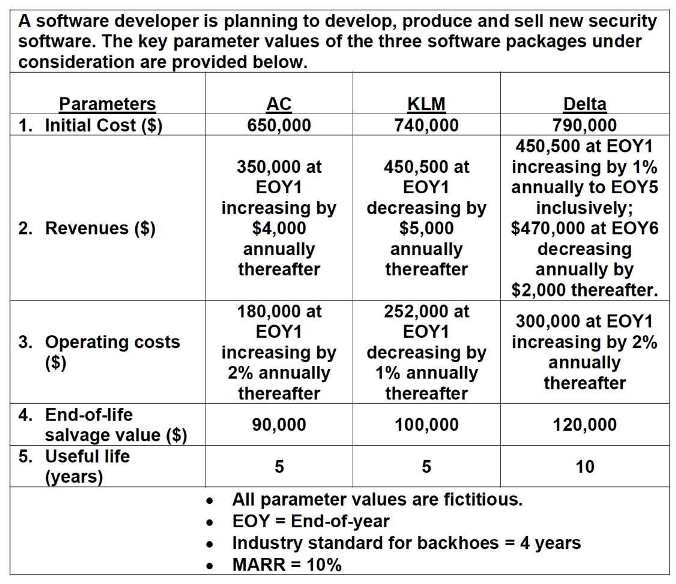

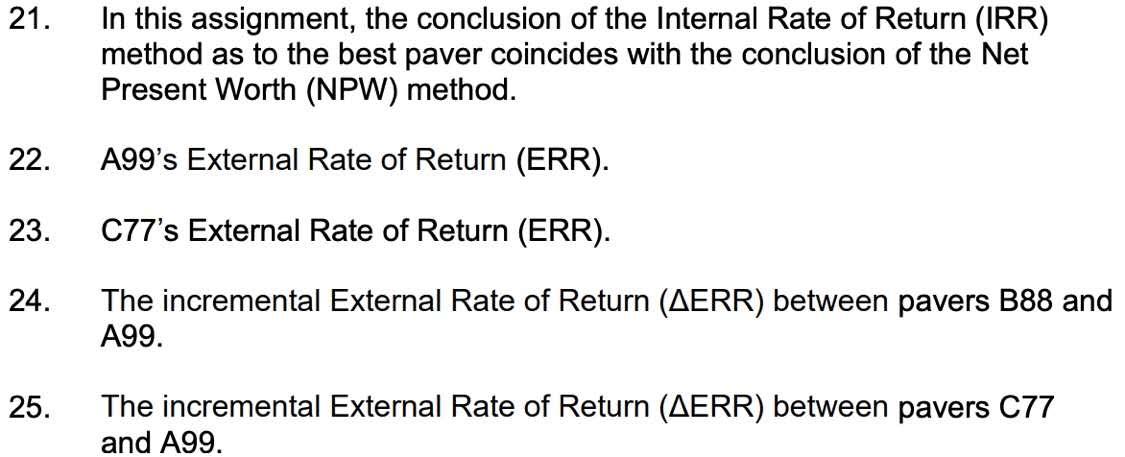

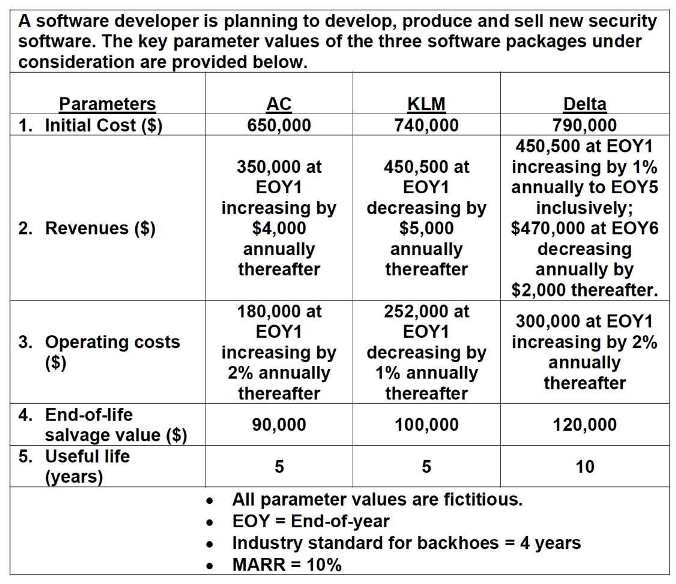

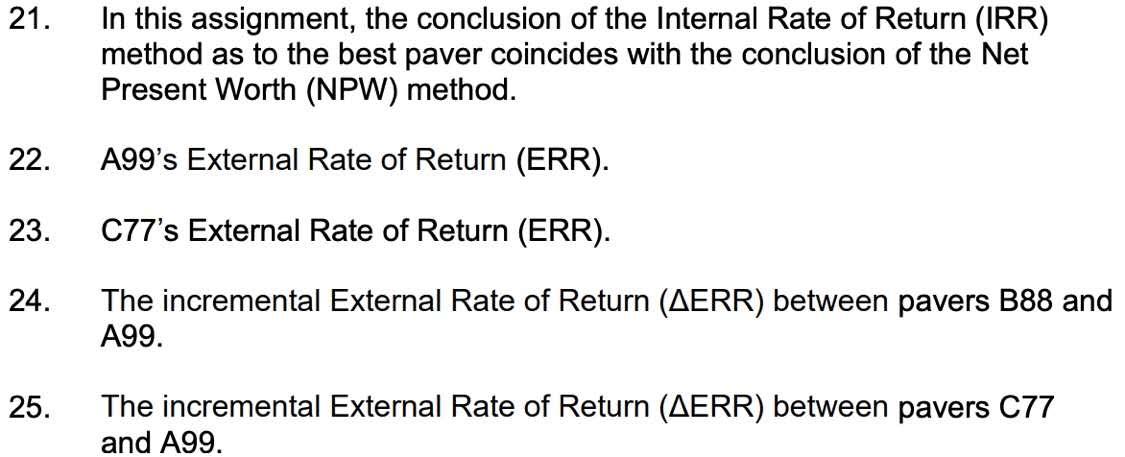

A software developer is planning to develop, produce and sell new security software. The key parameter values of the three software packages under consideration are provided below. Parameters 1. Initial Cost ($) AC 650,000 KLM 740,000 2. Revenues ($) 350,000 at EOY1 increasing by $4,000 annually thereafter 450,500 at EOY1 decreasing by $5,000 annually thereafter Delta 790,000 450,500 at EOY1 increasing by 1% annually to EOY5 inclusively; $470,000 at EOY6 decreasing annually by $2,000 thereafter. 300,000 at EOY1 increasing by 2% annually thereafter 3. Operating costs ($) 180,000 at EOY1 increasing by 2% annually thereafter 90,000 252,000 at EOY1 decreasing by 1% annually thereafter 100,000 120,000 4. End-of-life salvage value ($) 5. Useful life (years) 5 5 10 All parameter values are fictitious. EOY = End-of-year Industry standard for backhoes = 4 years MARR = 10% . 21. In this assignment, the conclusion of the Internal Rate of Return (IRR) method as to the best paver coincides with the conclusion of the Net Present Worth (NPW) method. 22. A99's External Rate of Return (ERR). 23. C77's External Rate of Return (ERR). 24. The incremental External Rate of Return (AERR) between pavers B88 and A99. 25. The incremental External Rate of Return (AERR) between pavers C77 and A99. A software developer is planning to develop, produce and sell new security software. The key parameter values of the three software packages under consideration are provided below. Parameters 1. Initial Cost ($) AC 650,000 KLM 740,000 2. Revenues ($) 350,000 at EOY1 increasing by $4,000 annually thereafter 450,500 at EOY1 decreasing by $5,000 annually thereafter Delta 790,000 450,500 at EOY1 increasing by 1% annually to EOY5 inclusively; $470,000 at EOY6 decreasing annually by $2,000 thereafter. 300,000 at EOY1 increasing by 2% annually thereafter 3. Operating costs ($) 180,000 at EOY1 increasing by 2% annually thereafter 90,000 252,000 at EOY1 decreasing by 1% annually thereafter 100,000 120,000 4. End-of-life salvage value ($) 5. Useful life (years) 5 5 10 All parameter values are fictitious. EOY = End-of-year Industry standard for backhoes = 4 years MARR = 10% . 21. In this assignment, the conclusion of the Internal Rate of Return (IRR) method as to the best paver coincides with the conclusion of the Net Present Worth (NPW) method. 22. A99's External Rate of Return (ERR). 23. C77's External Rate of Return (ERR). 24. The incremental External Rate of Return (AERR) between pavers B88 and A99. 25. The incremental External Rate of Return (AERR) between pavers C77 and A99