Question

A Singapore investor is evaluating two (2) Intellectual Properties: Patents. Each Patent costs him $10,000 and generates the following cashflow patterns (Figure 3): For Patent

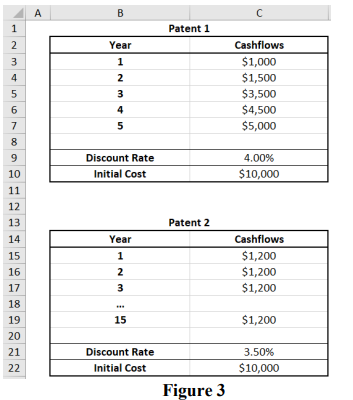

A Singapore investor is evaluating two (2) Intellectual Properties: Patents. Each Patent costs him $10,000 and generates the following cashflow patterns (Figure 3):

For Patent 1 and Patent 2:

(i) Calculate their respective Net Present Value. Round your answers to two (2) decimal places.

(ii) Show your Excel formulas for the NPV calculations.

(iii) Illustrate the differences between the usage for Excels NPV() and PV() functions.

(iv) Indicate which patent, as an investment, is better for the investor. Explain your reason. (16 marks)

(b) A friend of yours wants to take a bet that the equity market will recover from the Coronavirus crisis soon. She does not own any stock and is not willing to spend much money to buy the stock of concern. However, she wants to benefit from her speculative view if it materialises. You suggest that she buys a vanilla equity Call option.

(i) Discuss two (2) key features of buying a vanilla equity Call option without investing in the stock of concern. (8 marks)

(ii) The European style, nearest-dated vanilla equity Call option, with a strike price of $60, costs $5/share. Assume that the transaction cost and borrowing cost are ignored. Calculate her risk of taking a long position in a vanilla equity Call option, in dollar and cents, if she fails to exercise on the Expiry Date. Solve for the break-even price/share of this option on the Expiry date. (6 marks)

\begin{tabular}{|c|} \hline \\ \hline 1 \\ \hline 2 \\ \hline 3 \\ \hline 4 \\ \hline 5 \\ \hline 6 \\ \hline 7 \\ \hline 8 \\ \hline 9 \\ \hline 10 \\ \hline 11 \\ \hline 12 \\ \hline 13 \\ \hline 14 \\ \hline 15 \\ \hline 16 \\ \hline 17 \\ \hline 18 \\ \hline 19 \\ \hline 20 \\ \hline 21 \\ \hline 22 \\ \hline \end{tabular} Patent 2 \begin{tabular}{|cc|} \hline Year & Cashflows \\ \hline 1 & $1,200 \\ \hline 2 & $1,200 \\ 3 & $1,200 \\ & \\ 15 & $1,200 \\ \hline Discount Rate & 3.50% \\ \hline Initial Cost & $10,000 \\ \hline \end{tabular} Figure 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started