Question

A small, US-based manufacturing firm is interested developing a new product to that would be produced and sold starting in 2022. Based on a preliminary

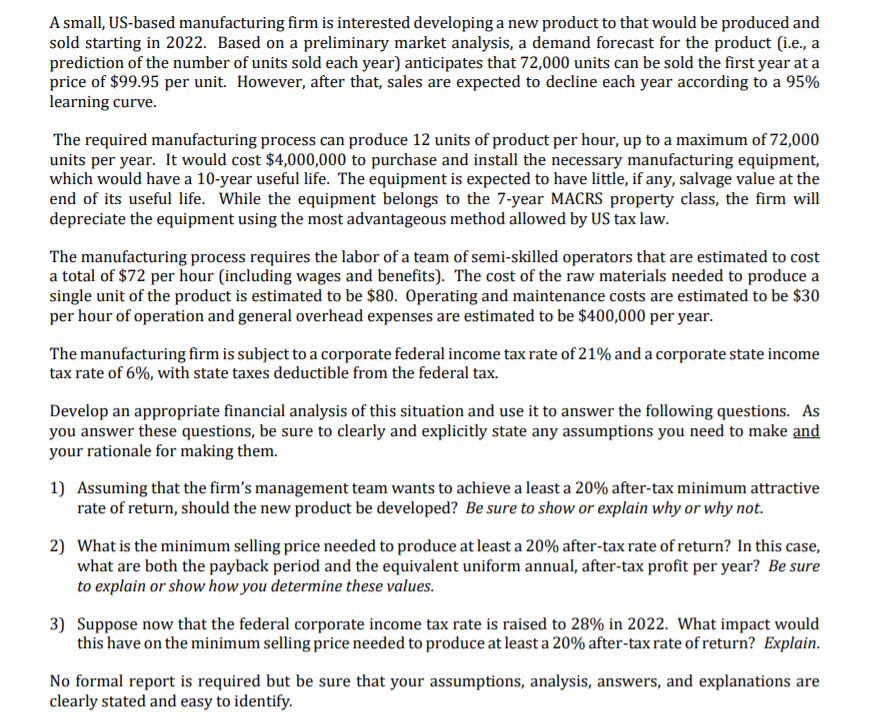

A small, US-based manufacturing firm is interested developing a new product to that would be produced and sold starting in 2022. Based on a preliminary market analysis, a demand forecast for the product (i.e., a prediction of the number of units sold each year) anticipates that 72,000 units can be sold the first year at a price of $99.95 per unit. However, after that, sales are expected to decline each year according to a 95% learning curve. The required manufacturing process can produce 12 units of product per hour, up to a maximum of 72,000 units per year. It would cost $4,000,000 to purchase and install the necessary manufacturing equipment, which would have a 10-year useful life. The equipment is expected to have little, if any, salvage value at the end of its useful life. While the equipment belongs to the 7-year MACRS property class, the firm will depreciate the equipment using the most advantageous method allowed by US tax law. The manufacturing process requires the labor of a team of semi-skilled operators that are estimated to cost a total of $72 per hour (including wages and benefits). The cost of the raw materials needed to produce a single unit of the product is estimated to be $80. Operating and maintenance costs are estimated to be $30 per hour of operation and general overhead expenses are estimated to be $400,000 per year. The manufacturing firm is subject to a corporate federal income tax rate of 21% and a corporate state income tax rate of 6%, with state taxes deductible from the federal tax. Develop an appropriate financial analysis of this situation and use it to answer the following questions. As you answer these questions, be sure to clearly and explicitly state any assumptions you need to make and your rationale for making them. 1) Assuming that the firms management team wants to achieve a least a 20% after-tax minimum attractive rate of return, should the new product be developed? Be sure to show or explain why or why not. 2) What is the minimum selling price needed to produce at least a 20% after-tax rate of return? In this case, what are both the payback period and the equivalent uniform annual, after-tax profit per year? Be sure to explain or show how you determine these values. 3) Suppose now that the federal corporate income tax rate is raised to 28% in 2022. What impact would this have on the minimum selling price needed to produce at least a 20% after-tax rate of return? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started