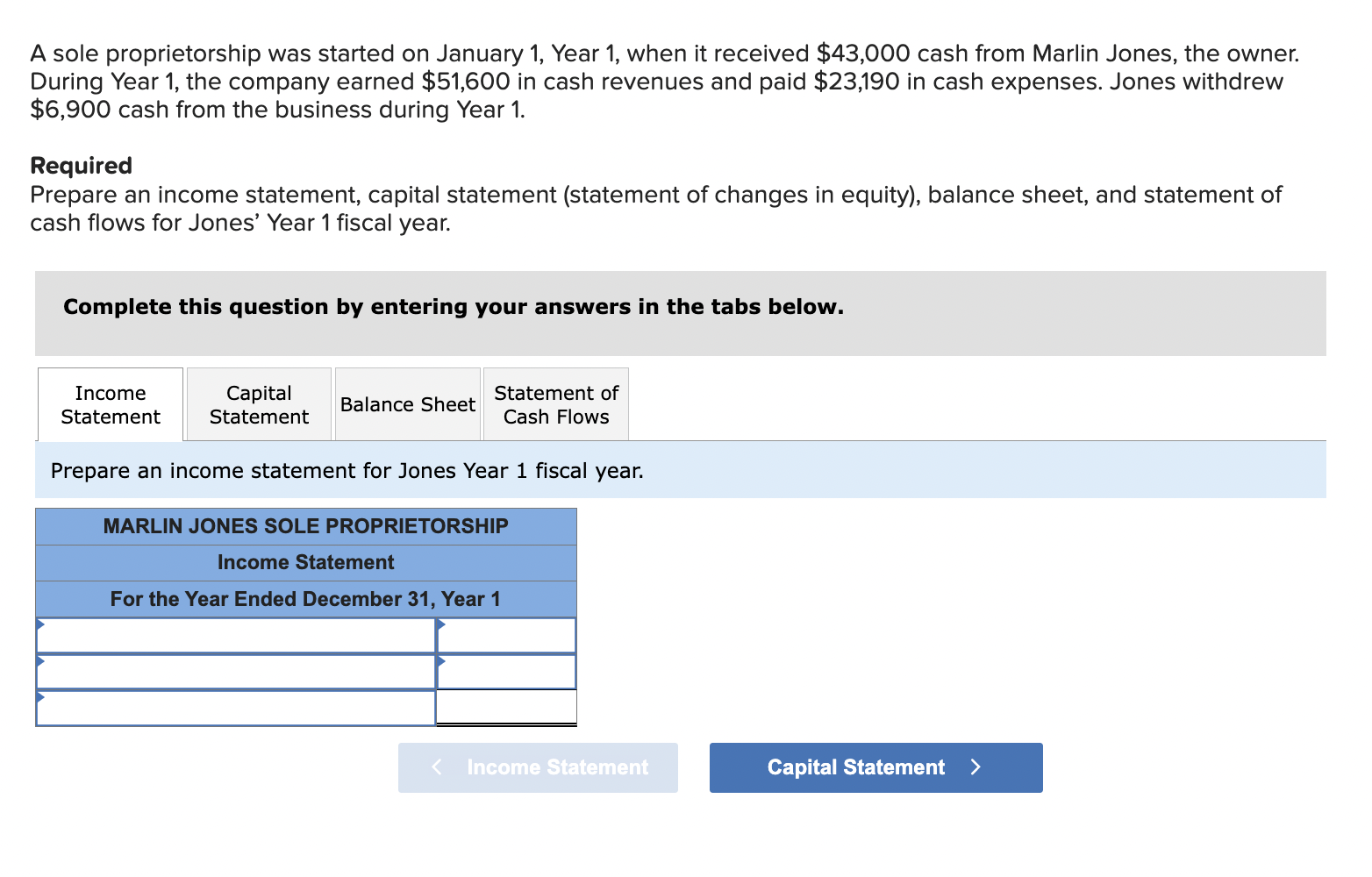

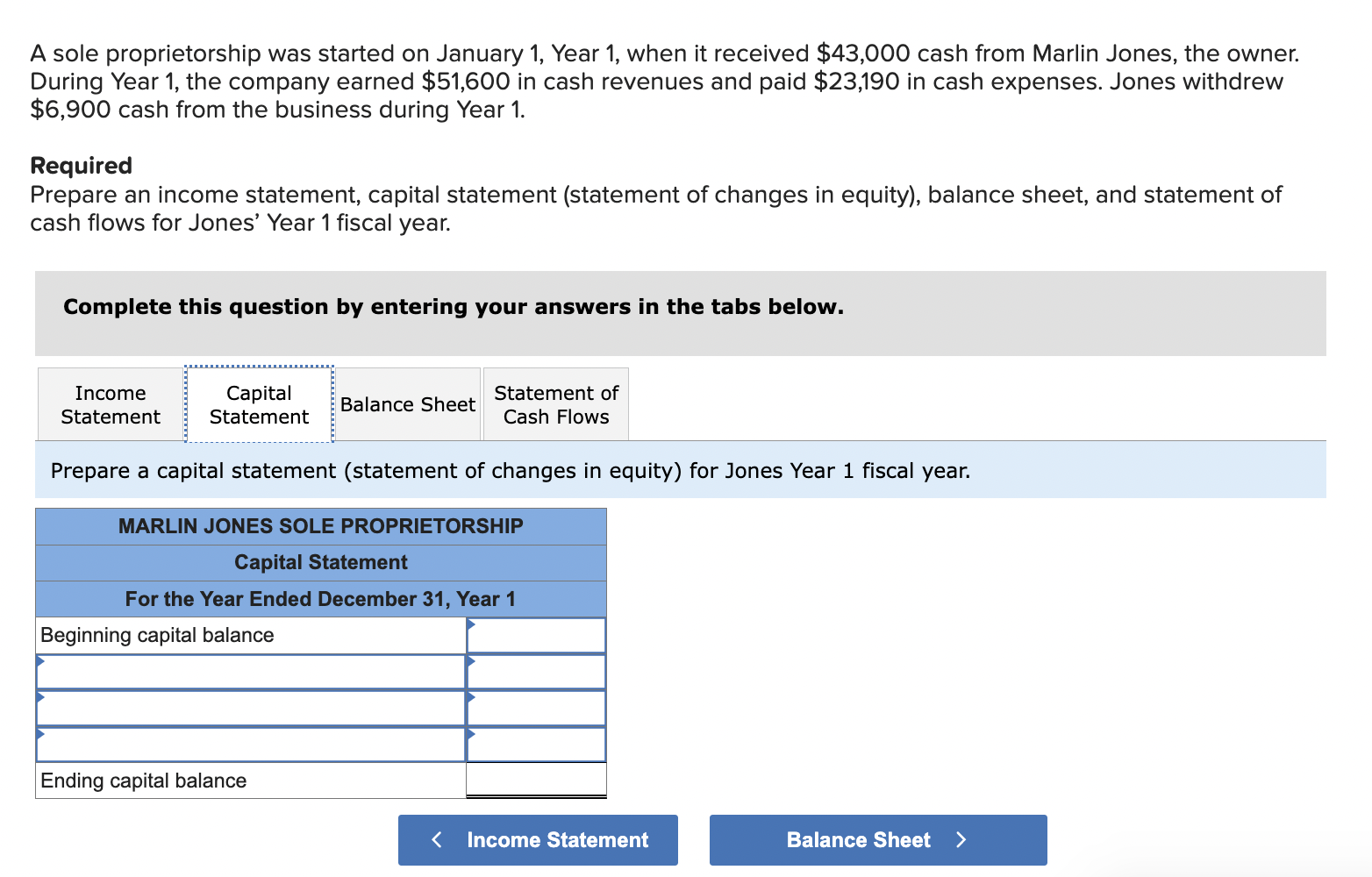

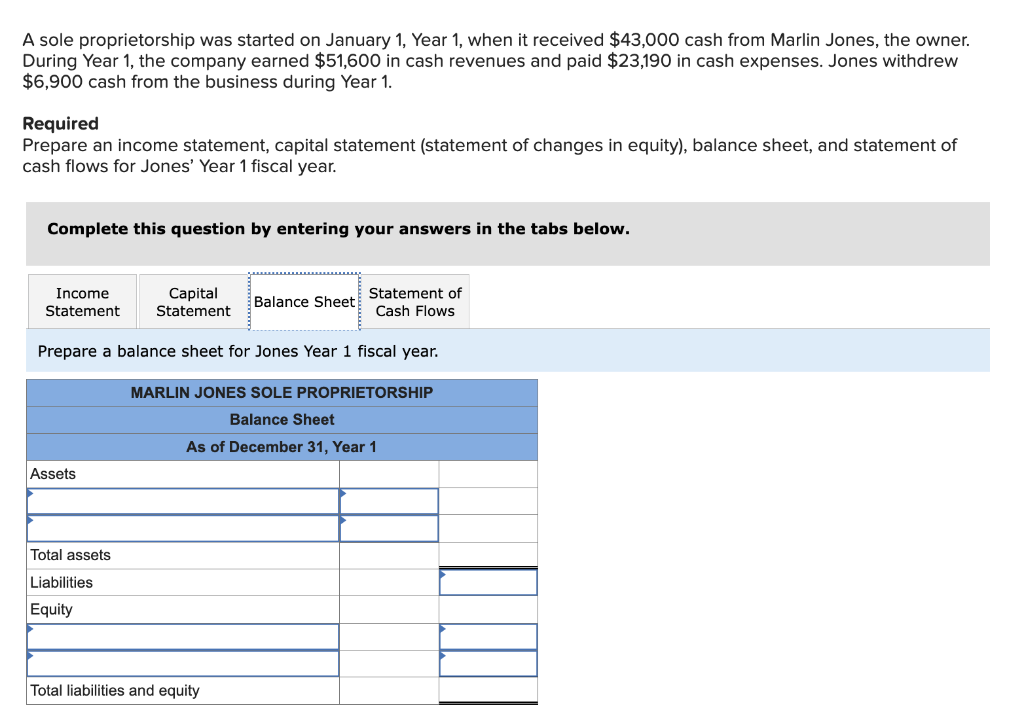

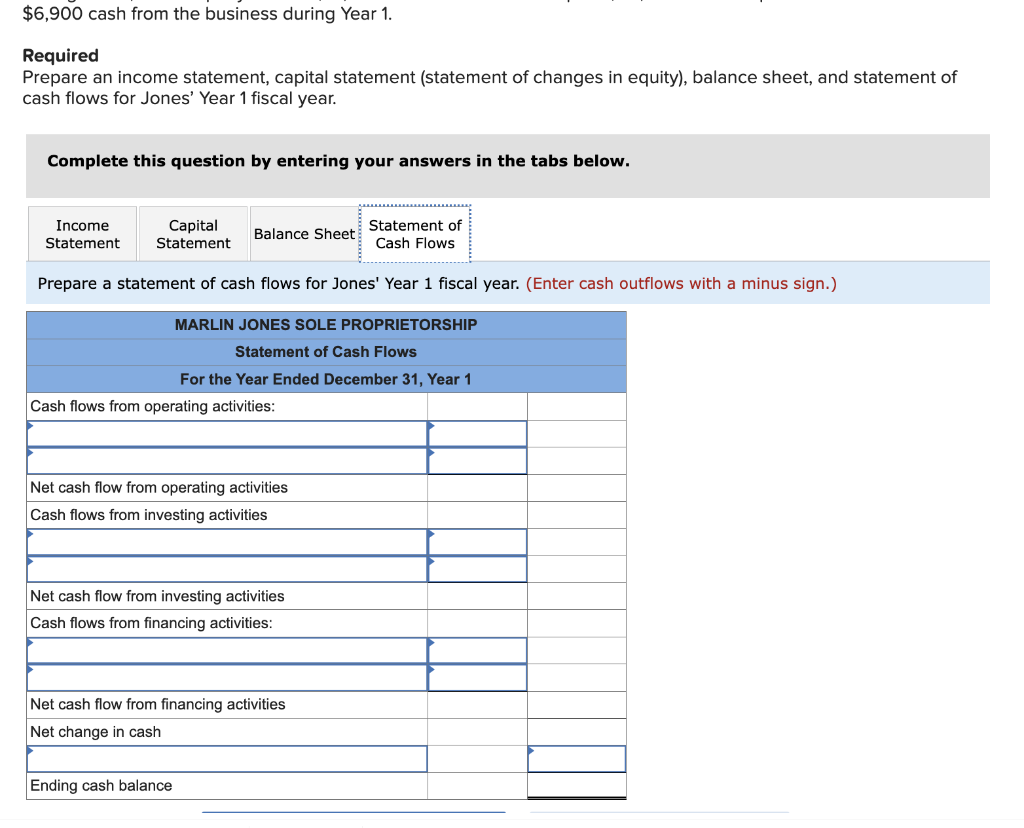

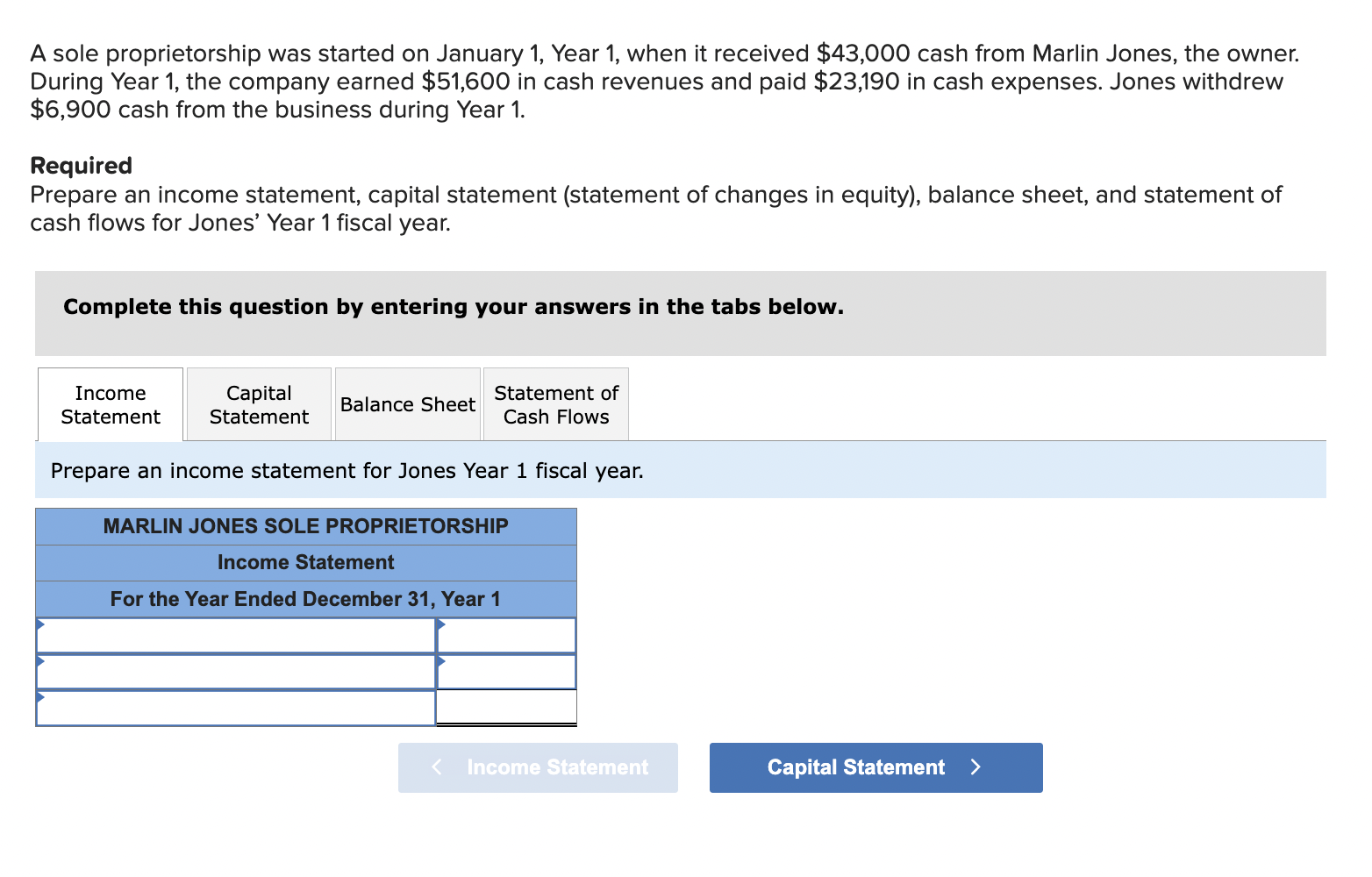

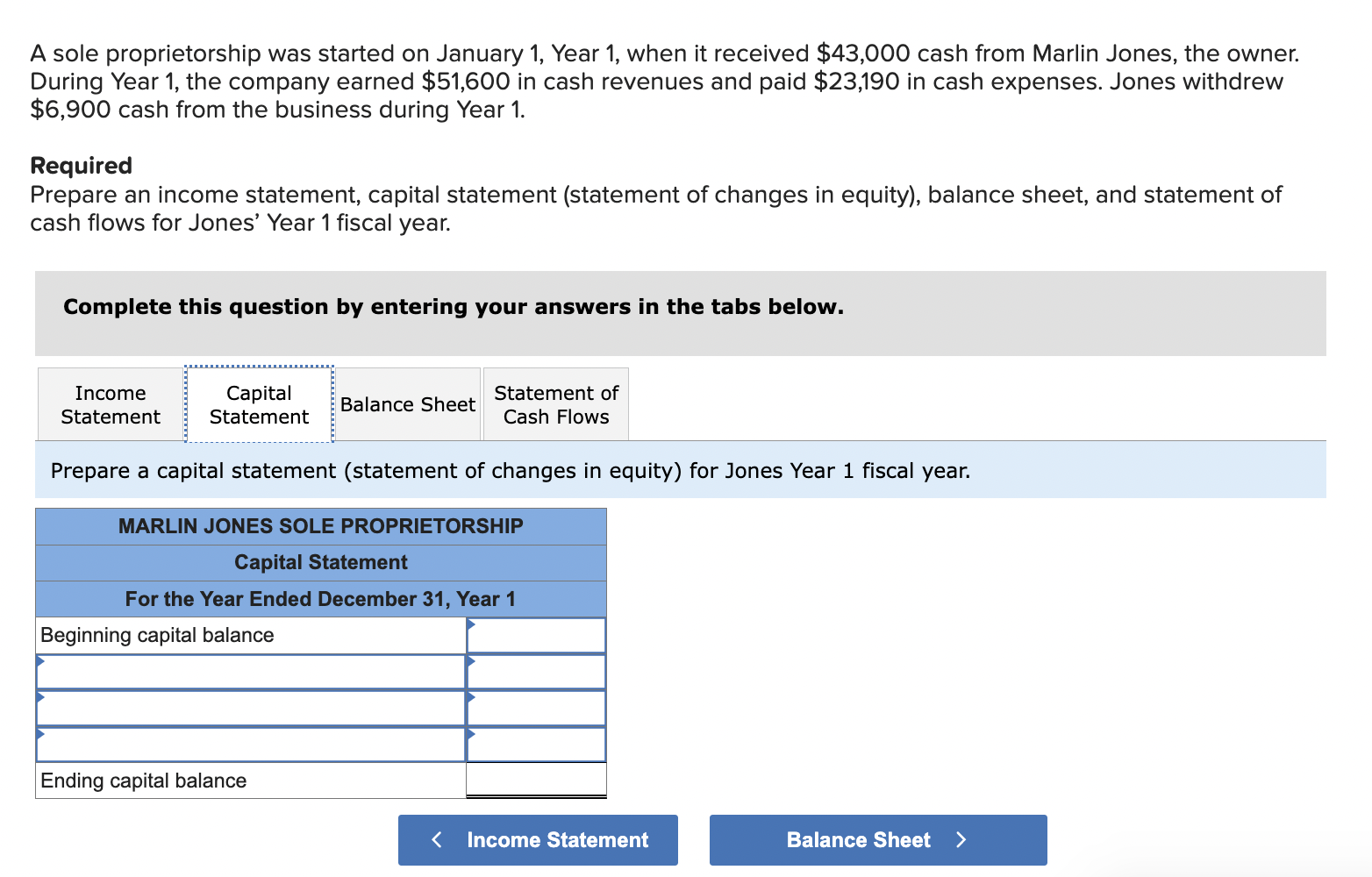

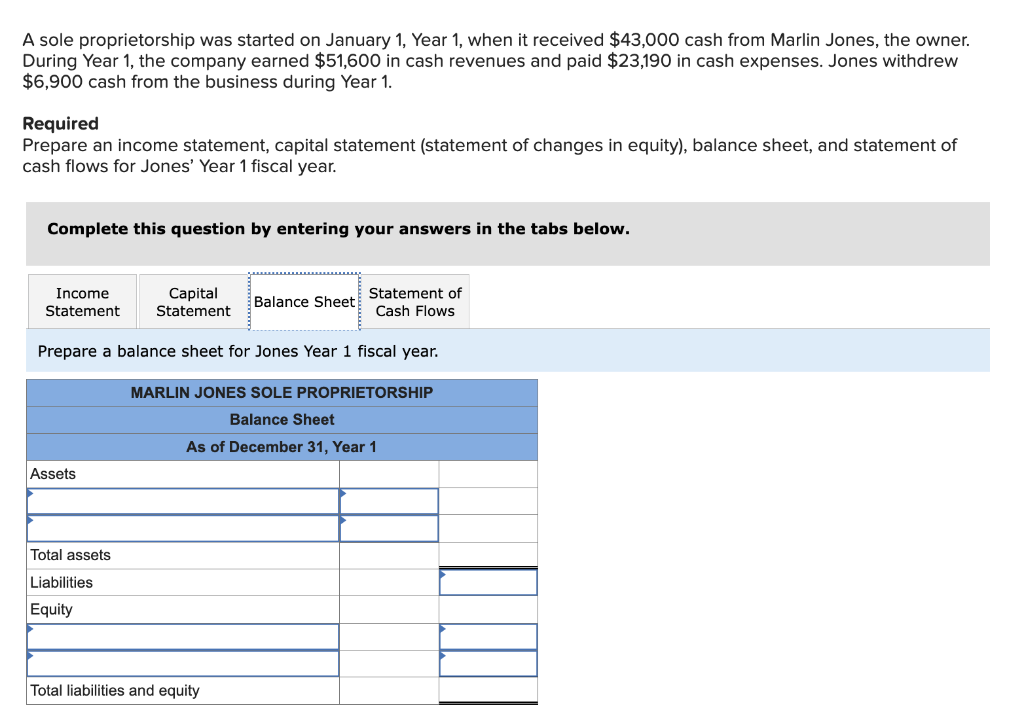

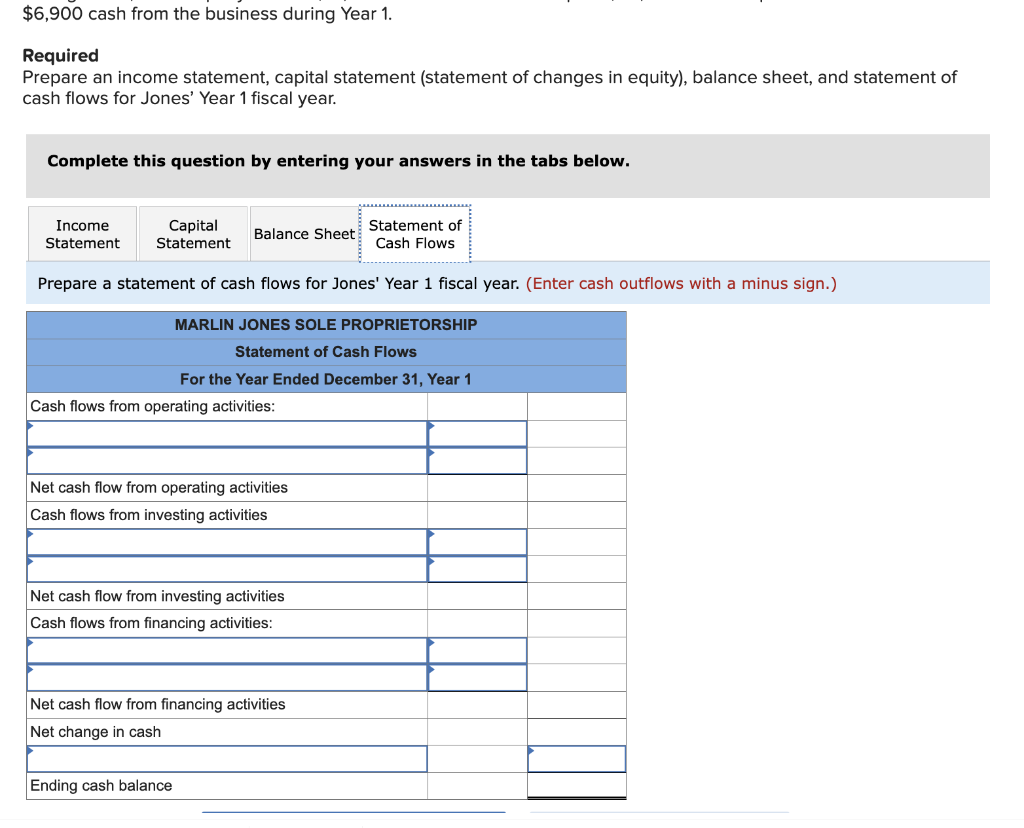

A sole proprietorship was started on January 1 , Year 1 , when it received $43,000 cash from Marlin Jones, the owner. During Year 1, the company earned $51,600 in cash revenues and paid $23,190 in cash expenses. Jones withdrew $6,900 cash from the business during Year 1. Required Prepare an income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones' Year 1 fiscal year. Complete this question by entering your answers in the tabs below. Prepare an income statement for Jones Year 1 fiscal year. A sole proprietorship was started on January 1, Year 1, when it received $43,000 cash from Marlin Jones, the owner. During Year 1, the company earned $51,600 in cash revenues and paid $23,190 in cash expenses. Jones withdrew $6,900 cash from the business during Year 1. Required Prepare an income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones' Year 1 fiscal year. Complete this question by entering your answers in the tabs below. Prepare a capital statement (statement of changes in equity) for Jones Year 1 fiscal year. A sole proprietorship was started on January 1 , Year 1, when it received $43,000 cash from Marlin Jones, the owner. During Year 1, the company earned $51,600 in cash revenues and paid $23,190 in cash expenses. Jones withdrew $6,900 cash from the business during Year 1. Required Prepare an income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones' Year 1 fiscal year. Complete this question by entering your answers in the tabs below. Prepare a balance sheet for Jones Year 1 fiscal year. $6,900 cash from the business during Year 1. Required Prepare an income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones' Year 1 fiscal year. Complete this question by entering your answers in the tabs below. Prepare a statement of cash flows for Jones' Year 1 fiscal year. (Enter cash outflows with a minus sign.)