Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A small Queensland farming company is contemplating whether to invest in a new irrigation system for their farmland. Currently their crop yields 45 tonnes that

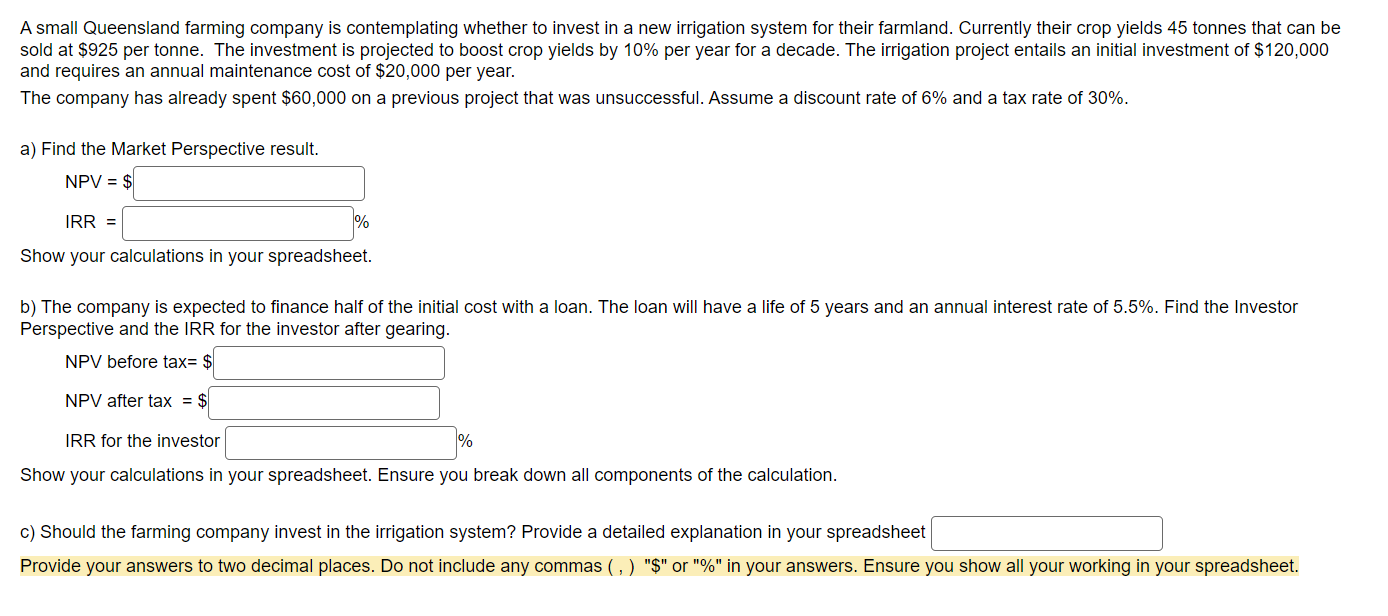

A small Queensland farming company is contemplating whether to invest in a new irrigation system for their farmland. Currently their crop yields 45 tonnes that can be sold at $925 per tonne. The investment is projected to boost crop yields by 10% per year for a decade. The irrigation project entails an initial investment of $120,000 and requires an annual maintenance cost of $20,000 per year. The company has already spent $60,000 on a previous project that was unsuccessful. Assume a discount rate of 6% and a tax rate of 30%. a) Find the Market Perspective result. NPV=$IRR= % Show your calculations in your spreadsheet. b) The company is expected to finance half of the initial cost with a loan. The loan will have a life of 5 years and an annual interest rate of 5.5%. Find the Investor Perspective and the IRR for the investor after gearing. NPV before tax =$ NPV after tax =$ IRR for the investor % Show your calculations in your spreadsheet. Ensure you break down all components of the calculation. c) Should the farming company invest in the irrigation system? Provide a detailed explanation in your spreadsheet Provide your answers to two decimal places. Do not include any commas (, ) "\$" or "\%" in your answers. Ensure you show all your working in your spreadsheet

A small Queensland farming company is contemplating whether to invest in a new irrigation system for their farmland. Currently their crop yields 45 tonnes that can be sold at $925 per tonne. The investment is projected to boost crop yields by 10% per year for a decade. The irrigation project entails an initial investment of $120,000 and requires an annual maintenance cost of $20,000 per year. The company has already spent $60,000 on a previous project that was unsuccessful. Assume a discount rate of 6% and a tax rate of 30%. a) Find the Market Perspective result. NPV=$IRR= % Show your calculations in your spreadsheet. b) The company is expected to finance half of the initial cost with a loan. The loan will have a life of 5 years and an annual interest rate of 5.5%. Find the Investor Perspective and the IRR for the investor after gearing. NPV before tax =$ NPV after tax =$ IRR for the investor % Show your calculations in your spreadsheet. Ensure you break down all components of the calculation. c) Should the farming company invest in the irrigation system? Provide a detailed explanation in your spreadsheet Provide your answers to two decimal places. Do not include any commas (, ) "\$" or "\%" in your answers. Ensure you show all your working in your spreadsheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started