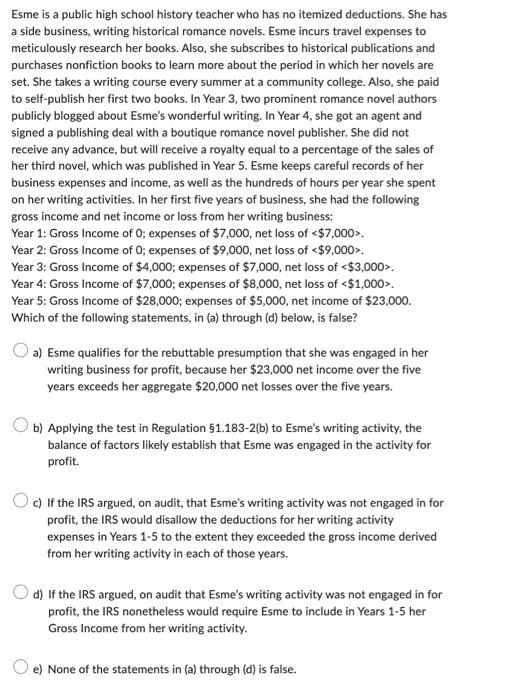

a side business, writing historical romance novels. Esme incurs travel expenses to meticulously research her books. Also, she subscribes to historical publications and purchases nonfiction books to learn more about the period in which her novels are set. She takes a writing course every summer at a community college. Also, she paid to self-publish her first two books. In Year 3, two prominent romance novel authors publicly blogged about Esme's wonderful writing. In Year 4, she got an agent and signed a publishing deal with a boutique romance novel publisher. She did not receive any advance, but will receive a royalty equal to a percentage of the sales of her third novel, which was published in Year 5. Esme keeps careful records of her business expenses and income, as well as the hundreds of hours per year she spent on her writing activities. In her first five years of business, she had the following gross income and net income or loss from her writing business: Year 1: Gross Income of 0; expenses of $7,000, net loss of $7,000. Year 2: Gross Income of 0; expenses of $9,000, net loss of $9,000. Year 3: Gross Income of $4,000; expenses of $7,000, net loss of $3,000. Year 4: Gross Income of $7,000; expenses of $8,000, net loss of $1,000. Year 5: Gross Income of $28,000; expenses of $5,000, net income of $23,000. Which of the following statements, in (a) through (d) below, is false? a) Esme qualifies for the rebuttable presumption that she was engaged in her writing business for profit, because her $23,000 net income over the five years exceeds her aggregate $20,000 net losses over the five years. b) Applying the test in Regulation $1.1832 (b) to Esme's writing activity, the balance of factors likely establish that Esme was engaged in the activity for profit. c) If the IRS argued, on audit, that Esme's writing activity was not engaged in for profit, the IRS would disallow the deductions for her writing activity expenses in Years 1-5 to the extent they exceeded the gross income derived from her writing activity in each of those years. d) If the IRS argued, on audit that Esme's writing activity was not engaged in for profit, the IRS nonetheless would require Esme to include in Years 1-5 her Gross Income from her writing activity. e) None of the statements in (a) through (d) is false