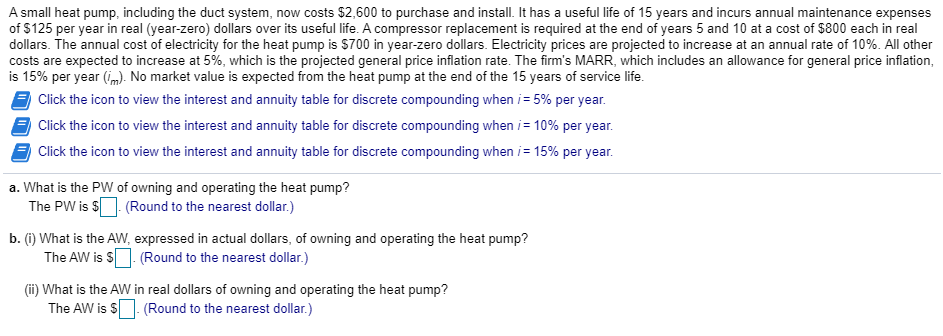

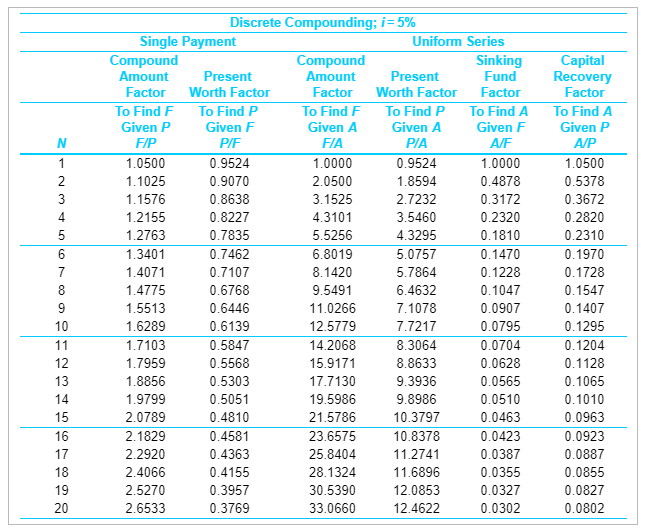

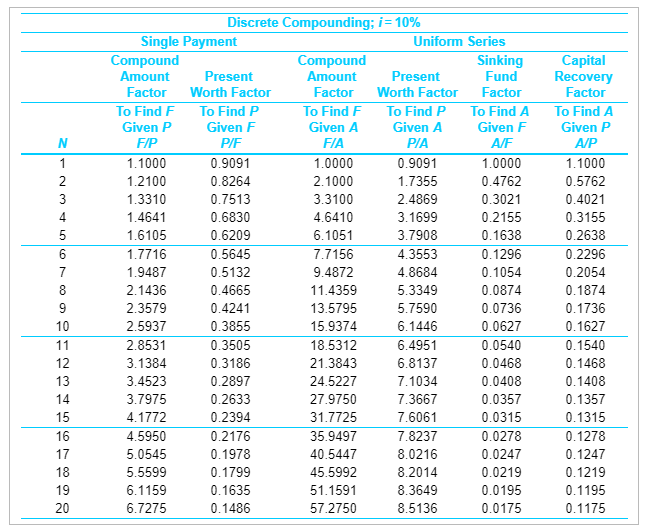

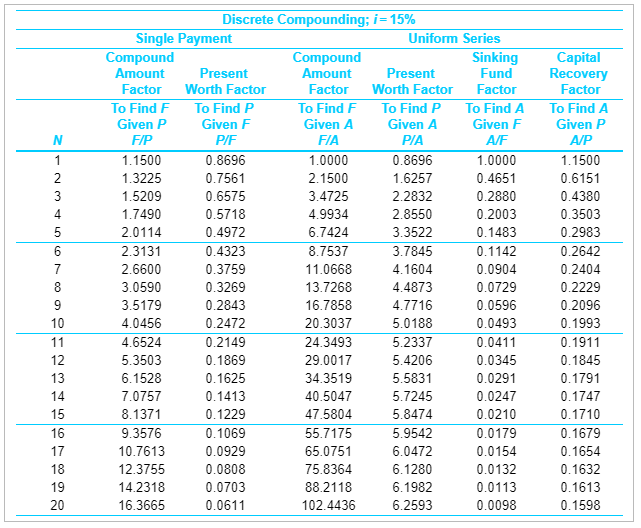

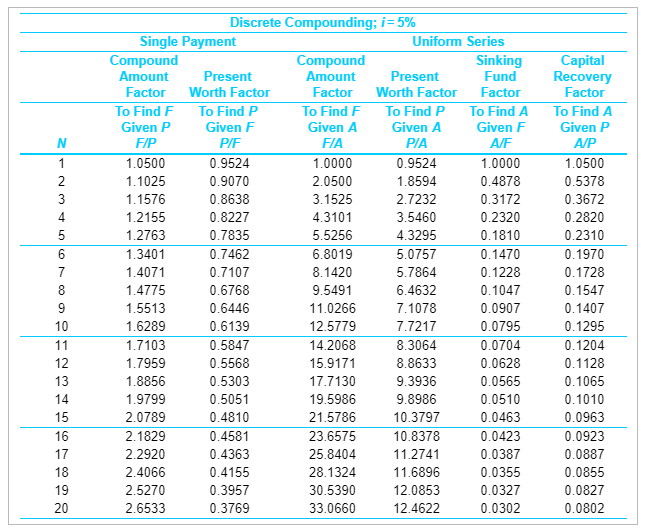

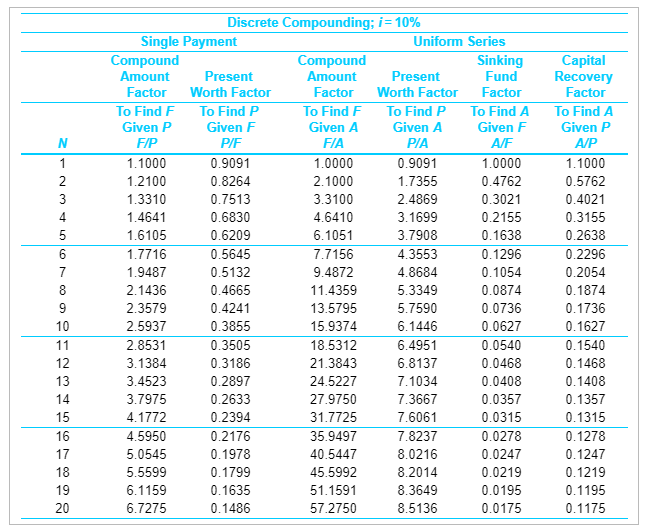

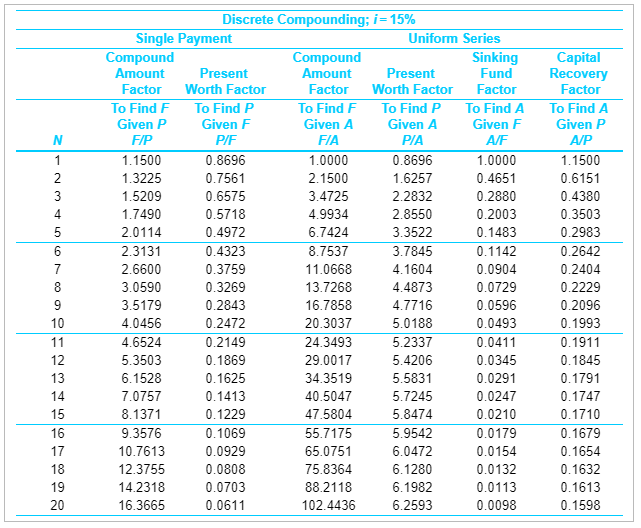

A small heat pump, including the duct system, now costs $2,600 to purchase and install. It has a useful life of 15 years and incurs annual maintenance expenses of $125 per year in real (year-zero) dollars over its useful life. A compressor replacement is required at the end of years 5 and 10 at a cost of $800 each in real dollars. The annual cost of electricity for the heat pump is $700 in year-zero dollars. Electricity prices are projected to increase at an annual rate of 10%. All other costs are expected to increase at 5%, which is the projected general price inflation rate. The firm's MARR, which includes an allowance for general price inflation, is 15% per year (im). No market value is expected from the heat pump at the end of the 15 years of service life. 5 Click the icon to view the interest and annuity table for discrete compounding when i = 5% per year. 9 Click the icon to view the interest and annuity table for discrete compounding when i = 10% per year. 9 Click the icon to view the interest and annuity table for discrete compounding when i = 15% per year. a. What is the PW of owning and operating the heat pump? The PW is $ (Round to the nearest dollar.) b.) What is the AW, expressed in actual dollars, of owning and operating the heat pump? The AW is $ (Round to the nearest dollar.) (ii) What is the AW in real dollars of owning and operating the heat pump? The AW is 5 (Round to the nearest dollar.) Si Capital Recovery Factor To Find A Given P A/P Discrete Compounding; i=5% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F F/P P/F FIA PIA A/F 1.0500 0.9524 1.0000 0.9524 1.0000 1.1025 0.9070 2.0500 1.8594 0.4878 1.1576 0.8638 3.1525 2.7232 0.3172 1.2155 0.8227 4.3101 3.5460 0.2320 1.2763 0.7835 5.5256 4.3295 0.1810 1.3401 0.7462 6.8019 5.0757 0.1470 1.4071 0.7107 8.1420 5.7864 0.1228 1.4775 0.6768 9.5491 6.4632 0.1047 1.5513 0.6446 11.0266 7.1078 0.0907 1.6289 0.6139 12.5779 7.7217 0.0795 1.7103 0.5847 14.2068 8.3064 0.0704 1.7959 0.5568 15.9171 8.8633 0.0628 1.8856 0.5303 17.7130 9.3936 0.0565 1.9799 0.5051 19.5986 9.8986 0.0510 2.0789 0.4810 21.5786 10.3797 0.0463 2. 1829 0.4581 23.6575 10.8378 0.0423 2.2920 0.4363 25.8404 11.2741 0.0387 2.4066 0.4155 28.1324 11.6896 0.0355 2.5270 0.3957 30.5390 12.0853 0.0327 2.6533 0.3769 33.0660 12.4622 0.0302 1.0500 0.5378 0.3672 0.2820 0.2310 0.1970 0.1728 0.1547 0.1407 0.1295 0.1204 0.1128 0.1065 0.1010 0.0963 0.0923 0.0887 0.0855 0.0827 0.0802 Discrete Compounding; i = 10% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP P/F FIA PIA A/F 1.1000 0.9091 1.0000 0.9091 1.0000 1.2100 0.8264 2.1000 1.7355 0.4762 1.3310 0.7513 3.3100 2.4869 0.3021 1.4641 0.6830 4.6410 3.1699 0.2155 1.6105 0.6209 6.1051 3.7908 0.1638 1.7716 0.5645 7.7156 4.3553 0.1296 1.9487 0.5132 9.4872 4.8684 0.1054 2.1436 0.4665 11.4359 5.3349 0.0874 2.3579 0.4241 13.5795 5.7590 0.0736 2.5937 0.3855 15.9374 6.1446 0.0627 2.8531 0.3505 18.5312 6.4951 0.0540 3.1384 0.3186 21.3843 6.8137 0.0468 3.4523 0.2897 24.5227 7.1034 0.0408 3.7975 0.2633 27.9750 7.3667 0.0357 4.1772 0.2394 31.7725 7.6061 0.0315 4.5950 0.2176 35.9497 7.8237 0.0278 5.0545 0.1978 40.5447 8.0216 0.0247 5.5599 0.1799 45.5992 8.2014 0.0219 6.1159 0.1635 51.1591 8.3649 0.0195 6.7275 0.1486 57.2750 8.5136 0.0175 Capital Recovery Factor To Find A Given P A/P 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0.1219 0.1195 0.1175 Discrete Compounding; i = 15% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F P F/ P /F FIA P/A A/F 1.1500 0.8696 1.0000 0.8696 1.0000 1.3225 0.7561 2.1500 1.6257 0.4651 1.5209 0.6575 3.4725 2.2832 0.2880 1.7490 0.5718 4.9934 2.8550 0.2003 2.0114 0.4972 6.7424 3.3522 0.1483 2.3131 0.4323 8.7537 3.7845 0.1142 2.6600 0.3759 11.0668 4.1604 0.0904 3.0590 0.3269 13.7268 4.4873 0.0729 3.5179 0.2843 16.7858 4.7716 0.0596 4.0456 0.2472 20.3037 5.0188 0.0493 4.6524 0.2149 24.3493 5.2337 0.0411 5.3503 0.1869 29.0017 5.4206 0.0345 6.1528 0.1625 34.3519 5.5831 0.0291 7.0757 0.1413 40.5047 5.7245 0.0247 8.1371 0.1229 47.5804 5.8474 0.0210 9.3576 0.1069 55.7175 5.9542 0.0179 10.7613 0.0929 65.0751 6.0472 0.0154 12.3755 0.0808 75.8364 6.1280 0.0132 14.2318 0.0703 88.2118 6.1982 0.0113 16.3665 0.0611 102.4436 6.2593 0.0098 Capital Recovery Factor To Find A Given P A/P 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 0.2229 0.2096 0.1993 0.1911 0.1845 0.1791 0.1747 0.1710 0.1679 0.1654 0.1632 0.1613 0.1598 A small heat pump, including the duct system, now costs $2,600 to purchase and install. It has a useful life of 15 years and incurs annual maintenance expenses of $125 per year in real (year-zero) dollars over its useful life. A compressor replacement is required at the end of years 5 and 10 at a cost of $800 each in real dollars. The annual cost of electricity for the heat pump is $700 in year-zero dollars. Electricity prices are projected to increase at an annual rate of 10%. All other costs are expected to increase at 5%, which is the projected general price inflation rate. The firm's MARR, which includes an allowance for general price inflation, is 15% per year (im). No market value is expected from the heat pump at the end of the 15 years of service life. 5 Click the icon to view the interest and annuity table for discrete compounding when i = 5% per year. 9 Click the icon to view the interest and annuity table for discrete compounding when i = 10% per year. 9 Click the icon to view the interest and annuity table for discrete compounding when i = 15% per year. a. What is the PW of owning and operating the heat pump? The PW is $ (Round to the nearest dollar.) b.) What is the AW, expressed in actual dollars, of owning and operating the heat pump? The AW is $ (Round to the nearest dollar.) (ii) What is the AW in real dollars of owning and operating the heat pump? The AW is 5 (Round to the nearest dollar.) Si Capital Recovery Factor To Find A Given P A/P Discrete Compounding; i=5% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F F/P P/F FIA PIA A/F 1.0500 0.9524 1.0000 0.9524 1.0000 1.1025 0.9070 2.0500 1.8594 0.4878 1.1576 0.8638 3.1525 2.7232 0.3172 1.2155 0.8227 4.3101 3.5460 0.2320 1.2763 0.7835 5.5256 4.3295 0.1810 1.3401 0.7462 6.8019 5.0757 0.1470 1.4071 0.7107 8.1420 5.7864 0.1228 1.4775 0.6768 9.5491 6.4632 0.1047 1.5513 0.6446 11.0266 7.1078 0.0907 1.6289 0.6139 12.5779 7.7217 0.0795 1.7103 0.5847 14.2068 8.3064 0.0704 1.7959 0.5568 15.9171 8.8633 0.0628 1.8856 0.5303 17.7130 9.3936 0.0565 1.9799 0.5051 19.5986 9.8986 0.0510 2.0789 0.4810 21.5786 10.3797 0.0463 2. 1829 0.4581 23.6575 10.8378 0.0423 2.2920 0.4363 25.8404 11.2741 0.0387 2.4066 0.4155 28.1324 11.6896 0.0355 2.5270 0.3957 30.5390 12.0853 0.0327 2.6533 0.3769 33.0660 12.4622 0.0302 1.0500 0.5378 0.3672 0.2820 0.2310 0.1970 0.1728 0.1547 0.1407 0.1295 0.1204 0.1128 0.1065 0.1010 0.0963 0.0923 0.0887 0.0855 0.0827 0.0802 Discrete Compounding; i = 10% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP P/F FIA PIA A/F 1.1000 0.9091 1.0000 0.9091 1.0000 1.2100 0.8264 2.1000 1.7355 0.4762 1.3310 0.7513 3.3100 2.4869 0.3021 1.4641 0.6830 4.6410 3.1699 0.2155 1.6105 0.6209 6.1051 3.7908 0.1638 1.7716 0.5645 7.7156 4.3553 0.1296 1.9487 0.5132 9.4872 4.8684 0.1054 2.1436 0.4665 11.4359 5.3349 0.0874 2.3579 0.4241 13.5795 5.7590 0.0736 2.5937 0.3855 15.9374 6.1446 0.0627 2.8531 0.3505 18.5312 6.4951 0.0540 3.1384 0.3186 21.3843 6.8137 0.0468 3.4523 0.2897 24.5227 7.1034 0.0408 3.7975 0.2633 27.9750 7.3667 0.0357 4.1772 0.2394 31.7725 7.6061 0.0315 4.5950 0.2176 35.9497 7.8237 0.0278 5.0545 0.1978 40.5447 8.0216 0.0247 5.5599 0.1799 45.5992 8.2014 0.0219 6.1159 0.1635 51.1591 8.3649 0.0195 6.7275 0.1486 57.2750 8.5136 0.0175 Capital Recovery Factor To Find A Given P A/P 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0.1219 0.1195 0.1175 Discrete Compounding; i = 15% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F P F/ P /F FIA P/A A/F 1.1500 0.8696 1.0000 0.8696 1.0000 1.3225 0.7561 2.1500 1.6257 0.4651 1.5209 0.6575 3.4725 2.2832 0.2880 1.7490 0.5718 4.9934 2.8550 0.2003 2.0114 0.4972 6.7424 3.3522 0.1483 2.3131 0.4323 8.7537 3.7845 0.1142 2.6600 0.3759 11.0668 4.1604 0.0904 3.0590 0.3269 13.7268 4.4873 0.0729 3.5179 0.2843 16.7858 4.7716 0.0596 4.0456 0.2472 20.3037 5.0188 0.0493 4.6524 0.2149 24.3493 5.2337 0.0411 5.3503 0.1869 29.0017 5.4206 0.0345 6.1528 0.1625 34.3519 5.5831 0.0291 7.0757 0.1413 40.5047 5.7245 0.0247 8.1371 0.1229 47.5804 5.8474 0.0210 9.3576 0.1069 55.7175 5.9542 0.0179 10.7613 0.0929 65.0751 6.0472 0.0154 12.3755 0.0808 75.8364 6.1280 0.0132 14.2318 0.0703 88.2118 6.1982 0.0113 16.3665 0.0611 102.4436 6.2593 0.0098 Capital Recovery Factor To Find A Given P A/P 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 0.2229 0.2096 0.1993 0.1911 0.1845 0.1791 0.1747 0.1710 0.1679 0.1654 0.1632 0.1613 0.1598