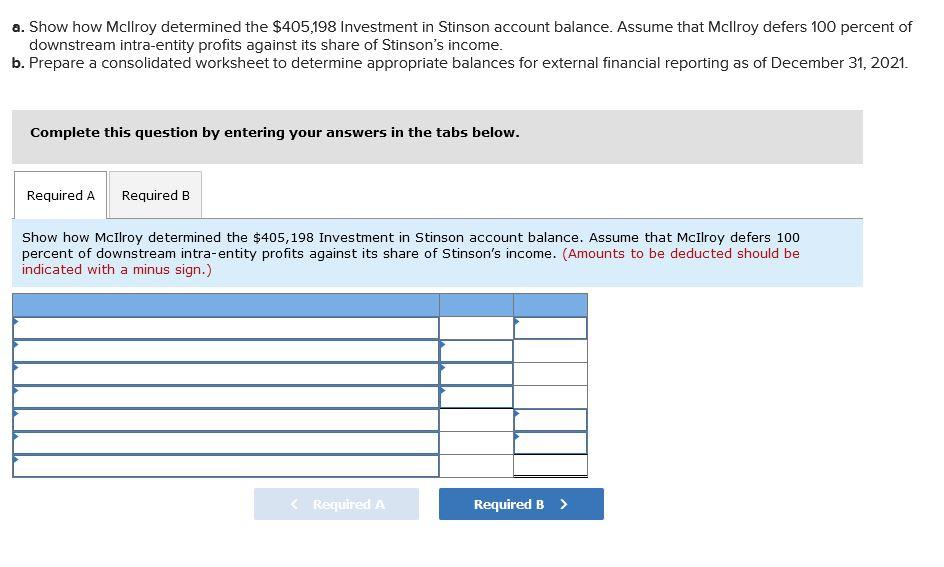

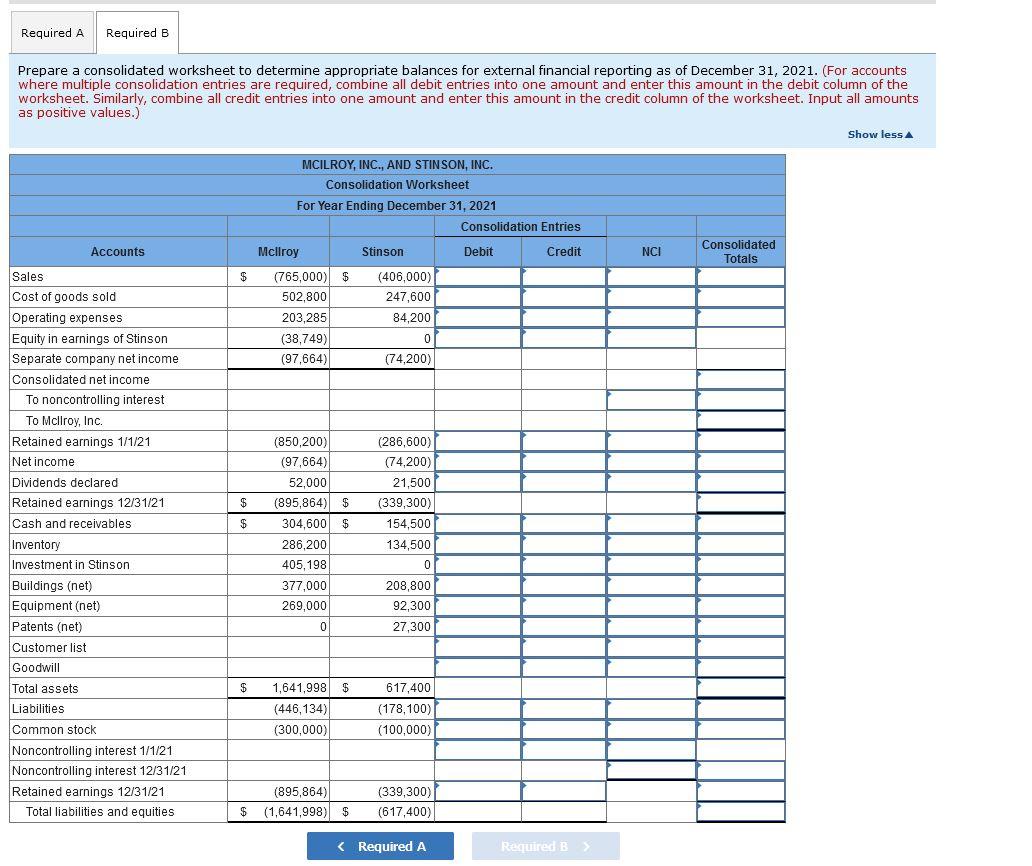

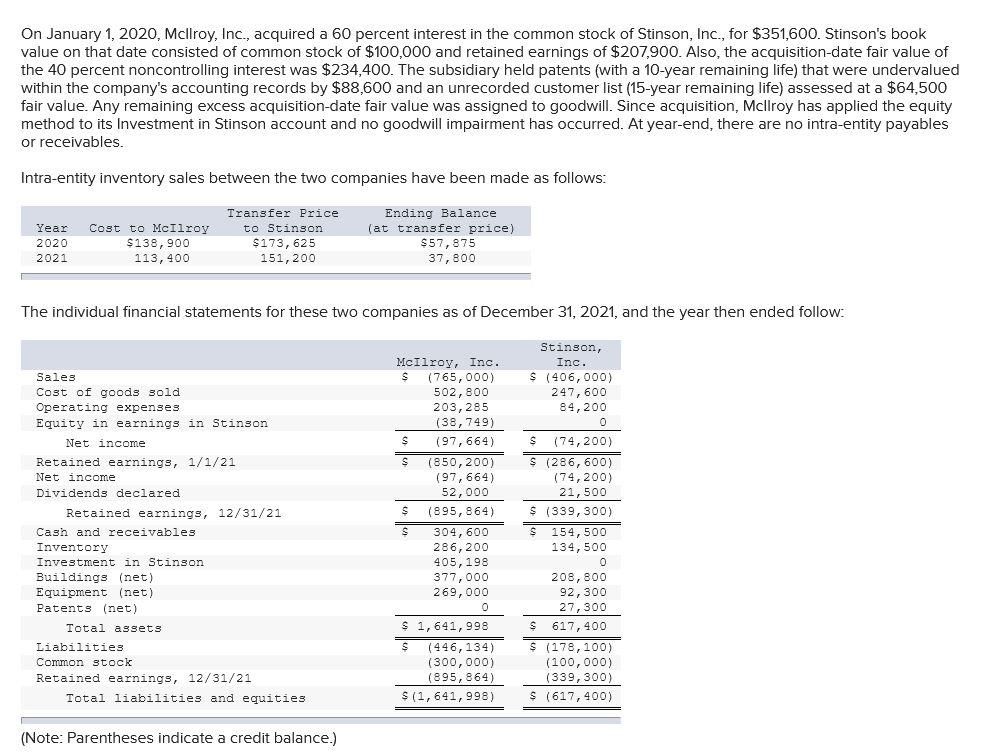

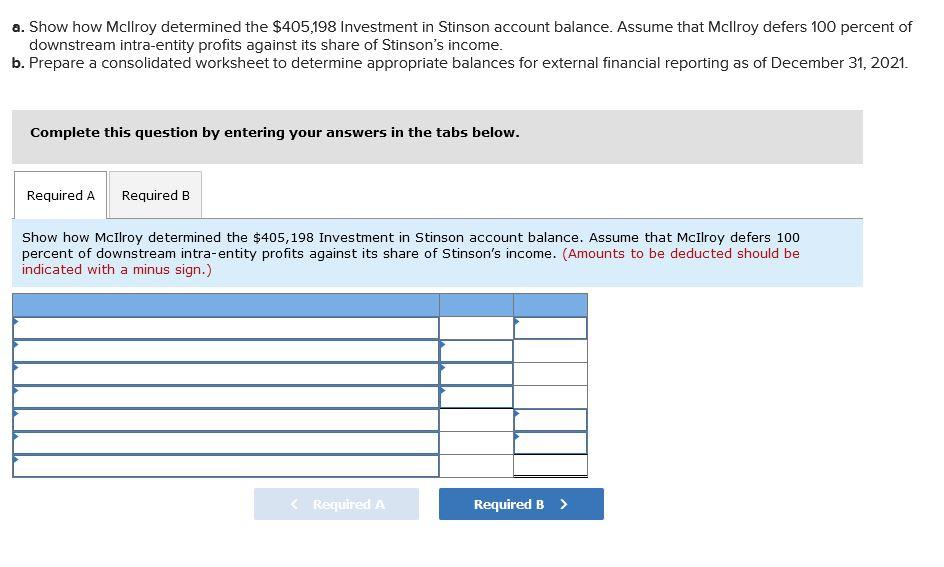

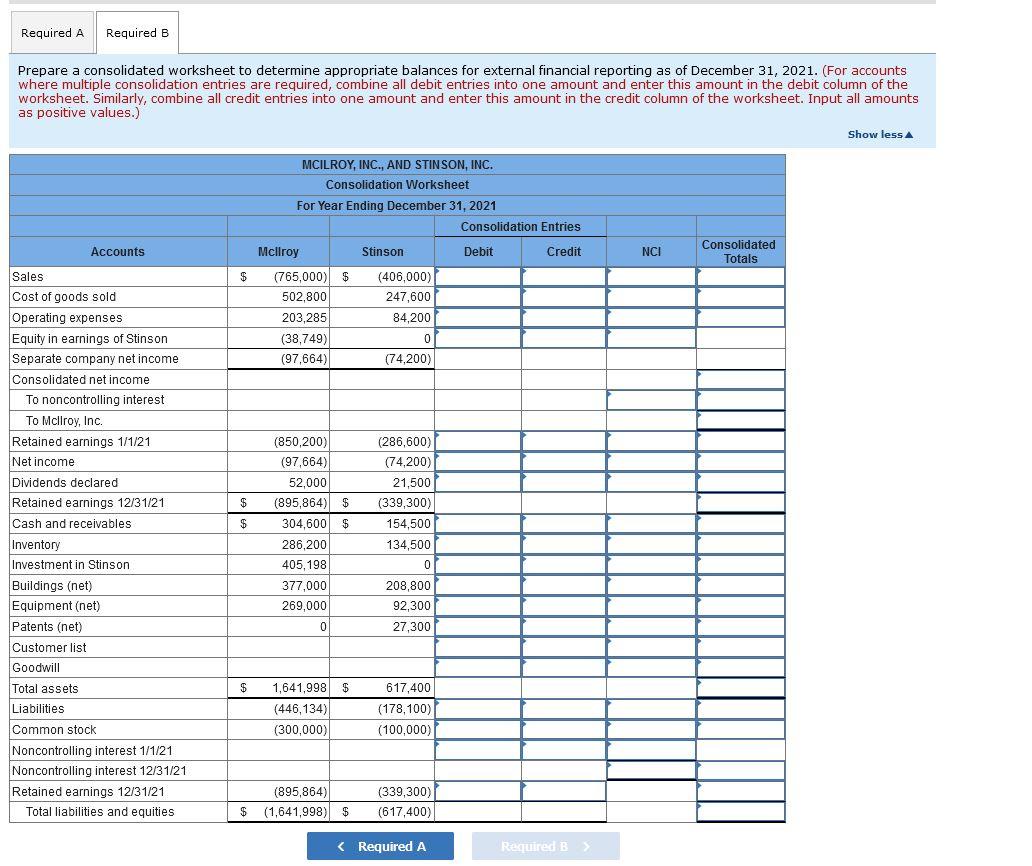

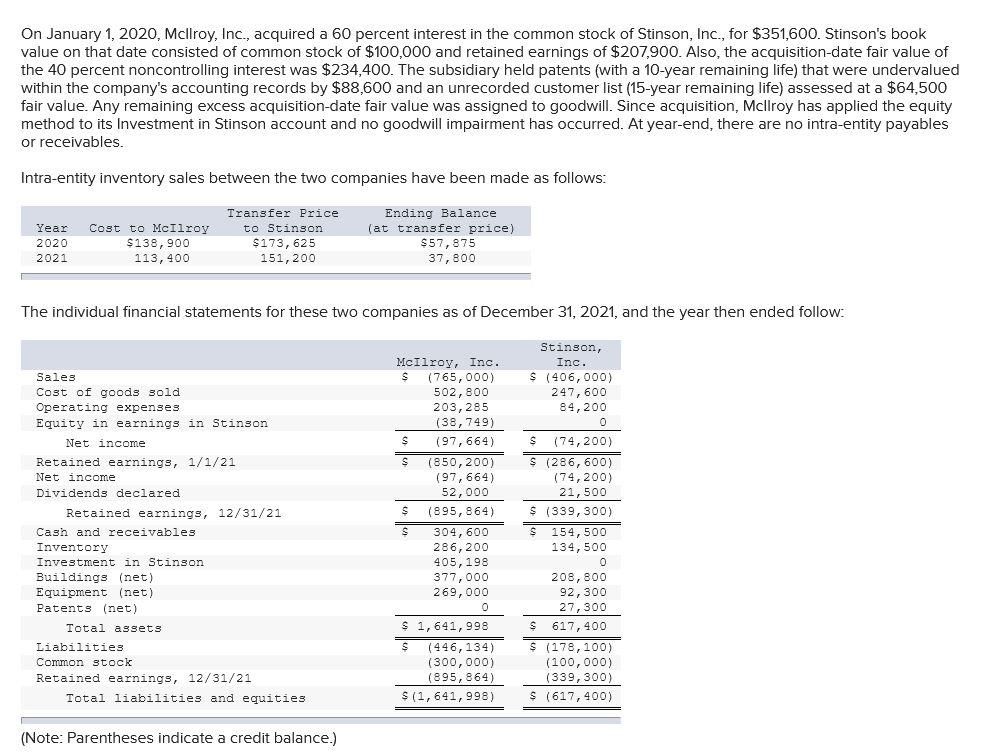

a. Show how Mcllroy determined the $405,198 Investment in Stinson account balance. Assume that Mcllroy defers 100 percent of downstream intra-entity profits against its share of Stinson's income. b. Prepare a consolidated worksheet to determine appropriate balances for external financial reporting as of December 31, 2021. Complete this question by entering your answers in the tabs below. Required A Required B Show how McIlroy determined the $405,198 Investment in Stinson account balance. Assume that McIlroy defers 100 percent of downstream intra-entity profits against its share of Stinson's income. (Amounts to be deducted should be indicated with a minus sign.) Required A Required B Prepare a consolidated worksheet to determine appropriate balances for external financial reporting as of December 31, 2021. (For accounts where multiple consolidation entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Input all amounts as positive values.) Show less MCILROY, INC., AND STINSON, INC. Consolidation Worksheet For Year Ending December 31, 2021 Consolidation Entries Accounts Mcllroy Stinson Debit Credit NCI Consolidated Totals $ (765,000) $ 502,800 203,285 (406,000) 247,600 84,200 (38,749) (97,664) 0 (74,200) $ $ Sales Cost of goods sold Operating expenses Equity in earnings of Stinson Separate company net income Consolidated net income To noncontrolling interest To Mcllroy, Inc. Retained earnings 1/1/21 Net income Dividends declared Retained earnings 12/31/21 Cash and receivables Inventory Investment in Stinson Buildings (net) Equipment (net) Patents (net) Customer list Goodwill Total assets Liabilities Common stock Noncontrolling interest 1/1/21 Noncontrolling interest 12/31/21 Retained earnings 12/31/21 Total liabilities and equities (850,200) (97,664) 52,000 (895,864) $ 304,600 $ 286,200 405,198 377,000 269,000 0 (286,600) (74,200) 21,500 (339,300) 154,500 134,500 0 208,800 92,300 27,300 $ 1,641,998 $ (446,134) (300,000) 617,400 (178,100) (100,000) (895,864) (1,641,998) $ (339,300 (617,400) $