Question

A small apartment property is estimated to have potential gross income of $ 25,000. Vacancy and collection losses are expected to average 5 percent

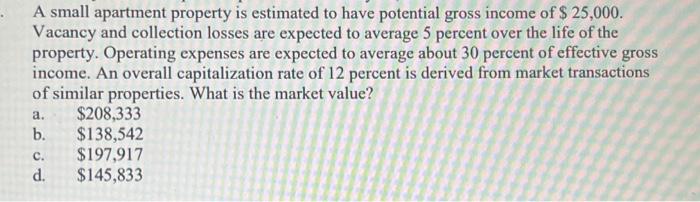

A small apartment property is estimated to have potential gross income of $ 25,000. Vacancy and collection losses are expected to average 5 percent over the life of the property. Operating expenses are expected to average about 30 percent of effective gross income. An overall capitalization rate of 12 percent is derived from market transactions of similar properties. What is the market value? $208,333 $138,542 C. $197,917 d. $145,833 a. b.

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the market value of the property we will use the income capitalization approach which t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Real Estate Finance and Investments

Authors: William Brueggeman, Jeffrey Fisher

14th edition

73377333, 73377339, 978-0073377339

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App