Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jetson Valves Ltd. (JVL) is engaged in manufacturing small-sized valves used in a variety of industrial applications. The company is located in Ahmedabad and

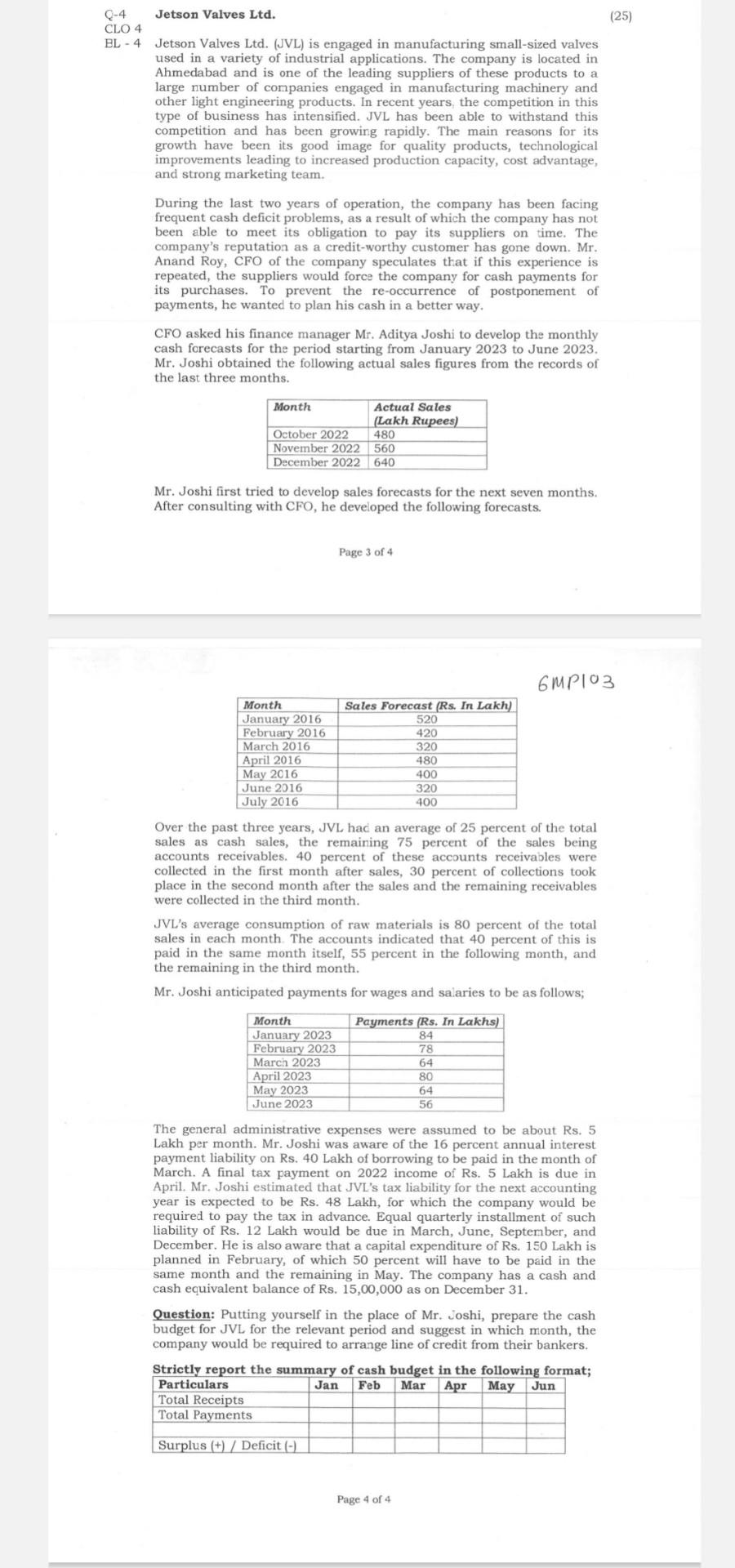

Jetson Valves Ltd. (JVL) is engaged in manufacturing small-sized valves used in a variety of industrial applications. The company is located in Ahmedabad and is one of the leading suppliers of these products to a large number of companies engaged in manufacturing machinery and other light engineering products. In recent years, the competition in this type of business has intensified. JVL has been able to withstand this competition and has been growing rapidly. The main reasons for its growth have been its good image for quality products, technological improvements leading to increased production capacity, cost advantage, and strong marketing team. Q-4 CLO 4 Jetson Valves Ltd. BL-4 Jetson Valves Ltd. (JVL) is engaged in manufacturing small-sized valves used in a variety of industrial applications. The company is located in Ahmedabad and is one of the leading suppliers of these products to a large number of companies engaged in manufacturing machinery and other light engineering products. In recent years, the competition in this type of business has intensified. JVL has been able to withstand this competition and has been growing rapidly. The main reasons for its growth have been its good image for quality products, technological improvements leading to increased production capacity, cost advantage, and strong marketing team. During the last two years of operation, the company has been facing frequent cash deficit problems, as a result of which the company has not been able to meet its obligation to pay its suppliers on time. The company's reputation as a credit-worthy customer has gone down. Mr. Anand Roy, CFO of the company speculates that if this experience is repeated, the suppliers would force the company for cash payments for its purchases. To prevent the re-occurrence of postponement of payments, he wanted to plan his cash in a better way. CFO asked his finance manager Mr. Aditya Joshi to develop the monthly cash forecasts for the period starting from January 2023 to June 2023. Mr. Joshi obtained the following actual sales figures from the records of the last three months. Actual Sales (Lakh Rupees) 480 October 2022 November 2022 560 December 2022 640 Month Mr. Joshi first tried to develop sales forecasts for the next seven months. After consulting with CFO, he developed the following forecasts. Month January 2016 February 2016 March 2016 April 2016 May 2016 June 2016 July 2016 Month January 2023 February 2023 Page 3 of 4 Over the past three years, JVL had an average of 25 percent of the total sales as cash sales, the remaining 75 percent of the sales being accounts receivables. 40 percent of these accounts receivables were collected in the first month after sales, 30 percent of collections took. place in the second month after the sales and the remaining receivables were collected in the third month. March 2023 April 2023 May 2023 June 2023 Sales Forecast (Rs. In Lakh) 520 420 320 480 400 320 400 JVL's average consumption of raw materials is 80 percent of the total sales in each month. The accounts indicated that 40 percent of this is paid in the same month itself, 55 percent in the following month, and the remaining in the third month. Mr. Joshi anticipated payments for wages and salaries to be as follows; Payments (Rs. In Lakhs) 84 Total Receipts Total Payments Surplus (+) / Deficit (-) 6MP103 78 64 80 64 56 The general administrative expenses were assumed to be about Rs. 5. Lakh per month. Mr. Joshi was aware of the 16 percent annual interest. payment liability on Rs. 40 Lakh of borrowing to be paid in the month of March. A final tax payment on 2022 income of Rs. 5 Lakh is due in April. Mr. Joshi estimated that JVL's tax liability for the next accounting year is expected to be Rs. 48 Lakh, for which the company would be required to pay the tax in advance. Equal quarterly installment of such liability of Rs. 12 Lakh would be due in March, June, September, and December. He is also aware that a capital expenditure of Rs. 150 Lakh is planned in February, of which 50 percent will have to be paid in the same month and the remaining in May. The company has a cash and cash equivalent balance of Rs. 15,00,000 as on December 31. Question: Putting yourself in the place of Mr. Joshi, prepare the cash budget for JVL for the relevant period and suggest in which month, the company would be required to arrange line of credit from their bankers. Strictly report the summary of cash budget in the following format; Particulars Jan Feb Mar Apr May Jun Page 4 of 4 (25)

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the cash budget for JVL we need to calculate the total receipts and total payments for ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started