Answered step by step

Verified Expert Solution

Question

1 Approved Answer

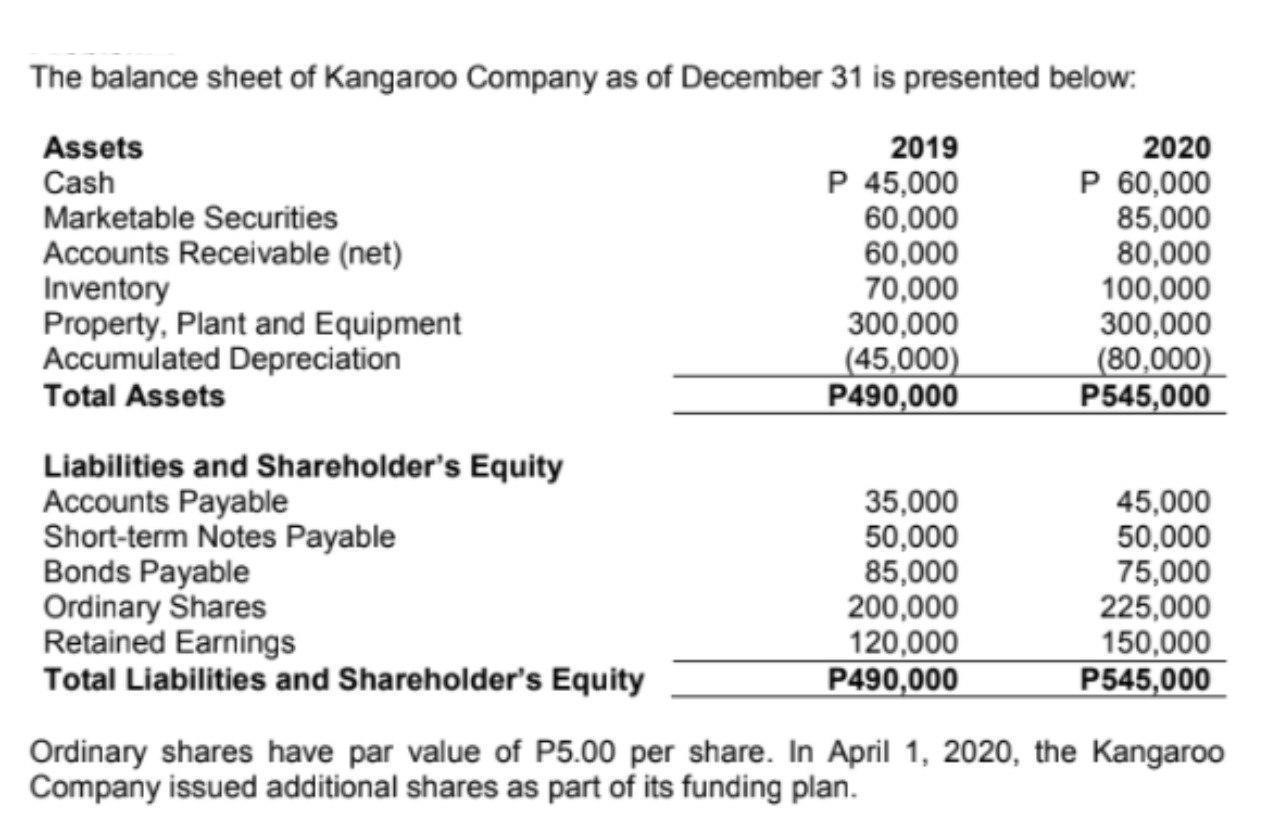

The balance sheet of Kangaroo Company as of December 31 is presented below: Assets Cash Marketable Securities Accounts Receivable (net) Inventory Property, Plant and

The balance sheet of Kangaroo Company as of December 31 is presented below: Assets Cash Marketable Securities Accounts Receivable (net) Inventory Property, Plant and Equipment Accumulated Depreciation Total Assets Liabilities and Shareholder's Equity Accounts Payable Short-term Notes Payable Bonds Payable Ordinary Shares Retained Earnings Total Liabilities and Shareholder's Equity 2019 P 45,000 60,000 60,000 70,000 300,000 (45,000) P490,000 35,000 50,000 85,000 200,000 120,000 P490,000 2020 P 60,000 85,000 80,000 100,000 300,000 (80,000) P545,000 45,000 50,000 75,000 225,000 150,000 P545,000 Ordinary shares have par value of P5.00 per share. In April 1, 2020, the Kangaroo Company issued additional shares as part of its funding plan. Compute the following: Assuming that on July 1, 2020, Kangaroo Company purchased its own share at P10.00. How much is the book value per share for the year 2020? Assuming that there is a cumulative and participating preference share, how this will affect the book value per share computation? Explain briefly.

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Assuming that on July 1 2020 Kangaroo Company purchased its own share at P1000 How much is the book value per share for the year 2020 Book value per s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started