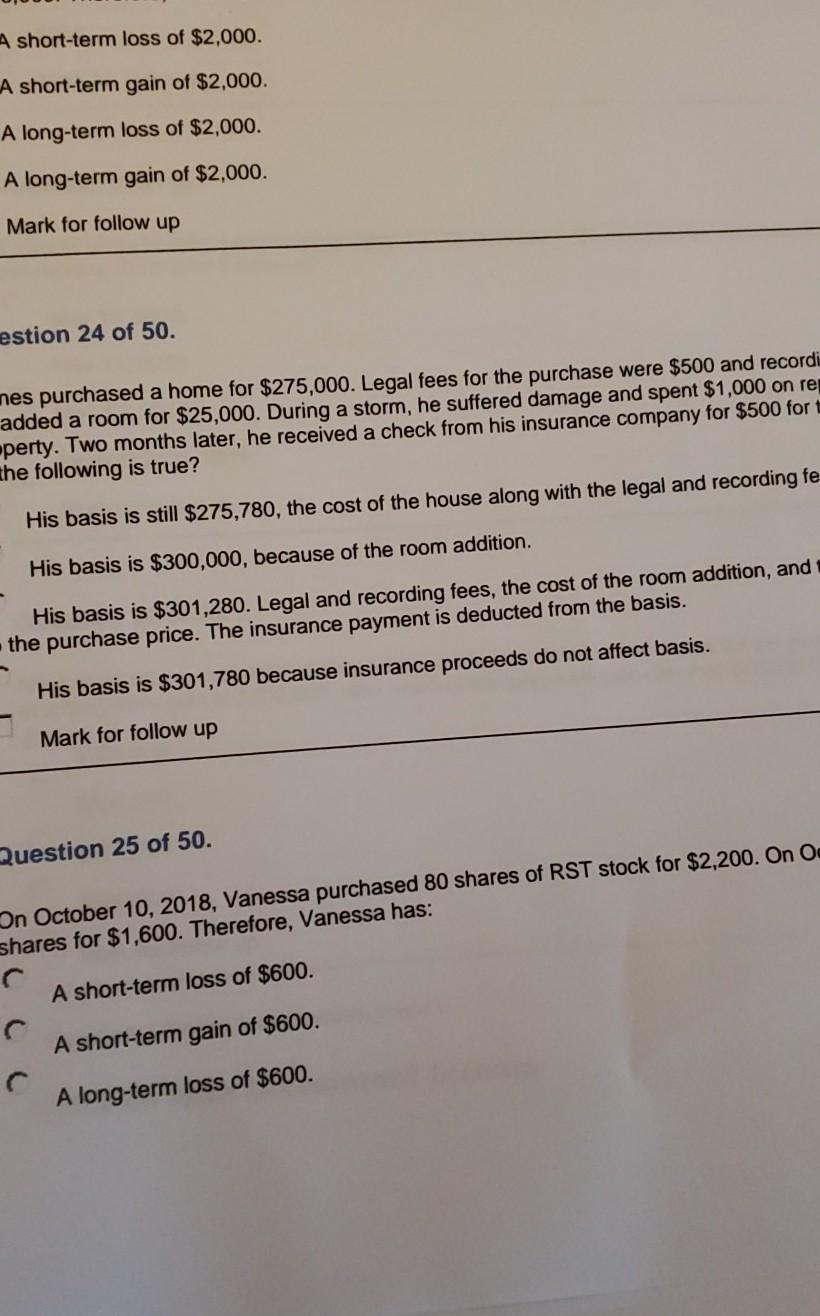

A short-term loss of $2,000. A short-term gain of $2,000. A long-term loss of $2,000. A long-term gain of $2,000. Mark for follow up estion

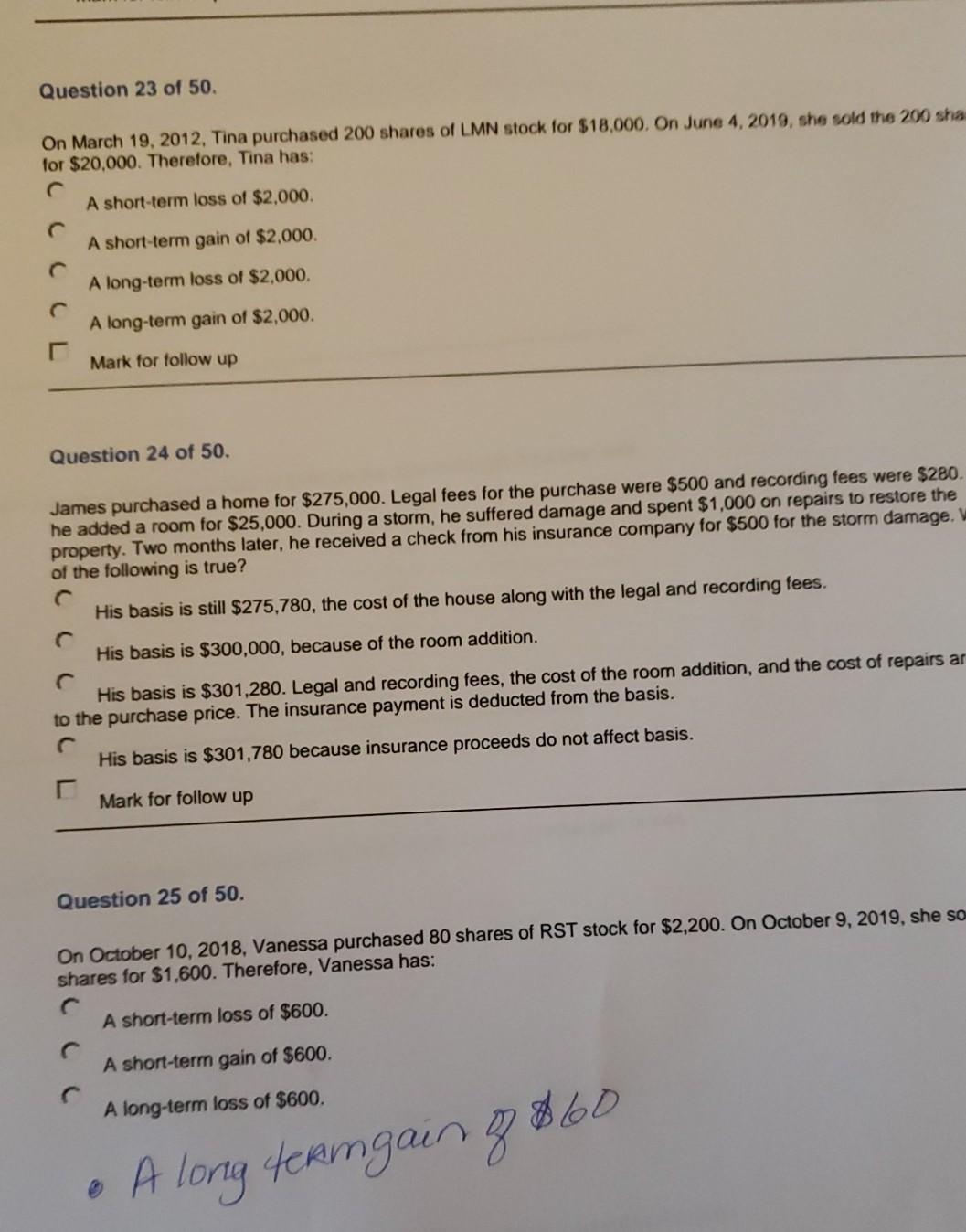

A short-term loss of $2,000. A short-term gain of $2,000. A long-term loss of $2,000. A long-term gain of $2,000. Mark for follow up estion 24 of 50. nes purchased a home for $275,000. Legal fees for the purchase were $500 and recordi added a room for $25,000. During a storm, he suffered damage and spent $1,000 on re perty. Two months later, he received a check from his insurance company for $500 fort the following is true? His basis is still $275,780, the cost of the house along with the legal and recording fe His basis is $300,000, because of the room addition. His basis is $301,280. Legal and recording fees, the cost of the room addition, and the purchase price. The insurance payment is deducted from the basis. His basis is $301,780 because insurance proceeds do not affect basis. Mark for follow up Question 25 of 50. On October 10, 2018, Vanessa purchased 80 shares of RST stock for $2,200. On O shares for $1,600. Therefore, Vanessa has: A short-term loss of $600. A short-term gain of $600. A long-term loss of $600. Question 23 of 50. On March 19, 2012, Tina purchased 200 shares of LMN stock for $18,000. On June 4, 2019, she sold the 200 sha for $20,000. Therefore, Tina has: A short-term loss of $2.000. A short-term gain of $2,000. A long-term loss of $2,000. A long-term gain of $2,000. Mark for follow up Question 24 of 50. James purchased a home for $275,000. Legal fees for the purchase were $500 and recording fees were $280. he added a room for $25,000. During a storm, he suffered damage and spent $1,000 on repairs to restore the property. Two months later, he received a check from his insurance company for $500 for the storm damage. of the following is true? His basis is still $275,780, the cost of the house along with the legal and recording fees. His basis is $300,000, because of the room addition. His basis is $301,280. Legal and recording fees, the cost of the room addition, and the cost of repairs ar to the purchase price. The insurance payment is deducted from the basis. His basis is $301,780 because insurance proceeds do not affect basis. Mark for follow up Question 25 of 50. On October 10, 2018, Vanessa purchased 80 shares of RST stock for $2,200. On October 9, 2019, she so shares for $1,600. Therefore, Vanessa has: A short-term loss of $600. A short-term gain of $600. A long-term loss of $600. A long termgain 3860

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started