Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a.) Single Family Homes A &C b.) Commercial B & D c.) None, Accept them all d.) Single Family Home C, Commercial D Elkridge Construction

a.) Single Family Homes A &C

b.) Commercial B & D

c.) None, Accept them all

d.) Single Family Home C, Commercial D

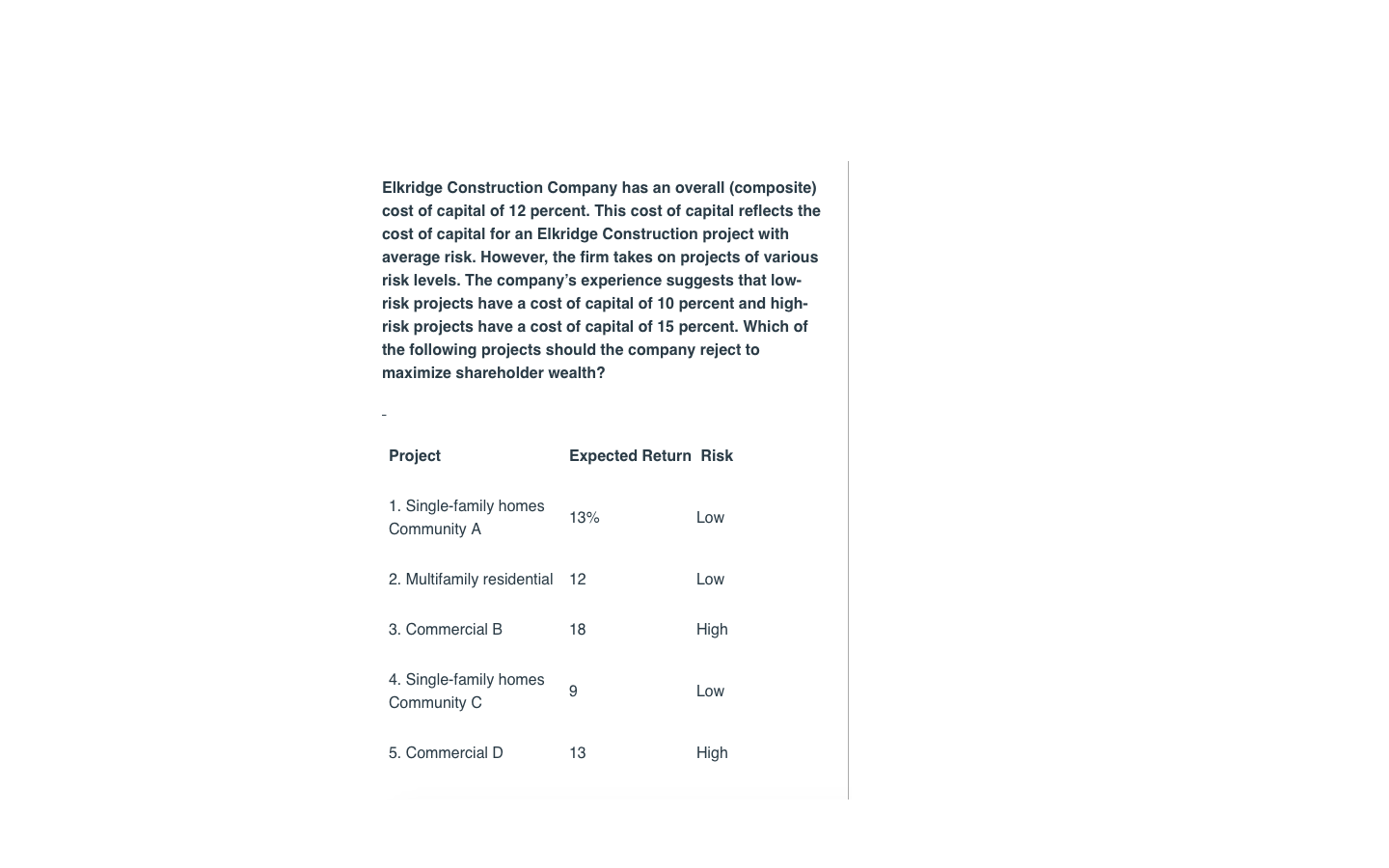

Elkridge Construction Company has an overall (composite) cost of capital of 12 percent. This cost of capital reflects the cost of capital for an Elkridge Construction project with average risk. However, the firm takes on projects of various risk levels. The company's experience suggests that low- risk projects have a cost of capital of 10 percent and high- risk projects have a cost of capital of 15 percent. Which of the following projects should the company reject to maximize shareholder wealth? Project Expected Return Risk 1. Single-family homes Community A 13% Low 2. Multifamily residential 12 Low 3. Commercial B 18 High 4. Single-family homes Community C Low 5. Commercial D R 13 HighStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started