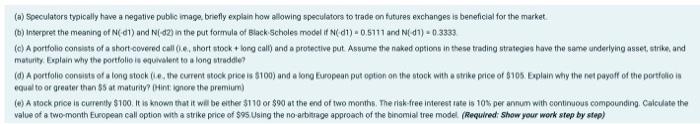

(a) Speculators typically have a negative public image, briefly explain how allowing speculators to trade on futures exchanges is beneficial for the market (6) Interpret the meaning of (01) and N(-42) in the put formula of Black Scholes model it (01) - 0.5111 and N(-41) = 0.3333 (c) A portfolio consists of a short covered call (e, short stock + long cally and a protective put Assume the naked options in these trading strategies have the same underlying asset, strike and maturity. Explain why the portfolio is equivalent to a long stredde? (d) A portfolio Contists of a long stock (lo, the current stock price is $100) and a long European put option on the stock with a strike price of $105. Explain why the net payoff of the portfolio in equal to or greater than $5 at maturity? Hint: ignore the premium) (a) A stock price is currently $100. It is known that it will be either $110 or $90 at the end of two months. The risk-free interest rate is 10% per annum with continuous compounding, Calculate the value of a two month European call option with a strike price of $95 Using the no-arbitrage approach of the binomial tree modet (Required: Show your work step by step) (a) Speculators typically have a negative public image, briefly explain how allowing speculators to trade on futures exchanges is beneficial for the market (6) Interpret the meaning of (01) and N(-42) in the put formula of Black Scholes model it (01) - 0.5111 and N(-41) = 0.3333 (c) A portfolio consists of a short covered call (e, short stock + long cally and a protective put Assume the naked options in these trading strategies have the same underlying asset, strike and maturity. Explain why the portfolio is equivalent to a long stredde? (d) A portfolio Contists of a long stock (lo, the current stock price is $100) and a long European put option on the stock with a strike price of $105. Explain why the net payoff of the portfolio in equal to or greater than $5 at maturity? Hint: ignore the premium) (a) A stock price is currently $100. It is known that it will be either $110 or $90 at the end of two months. The risk-free interest rate is 10% per annum with continuous compounding, Calculate the value of a two month European call option with a strike price of $95 Using the no-arbitrage approach of the binomial tree modet (Required: Show your work step by step)