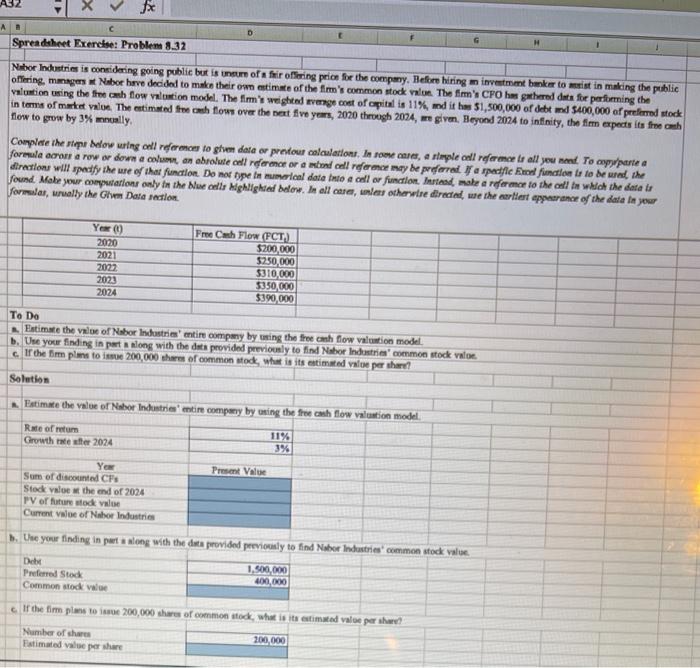

A Spreadsheet Exercise: Problem 8.32 Nabor Industries is considering going public but is our offrir offering price for the company. Before hiring an investment banker to it in making the public offering, managers Nibor have decided to make their own estimate of the fm's common stock value. The firm's CFO hm hered data for performing the valuation using the freewh flow valtion model. The firm's weighted vege cont of apital is 11%, and it has 51,500,000 of debt and $400,000 of preferred stock in terms of market value. The estimated fresh flows over the next five years, 2020 through 2004, e given. Beyond 2024 to infinity, the firm expects is free anh How to grow by 3% mcally Complete the stope dow uring cell refermon to ghe date or pronour calculation. In some care, a sluple call reformee te all you need to appartea formula acron a row or down a colunan ahrolute cell recrmce or a ten cell reformce may be preferred a padfic function is to be used the direction will specify the use of the function. Do mer rype in marlon data tnto a cell or function. Instand make a refermer to the call in which the data ta found. Make your computation only in the blue cells Highlighted below. In all cure, unless other tre directed, use the earliest appearance of the data in your formula, wally the Glen Data section Yex) 2020 2021 2022 2023 2024 Free Cash Flow (FCT) $200,000 $250,000 $310.000 3350,000 $390,000 To Do Estimate the value of Nabor contre entire company by using the free anh flow valtion model Use your finding in part along with the data provided previously to find Nabor Industria common stock valor If the fim plans to issue 200,000 shares of common stock, what is its estimated vale per her! Solution Estimate the value of Naber Industrie entire company by using the free shflow valtion model Rate of retum Growth rate ster 2024 11% 3% Present Value YEN Sum of discounted CF Stock valve the end of 2024 PV or future stock value Current value of Nahor Industries Use your finding in part along with the data provided previously to find aber Industries' common stock value Der Preferred Stock Common stock vale 1,500,000 400,000 If the firm plans to 200,000 shares of common stock, what is its estimated vale per shared Number of shares Estimated value por share 200,000