Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. Speedo Sdn Bhd, a resident company, commenced it manufacturing business in 2017 with a paid up share capital of RM2.5 million. The company

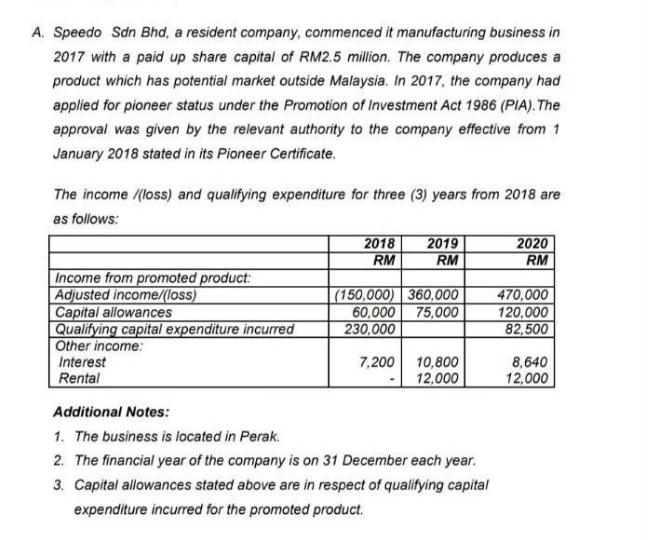

A. Speedo Sdn Bhd, a resident company, commenced it manufacturing business in 2017 with a paid up share capital of RM2.5 million. The company produces a product which has potential market outside Malaysia. In 2017, the company had applied for pioneer status under the Promotion of Investment Act 1986 (PIA). The approval was given by the relevant authority to the company effective from 1 January 2018 stated in its Pioneer Certificate. The income /(loss) and qualifying expenditure for three (3) years from 2018 are as follows: Income from promoted product: Adjusted income/(loss) Capital allowances Qualifying capital expenditure incurred Other income: Interest Rental 2018 RM 2019 RM (150,000) 360,000 60,000 75,000 230,000 7,200 10,800 12,000 Additional Notes: 1. The business is located in Perak. 2. The financial year of the company is on 31 December each year. 3. Capital allowances stated above are in respect of qualifying capital expenditure incurred for the promoted product. 2020 RM 470,000 120,000 82,500 8,640 12,000 Required: Compute the income tax payable and the tax exempt income (if any) of Speedo Sdn Bhd for the years of assessment 2018 to 2020. (15 marks) B. Reinvestment allowance (RE) is also known as a second round incentive for company which had exit from the tax holiday of pioneer status or investment tax allowance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started