Answered step by step

Verified Expert Solution

Question

1 Approved Answer

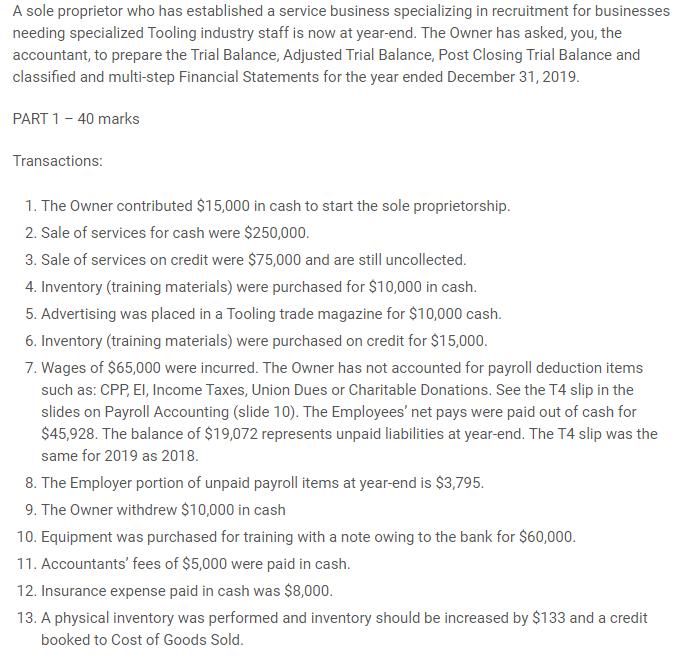

A sole proprietor who has established a service business specializing in recruitment for businesses needing specialized Tooling industry staff is now at year-end. The

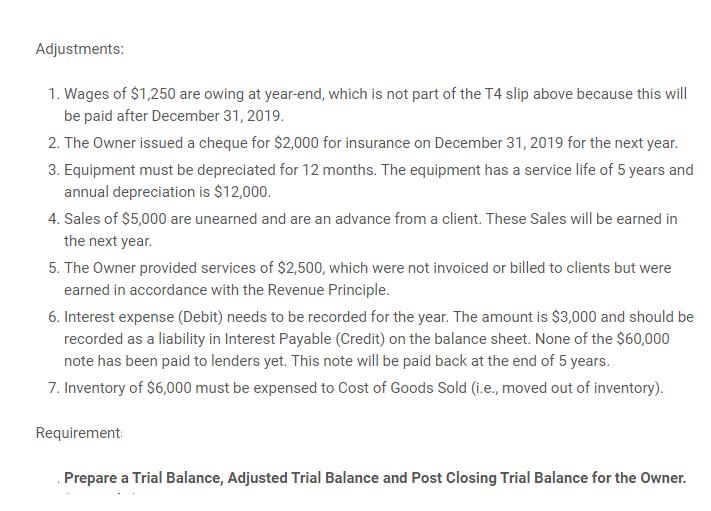

A sole proprietor who has established a service business specializing in recruitment for businesses needing specialized Tooling industry staff is now at year-end. The Owner has asked, you, the accountant, to prepare the Trial Balance, Adjusted Trial Balance, Post Closing Trial Balance and classified and multi-step Financial Statements for the year ended December 31, 2019. PART 1- 40 marks Transactions: 1. The Owner contributed $15,000 in cash to start the sole proprietorship. 2. Sale of services for cash were $250,000. 3. Sale of services on credit were $75,000 and are still uncollected. 4. Inventory (training materials) were purchased for $10,000 in cash. 5. Advertising was placed in a Tooling trade magazine for $10,000 cash. 6. Inventory (training materials) were purchased on credit for $15,000. 7. Wages of $65,000 were incurred. The Owner has not accounted for payroll deduction items such as: CPP, EI, Income Taxes, Union Dues or Charitable Donations. See the T4 slip in the slides on Payroll Accounting (slide 10). The Employees' net pays were paid out of cash for $45,928. The balance of $19,072 represents unpaid liabilities at year-end. The T4 slip was the same for 2019 as 2018. 8. The Employer portion of unpaid payroll items at year-end is $3,795. 9. The Owner withdrew $10,000 in cash 10. Equipment was purchased for training with a note owing to the bank for $60,000. 11. Accountants' fees of $5,000 were paid in cash. 12. Insurance expense paid in cash was $8,000. 13. A physical inventory was performed and inventory should be increased by $133 and a credit booked to Cost of Goods Sold. Adjustments: 1. Wages of $1,250 are owing at year-end, which is not part of the T4 slip above because this will be paid after December 31, 2019. 2. The Owner issued a cheque for $2,000 for insurance on December 31, 2019 for the next year. 3. Equipment must be depreciated for 12 months. The equipment has a service life of 5 years and annual depreciation is $12,000. 4. Sales of $5,000 are unearned and are an advance from a client. These Sales will be earned in the next year. 5. The Owner provided services of $2,500, which were not invoiced or billed to clients but were earned in accordance with the Revenue Principle. 6. Interest expense (Debit) needs to be recorded for the year. The amount is $3,000 and should be recorded as a liability in Interest Payable (Credit) on the balance sheet. None of the $60,000 note has been paid to lenders yet. This note will be paid back at the end of 5 years. 7. Inventory of $6,000 must be expensed to Cost of Goods Sold (i.e., moved out of inventory). Requirement Prepare a Trial Balance, Adjusted Trial Balance and Post Closing Trial Balance for the Owner.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A Trial Balance Unadjusted at year end Particulars Debit Credit Cash and Bank balance 176072 Account...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started