Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A small aviation school is evaluating the merits of two independent projects - a fullmotion flight simulator, and an instrument device offering state-of-the-art nighttime flight

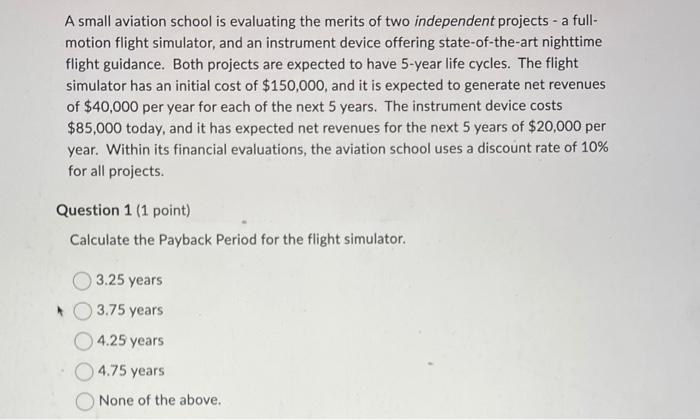

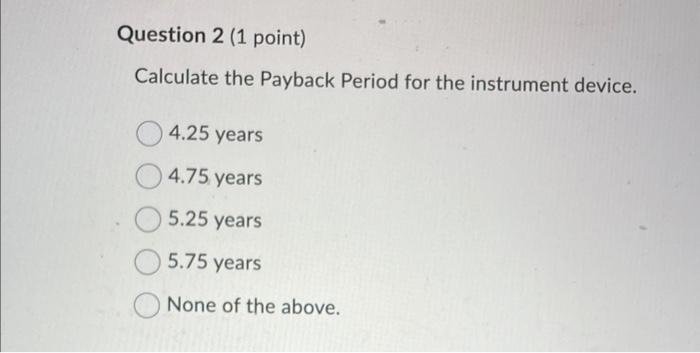

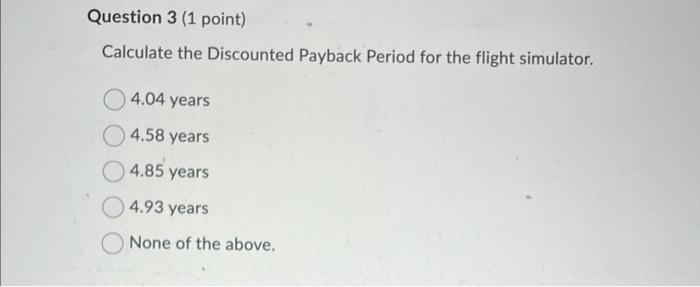

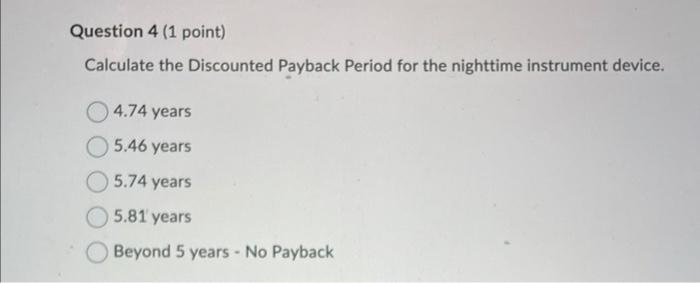

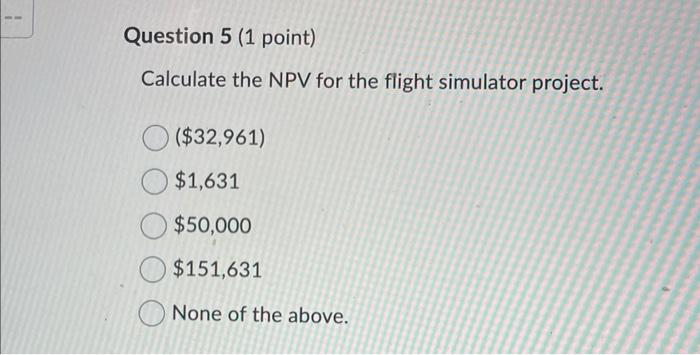

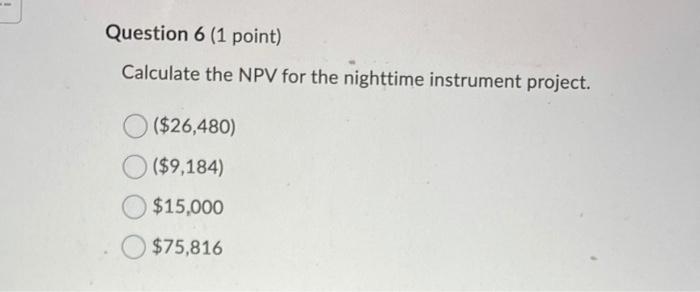

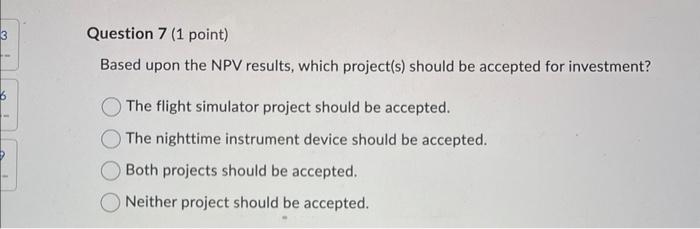

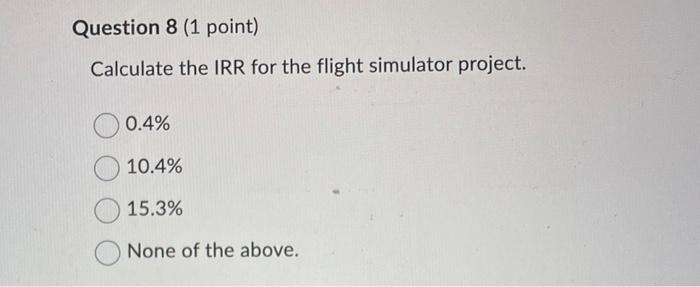

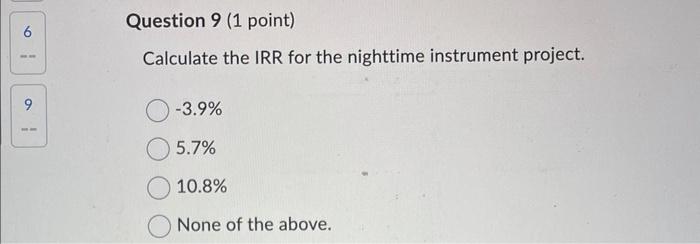

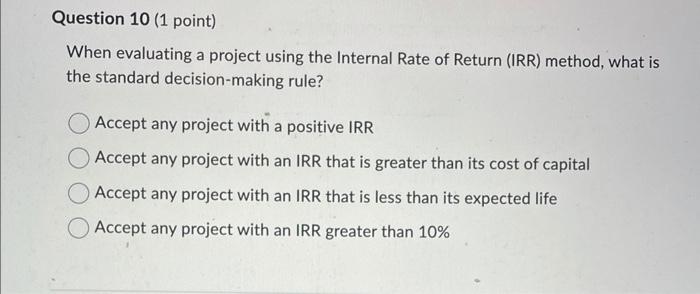

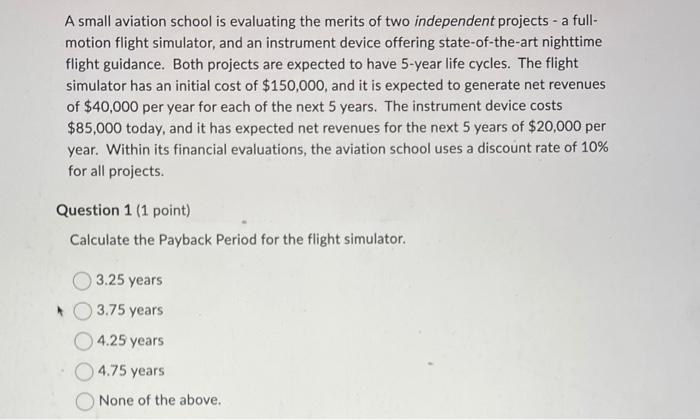

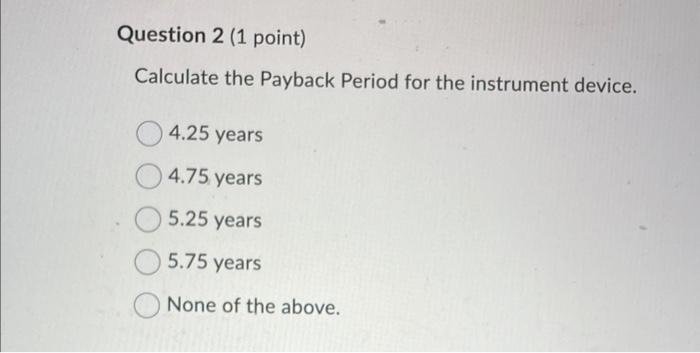

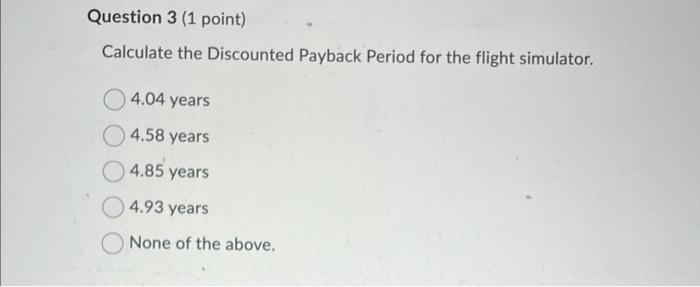

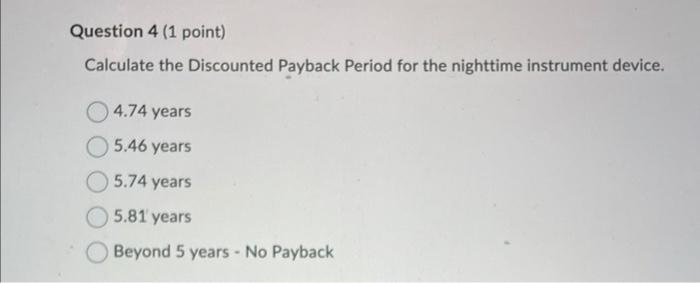

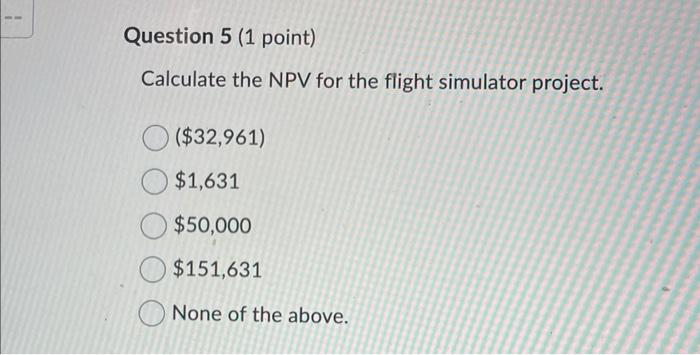

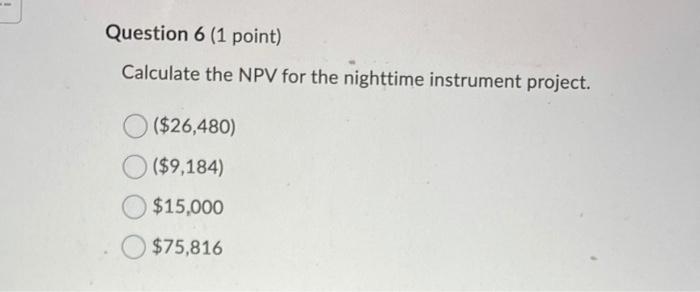

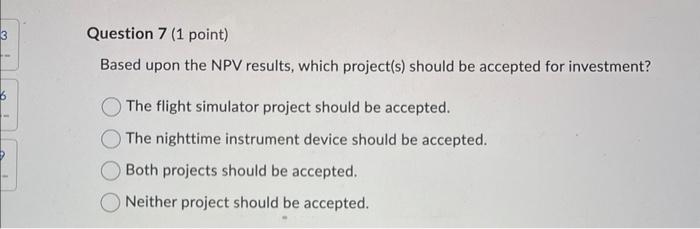

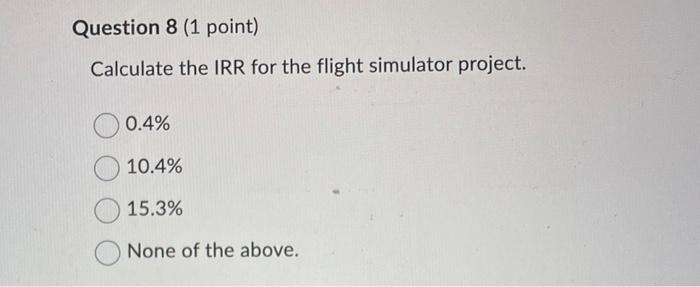

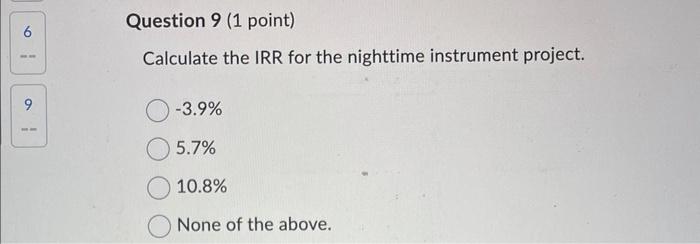

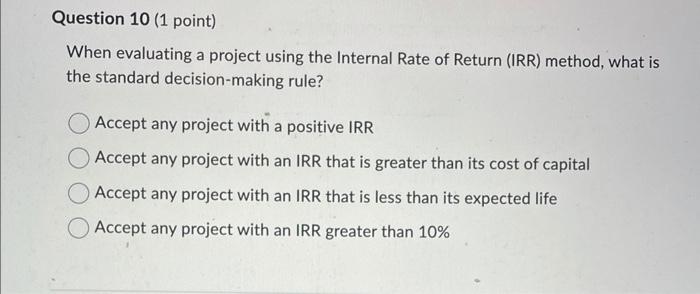

A small aviation school is evaluating the merits of two independent projects - a fullmotion flight simulator, and an instrument device offering state-of-the-art nighttime flight guidance. Both projects are expected to have 5 -year life cycles. The flight simulator has an initial cost of $150,000, and it is expected to generate net revenues of $40,000 per year for each of the next 5 years. The instrument device costs $85,000 today, and it has expected net revenues for the next 5 years of $20,000 per year. Within its financial evaluations, the aviation school uses a discount rate of 10% for all projects. Question 1 (1 point) Calculate the Payback Period for the flight simulator. 3.25 years 3.75 years 4.25 years 4.75 years None of the above. Calculate the Payback Period for the instrument device. 4.25 years 4.75 years 5.25 years 5.75 years None of the above. Calculate the Discounted Payback Period for the flight simulator. 4.04 years 4.58 years 4.85 years 4.93 years None of the above. Calculate the Discounted Payback Period for the nighttime instrument device. 4.74 years 5.46 years 5.74 years 5.81 years Beyond 5 years - No Payback Calculate the NPV for the flight simulator project. ($32,961) $1,631 $50,000 $151,631 None of the above. Calculate the NPV for the nighttime instrument project. ($26,480) ($9,184) $15,000 $75,816 Based upon the NPV results, which project(s) should be accepted for investment? The flight simulator project should be accepted. The nighttime instrument device should be accepted. Both projects should be accepted. Neither project should be accepted. Calculate the IRR for the flight simulator project. 0.4%10.4%15.3% None of the above. Calculate the IRR for the nighttime instrument project. 3.9% 5.7% 10.8% None of the above. When evaluating a project using the Internal Rate of Return (IRR) method, what is the standard decision-making rule? Accept any project with a positive IRR Accept any project with an IRR that is greater than its cost of capital Accept any project with an IRR that is less than its expected life Accept any project with an IRR greater than 10% A small aviation school is evaluating the merits of two independent projects - a fullmotion flight simulator, and an instrument device offering state-of-the-art nighttime flight guidance. Both projects are expected to have 5 -year life cycles. The flight simulator has an initial cost of $150,000, and it is expected to generate net revenues of $40,000 per year for each of the next 5 years. The instrument device costs $85,000 today, and it has expected net revenues for the next 5 years of $20,000 per year. Within its financial evaluations, the aviation school uses a discount rate of 10% for all projects. Question 1 (1 point) Calculate the Payback Period for the flight simulator. 3.25 years 3.75 years 4.25 years 4.75 years None of the above. Calculate the Payback Period for the instrument device. 4.25 years 4.75 years 5.25 years 5.75 years None of the above. Calculate the Discounted Payback Period for the flight simulator. 4.04 years 4.58 years 4.85 years 4.93 years None of the above. Calculate the Discounted Payback Period for the nighttime instrument device. 4.74 years 5.46 years 5.74 years 5.81 years Beyond 5 years - No Payback Calculate the NPV for the flight simulator project. ($32,961) $1,631 $50,000 $151,631 None of the above. Calculate the NPV for the nighttime instrument project. ($26,480) ($9,184) $15,000 $75,816 Based upon the NPV results, which project(s) should be accepted for investment? The flight simulator project should be accepted. The nighttime instrument device should be accepted. Both projects should be accepted. Neither project should be accepted. Calculate the IRR for the flight simulator project. 0.4%10.4%15.3% None of the above. Calculate the IRR for the nighttime instrument project. 3.9% 5.7% 10.8% None of the above. When evaluating a project using the Internal Rate of Return (IRR) method, what is the standard decision-making rule? Accept any project with a positive IRR Accept any project with an IRR that is greater than its cost of capital Accept any project with an IRR that is less than its expected life Accept any project with an IRR greater than 10%

A small aviation school is evaluating the merits of two independent projects - a fullmotion flight simulator, and an instrument device offering state-of-the-art nighttime flight guidance. Both projects are expected to have 5 -year life cycles. The flight simulator has an initial cost of $150,000, and it is expected to generate net revenues of $40,000 per year for each of the next 5 years. The instrument device costs $85,000 today, and it has expected net revenues for the next 5 years of $20,000 per year. Within its financial evaluations, the aviation school uses a discount rate of 10% for all projects. Question 1 (1 point) Calculate the Payback Period for the flight simulator. 3.25 years 3.75 years 4.25 years 4.75 years None of the above. Calculate the Payback Period for the instrument device. 4.25 years 4.75 years 5.25 years 5.75 years None of the above. Calculate the Discounted Payback Period for the flight simulator. 4.04 years 4.58 years 4.85 years 4.93 years None of the above. Calculate the Discounted Payback Period for the nighttime instrument device. 4.74 years 5.46 years 5.74 years 5.81 years Beyond 5 years - No Payback Calculate the NPV for the flight simulator project. ($32,961) $1,631 $50,000 $151,631 None of the above. Calculate the NPV for the nighttime instrument project. ($26,480) ($9,184) $15,000 $75,816 Based upon the NPV results, which project(s) should be accepted for investment? The flight simulator project should be accepted. The nighttime instrument device should be accepted. Both projects should be accepted. Neither project should be accepted. Calculate the IRR for the flight simulator project. 0.4%10.4%15.3% None of the above. Calculate the IRR for the nighttime instrument project. 3.9% 5.7% 10.8% None of the above. When evaluating a project using the Internal Rate of Return (IRR) method, what is the standard decision-making rule? Accept any project with a positive IRR Accept any project with an IRR that is greater than its cost of capital Accept any project with an IRR that is less than its expected life Accept any project with an IRR greater than 10% A small aviation school is evaluating the merits of two independent projects - a fullmotion flight simulator, and an instrument device offering state-of-the-art nighttime flight guidance. Both projects are expected to have 5 -year life cycles. The flight simulator has an initial cost of $150,000, and it is expected to generate net revenues of $40,000 per year for each of the next 5 years. The instrument device costs $85,000 today, and it has expected net revenues for the next 5 years of $20,000 per year. Within its financial evaluations, the aviation school uses a discount rate of 10% for all projects. Question 1 (1 point) Calculate the Payback Period for the flight simulator. 3.25 years 3.75 years 4.25 years 4.75 years None of the above. Calculate the Payback Period for the instrument device. 4.25 years 4.75 years 5.25 years 5.75 years None of the above. Calculate the Discounted Payback Period for the flight simulator. 4.04 years 4.58 years 4.85 years 4.93 years None of the above. Calculate the Discounted Payback Period for the nighttime instrument device. 4.74 years 5.46 years 5.74 years 5.81 years Beyond 5 years - No Payback Calculate the NPV for the flight simulator project. ($32,961) $1,631 $50,000 $151,631 None of the above. Calculate the NPV for the nighttime instrument project. ($26,480) ($9,184) $15,000 $75,816 Based upon the NPV results, which project(s) should be accepted for investment? The flight simulator project should be accepted. The nighttime instrument device should be accepted. Both projects should be accepted. Neither project should be accepted. Calculate the IRR for the flight simulator project. 0.4%10.4%15.3% None of the above. Calculate the IRR for the nighttime instrument project. 3.9% 5.7% 10.8% None of the above. When evaluating a project using the Internal Rate of Return (IRR) method, what is the standard decision-making rule? Accept any project with a positive IRR Accept any project with an IRR that is greater than its cost of capital Accept any project with an IRR that is less than its expected life Accept any project with an IRR greater than 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started