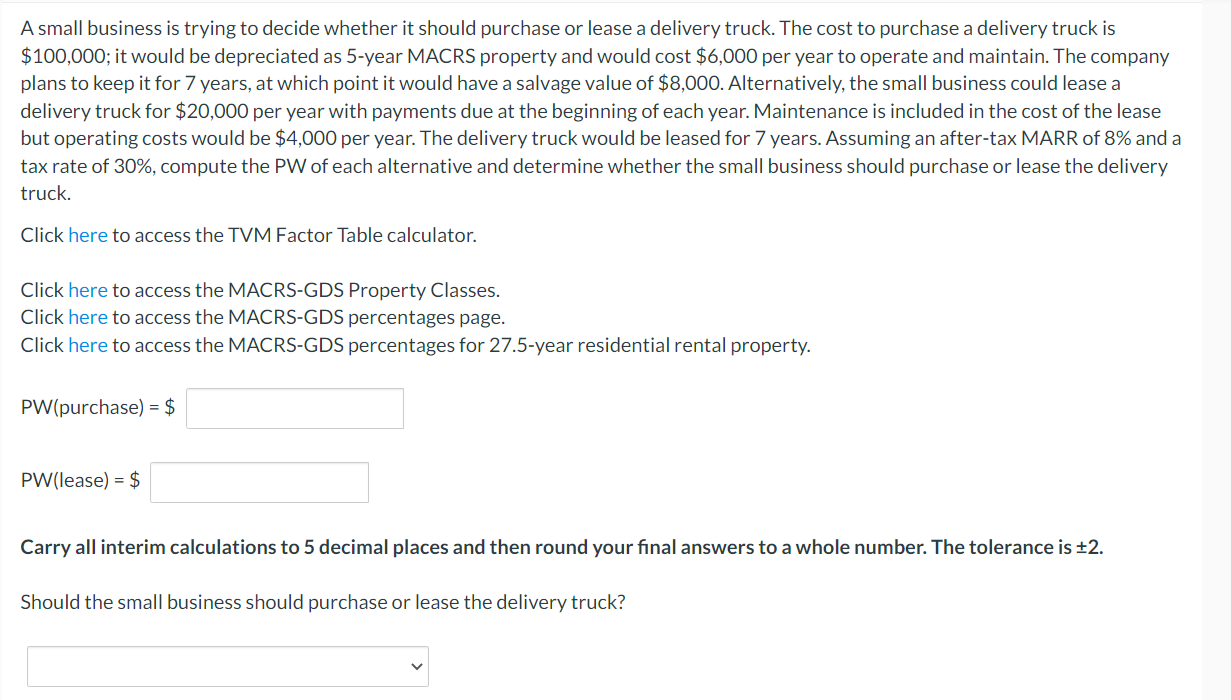

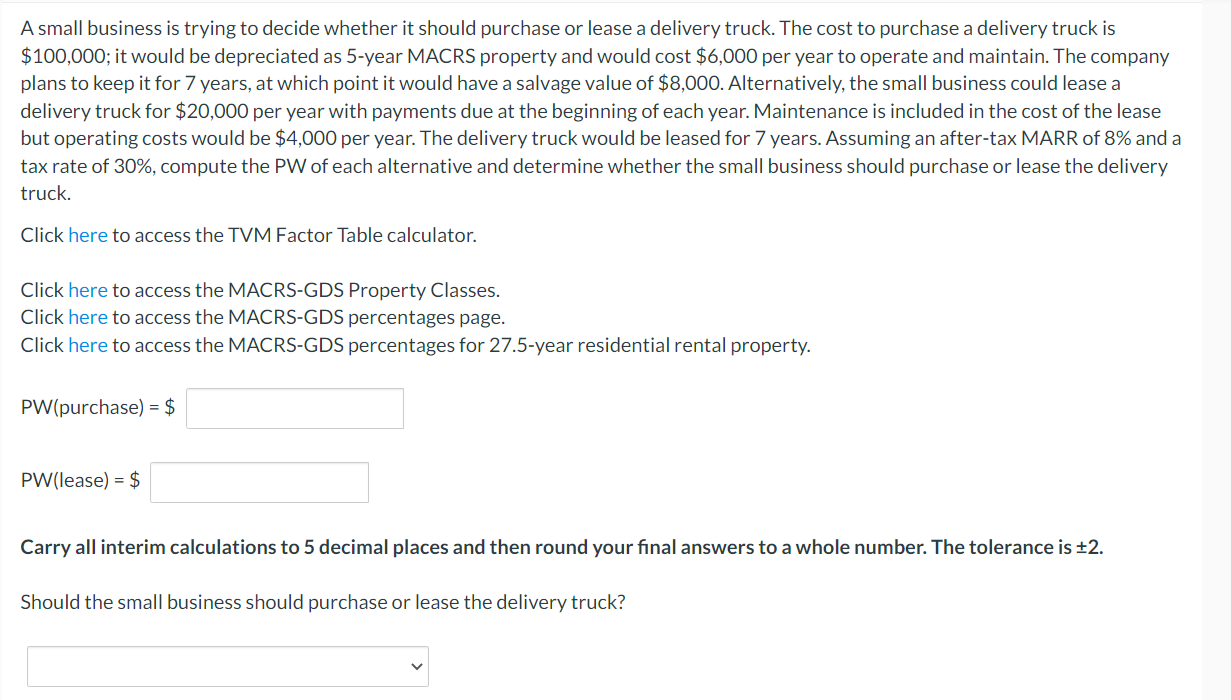

A small business is trying to decide whether it should purchase or lease a delivery truck. The cost to purchase a delivery truck is $100,000; it would be depreciated as 5-year MACRS property and would cost $6,000 per year to operate and maintain. The company plans to keep it for 7 years, at which point it would have a salvage value of $8,000. Alternatively, the small business could lease a delivery truck for $20,000 per year with payments due at the beginning of each year. Maintenance is included in the cost of the lease but operating costs would be $4,000 per year. The delivery truck would be leased for 7 years. Assuming an after-tax MARR of 8% and a tax rate of 30%, compute the PW of each alternative and determine whether the small business should purchase or lease the delivery truck. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. PW(purchase) = $ PW(lease) = $ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is +2. Should the small business should purchase or lease the delivery truck? A small business is trying to decide whether it should purchase or lease a delivery truck. The cost to purchase a delivery truck is $100,000; it would be depreciated as 5-year MACRS property and would cost $6,000 per year to operate and maintain. The company plans to keep it for 7 years, at which point it would have a salvage value of $8,000. Alternatively, the small business could lease a delivery truck for $20,000 per year with payments due at the beginning of each year. Maintenance is included in the cost of the lease but operating costs would be $4,000 per year. The delivery truck would be leased for 7 years. Assuming an after-tax MARR of 8% and a tax rate of 30%, compute the PW of each alternative and determine whether the small business should purchase or lease the delivery truck. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. PW(purchase) = $ PW(lease) = $ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is +2. Should the small business should purchase or lease the delivery truck