Answered step by step

Verified Expert Solution

Question

1 Approved Answer

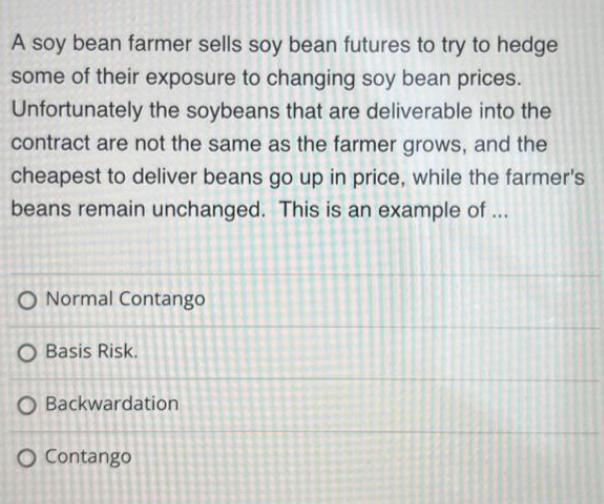

A soy bean farmer sells soy bean futures to try to hedge some of their exposure to changing soy bean prices. Unfortunately the soybeans

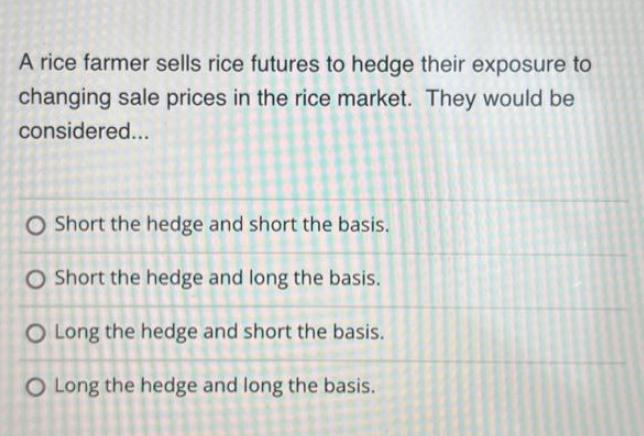

A soy bean farmer sells soy bean futures to try to hedge some of their exposure to changing soy bean prices. Unfortunately the soybeans that are deliverable into the contract are not the same as the farmer grows, and the cheapest to deliver beans go up in price, while the farmer's beans remain unchanged. This is an example of ... O Normal Contango O Basis Risk. O Backwardation O Contango A rice farmer sells rice futures to hedge their exposure to changing sale prices in the rice market. They would be considered... O Short the hedge and short the basis. O Short the hedge and long the basis. O Long the hedge and short the basis. O Long the hedge and long the basis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The first scenario is an example of Bas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started