Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Should Mr. Denton buy or sell futures? Explain why. b. What is the expected clean price for the cheapest-to-deliver issue on the expiry date?

a. Should Mr. Denton buy or sell futures? Explain why.

b. What is the expected clean price for the cheapest-to-deliver issue on the expiry date?

c. If futures prices increase after the position in the futures is taken, what happens in terms of profit/loss to Mr. Denton? Explain.

d. How many futures contracts should Mr. Denton sell or buy? Explain

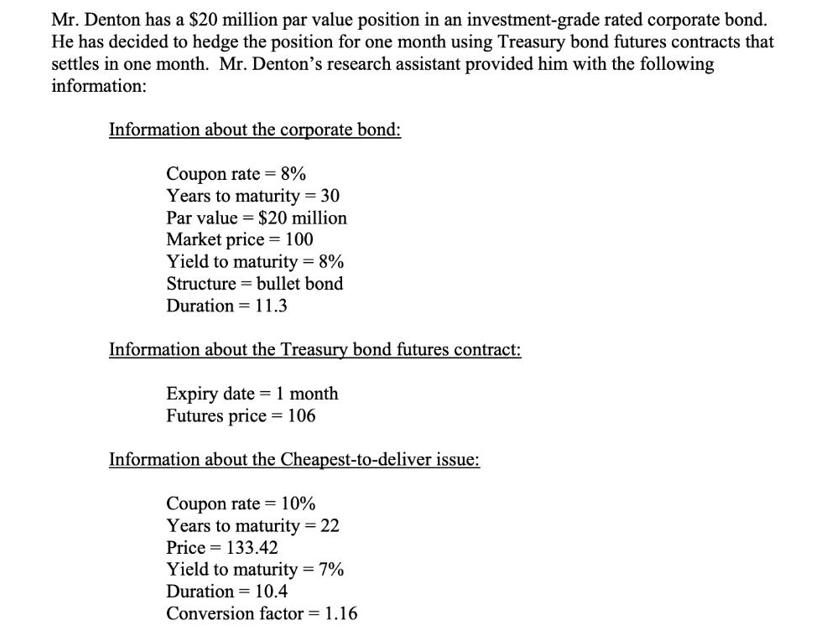

Mr. Denton has a $20 million par value position in an investment-grade rated corporate bond. He has decided to hedge the position for one month using Treasury bond futures contracts that settles in one month. Mr. Denton's research assistant provided him with the following information: Information about the corporate bond: Coupon rate = 8% Years to maturity = 30 Par value = $20 million Market price 100 Yield to maturity = 8% Structure = bullet bond Duration = 11.3 Information about the Treasury bond futures contract: Expiry date = 1 month Futures price = 106 Information about the Cheapest-to-deliver issue: Coupon rate = 10% Years to maturity = 22 Price = 133.42 Yield to maturity = 7% Duration = 10.4 Conversion factor = 1.16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Mr Denton should sell Treasury bond futures contracts Explanation To hedge his 20 million par value corporate bond position he wants to protect hims...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started