Question

a) Show the change in the Owners Equity section of the balance sheet if Evergreen declares a 15% stock dividend. What will be the new

-

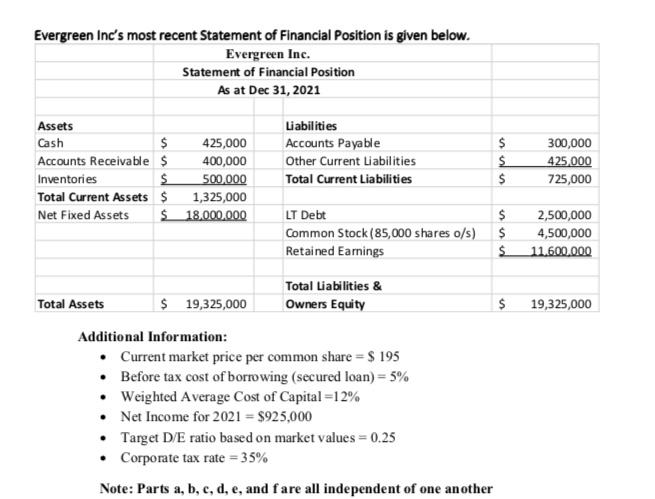

a) Show the change in the Owners Equity section of the balance sheet if Evergreen declares a 15% stock dividend. What will be the new market price share? (6 marks)

-

b) Suppose instead of the stock dividend, Evergreen declares a 5 for 2 stock split. Show the change in the Owners Equity section of the balance sheet and the new stock price.(3 marks)

-

c) Suppose instead, Evergreen uses a residual dividend policy. Their capital budget for the upcoming year = $1,600,000. Calculate the debt, external equity financing required and the dividends per share. ( (6 Marks)

-

d) Suppose instead, Evergreen uses a residual dividend policy. Their capital budget for the upcoming year = $1,100,000. Calculate the debt, external equity financing required and the dividends per share. (6 Marks)

-

e) Suppose instead, Evergreen uses a retention ratio of 30%. Their capital budget for the upcoming year = $1,600,000. Calculate the debt, external equity financing required and the dividends per share. (6 marks)

-

f) Suppose instead, Evergreen follows a stable dividend policy and declares a $2.00 per share dividend. The holder of record date is January 10, 2022, and the payment date is January 31, 2022. Emily sold 500 shares of Evergreen on January 7, 2022, to Anna. Which of the two investors will receive the dividends? How much dividend income with they receive? (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started