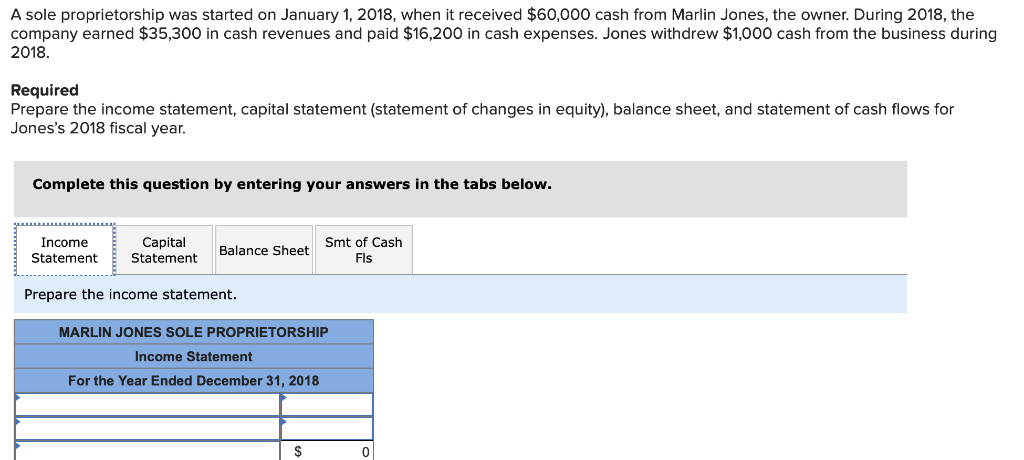

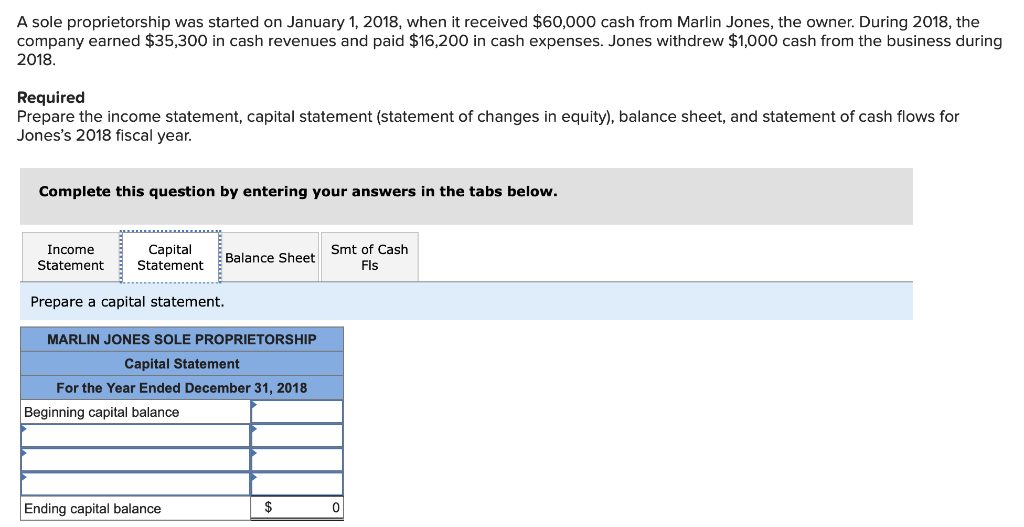

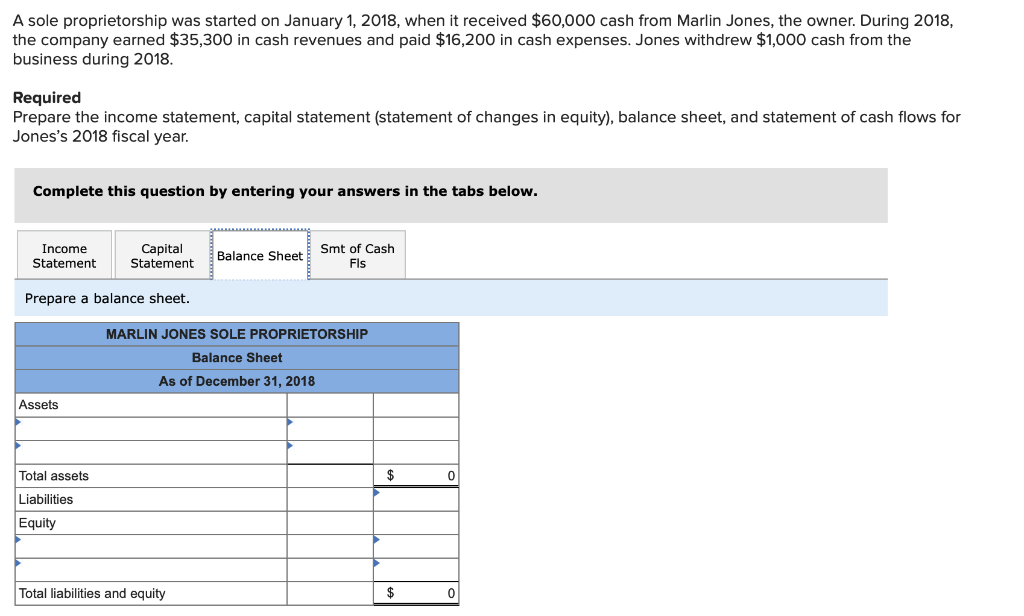

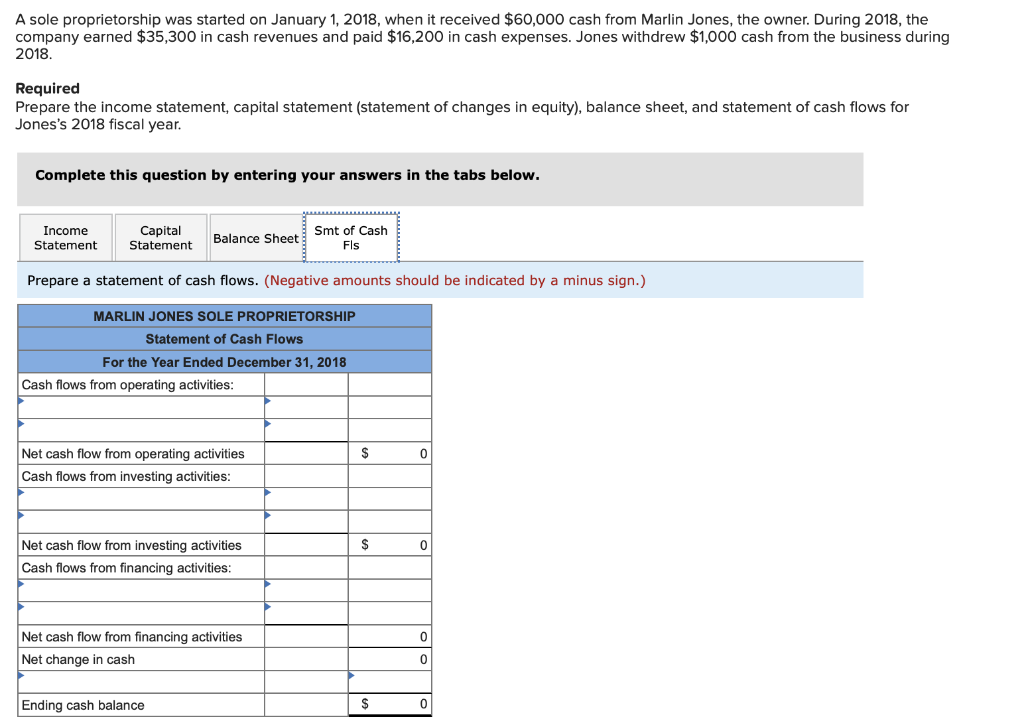

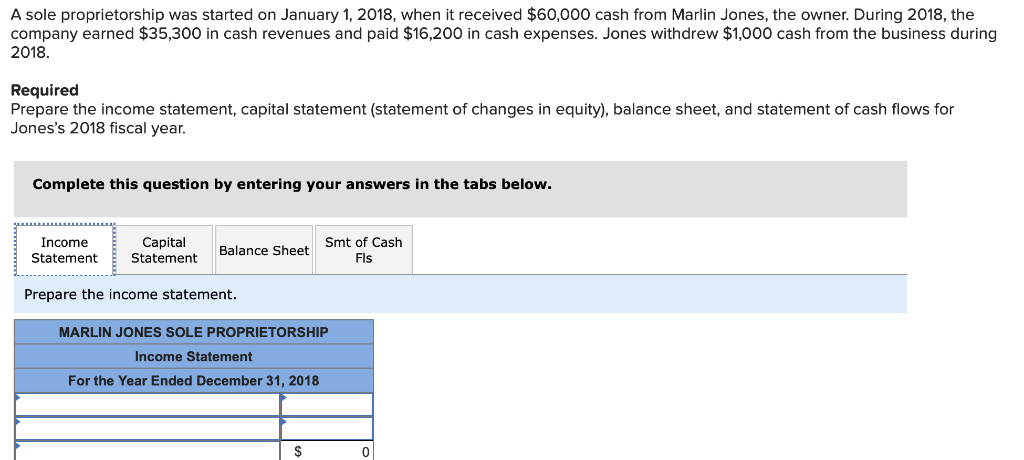

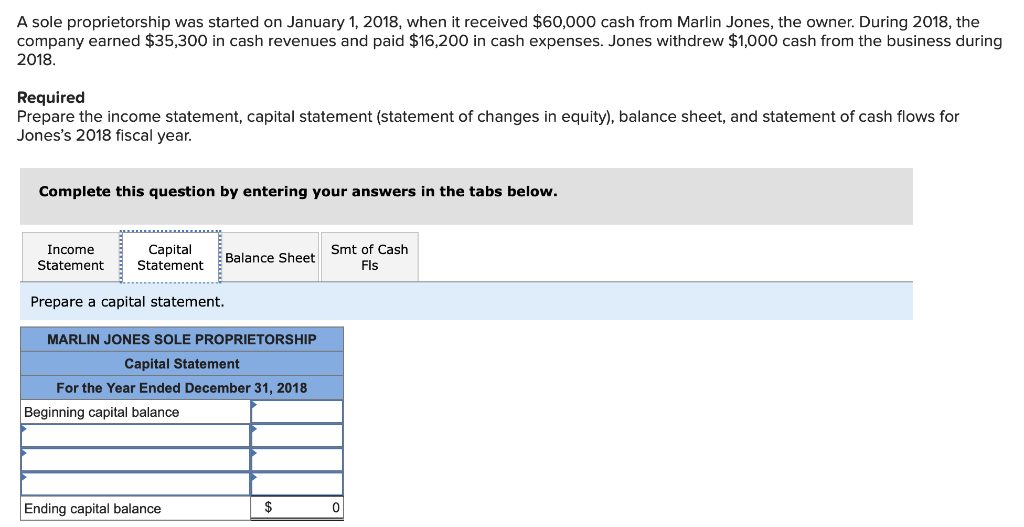

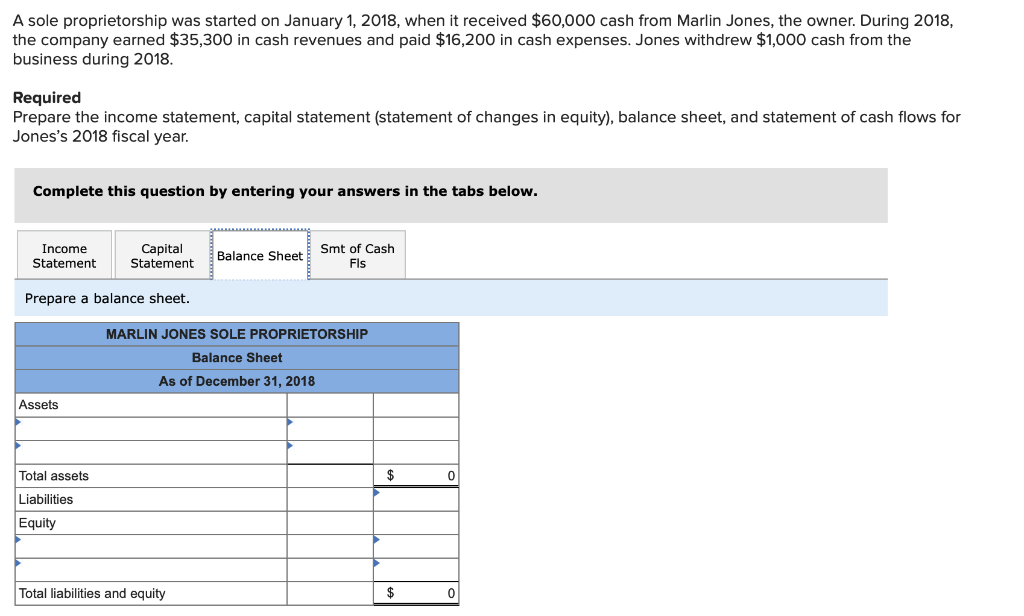

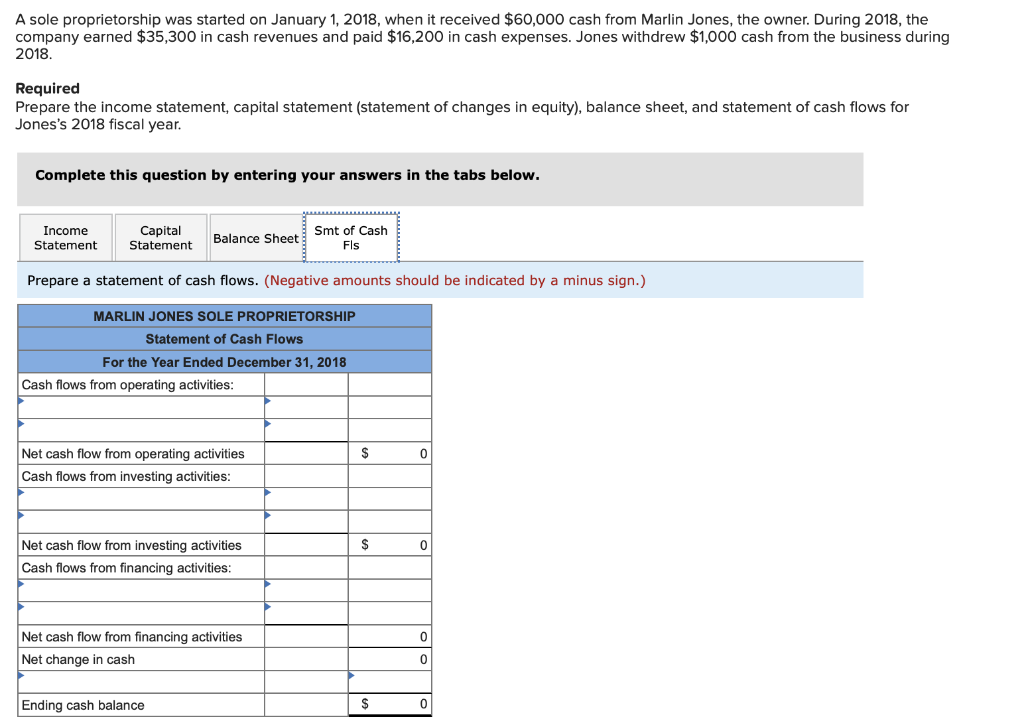

A sole proprietorship was started on January 1, 2018, when it received $60,000 cash from Marlin Jones, the owner. During 2018, the company earned $35,300 in cash revenues and paid $16,200 in cash expenses. Jones withdrew $1,000 cash from the business during 2018 Required Prepare the income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones's 2018 fiscal year. Complete this question by entering your answers in the tabs below. Income Capital Statement Smt of Cash Fls Balance Sheet Statement Prepare the income statement. MARLIN JONES SOLE PROPRIETORSHIP Income Statement For the Year Ended December 31, 2018 0 A sole proprietorship was started on January 1, 2018, when it received $60,000 cash from Marlin Jones, the owner. During 2018, the company earned $35,300 in cash revenues and paid $16,200 in cash expenses. Jones withdrew $1,000 cash from the business during 2018 Required Prepare the income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones's 2018 fiscal year. Complete this question by entering your answers in the tabs below. Smt of Cash Capital Statement Income Balance Sheet Statement Fls Prepare a capital statement. MARLIN JONES SOLE PROPRIETORSHIP Capital Statement For the Year Ended December 31, 2018 Beginning capital balance C Ending capital balance A sole proprietorship was started on January 1, 2018, when it received $60,000 cash from Marlin Jones, the owner. During 2018 the company earned $35,300 in cash revenues and paid $16,200 in cash expenses. . Jones withdrew $1,000 cash from the business during 2018. Required Prepare the income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones's 2018 fiscal year. Complete this question by entering your answers in the tabs below. Income Statement Capital Statement Smt of Cash Balance Sheet Fls Prepare a balance sheet. MARLIN JONES SOLE PROPRIETORS HIP Balance Sheet As of December 31, 2018 Assets Total assets 0 Liabilities Equity Total liabilities and equity 0 A sole proprietorship was started on January 1, 2018, when it received $60,000 cash from Marlin Jones, the owner. During 2018, the company earned $35,300 in cash revenues and paid $16,200 in cash expenses. Jones withdrew $1,000 cash from the business during 2018 Required Prepare the income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones's 2018 fiscal year Complete this question by entering your answers in the tabs below. Capital Smt of Cash Fls Income Balance Sheet Statement Statement Prepare a statement of cash flows. (Negative amounts should be indicated by a minus sign.) MARLIN JONES SOLE PROPRIETORSHIP Statement of Cash Flows For the Year Ended December 31, 2018 Cash flows from operating activities: Net cash flow from operating activities Cash flows from investing activities: S 0 Net cash flow from investing activities $ Cash flows from financing activities Net cash flow from financing activities 0 Net change in cash C Ending cash balance