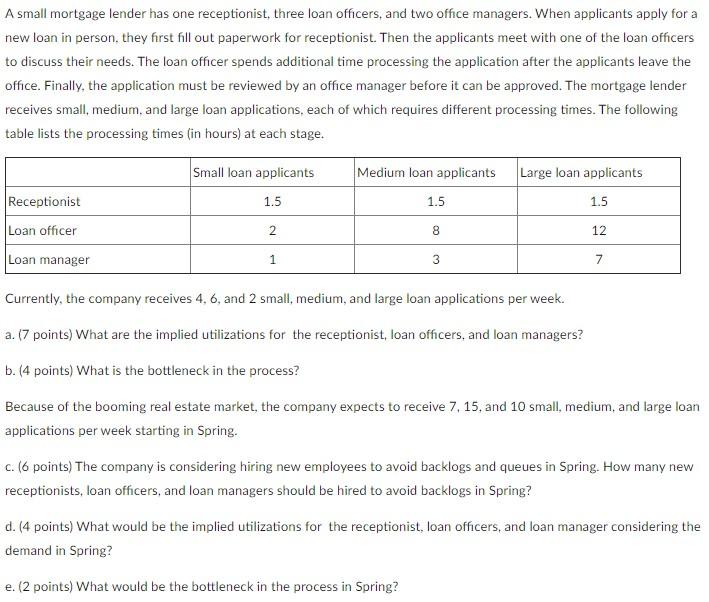

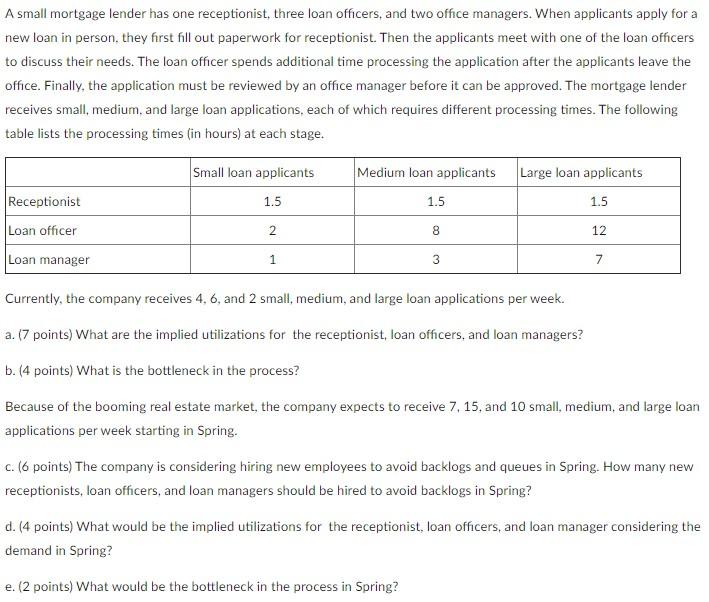

A small mortgage lender has one receptionist, three loan officers, and two office managers. When applicants apply for a new loan in person, they first fill out paperwork for receptionist. Then the applicants meet with one of the loan officers to discuss their needs. The loan officer spends additional time processing the application after the applicants leave the office. Finally, the application must be reviewed by an office manager before it can be approved. The mortgage lender receives small, medium and large loan applications, each of which requires different processing times. The following table lists the processing times (in hours) at each stage. Small loan applicants Medium loan applicants Large loan applicants 1.5 1.5 1.5 Receptionist Loan officer 2 8 12 Loan manager 1 3 7 Currently, the company receives 4, 6, and 2 small, medium, and large loan applications per week. a. (7 points) What are the implied utilizations for the receptionist, loan officers, and loan managers? b. (4 points) What is the bottleneck in the process? Because of the booming real estate market, the company expects to receive 7. 15, and 10 small, medium, and large loan applications per week starting in Spring. c. (6 points) The company is considering hiring new employees to avoid backlogs and queues in Spring. How many new receptionists, loan officers, and loan managers should be hired to avoid backlogs in Spring? d. (4 points) What would be the implied utilizations for the receptionist, loan officers, and loan manager considering the demand in Spring? e. (2 points) What would be the bottleneck in the process in Spring? A small mortgage lender has one receptionist, three loan officers, and two office managers. When applicants apply for a new loan in person, they first fill out paperwork for receptionist. Then the applicants meet with one of the loan officers to discuss their needs. The loan officer spends additional time processing the application after the applicants leave the office. Finally, the application must be reviewed by an office manager before it can be approved. The mortgage lender receives small, medium and large loan applications, each of which requires different processing times. The following table lists the processing times (in hours) at each stage. Small loan applicants Medium loan applicants Large loan applicants 1.5 1.5 1.5 Receptionist Loan officer 2 8 12 Loan manager 1 3 7 Currently, the company receives 4, 6, and 2 small, medium, and large loan applications per week. a. (7 points) What are the implied utilizations for the receptionist, loan officers, and loan managers? b. (4 points) What is the bottleneck in the process? Because of the booming real estate market, the company expects to receive 7. 15, and 10 small, medium, and large loan applications per week starting in Spring. c. (6 points) The company is considering hiring new employees to avoid backlogs and queues in Spring. How many new receptionists, loan officers, and loan managers should be hired to avoid backlogs in Spring? d. (4 points) What would be the implied utilizations for the receptionist, loan officers, and loan manager considering the demand in Spring? e. (2 points) What would be the bottleneck in the process in Spring