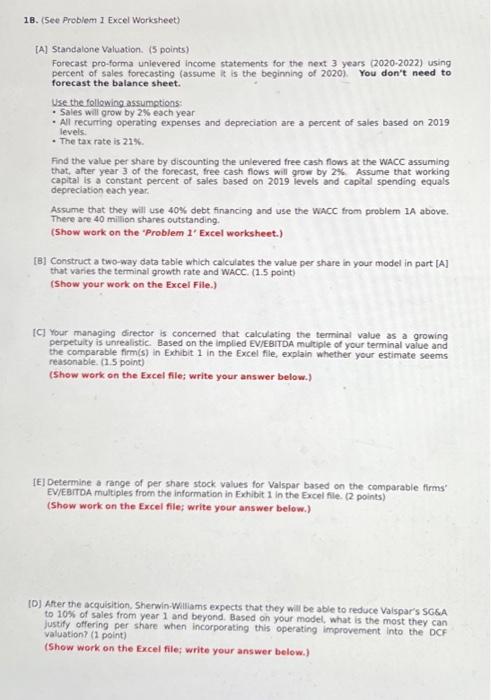

[A] Standalone Valuation. (5 points) Forecast pro-forma unievered income statements for the next 3 years (2020-2022) using percent of sales forecasting (assume it is the beginning of 2020). You don't need to forecast the balance sheet. Wse the following assumptions: - Sales will grow by 2% each year - All recurring operating expenses and depreciation are a percent of sales based on 2019 levels. - The tax rate is 21%. Find the value per share by discounting the unlevered free cash flows at the Wace assuming that, after year 3 of the forecast, free cash flows will grow by 2%. Assume that working capital is a constant percent of sales based on 2019 levels and copital spending equals depreciation each year. Assume that they will use 40% debt financing and use the WACC from problem 1 A above. There are 40 million shares outstanding. (5how work on the "Problem 1' Excel worksheet.) [B] Construct a two-way data table which calculates the value per share in your model in part [A] that varies the terminal growth rate and WACC. (1.5 point) (Show your work on the Excel File.) [C] Your managing director is concerned that calculating the terminal value as a growing perpetuity is unrealistic. Based on the impled EV/EBITDA multiple of your terminal value and the comparable firm(s) in Exch bit 1 in the Excel file, explain whether your estimate seems reasonabie. (1.5 point) (Show work on the Excel fle; write your answer below.) [E] Determine a range of per share stock values for Vaispar based on the comparable firms" EV/EBrDDA multiples from the information in Exhibit 1 in the Excel flle. (2 points) (Show work on the Excel file; write your answer below.) [0] After the acquisition, Sherwin-Wiliamis expects that they will be able to reduce Valspar's SGsA to 10% of sales from year 1 and beyond. Based on your model, what is the most they can justify offering per share when incorporating this operating improvement into the DCF valuation? (1 point) (Show work on the Excel file: write your ans wer below.) [A] Standalone Valuation. (5 points) Forecast pro-forma unievered income statements for the next 3 years (2020-2022) using percent of sales forecasting (assume it is the beginning of 2020). You don't need to forecast the balance sheet. Wse the following assumptions: - Sales will grow by 2% each year - All recurring operating expenses and depreciation are a percent of sales based on 2019 levels. - The tax rate is 21%. Find the value per share by discounting the unlevered free cash flows at the Wace assuming that, after year 3 of the forecast, free cash flows will grow by 2%. Assume that working capital is a constant percent of sales based on 2019 levels and copital spending equals depreciation each year. Assume that they will use 40% debt financing and use the WACC from problem 1 A above. There are 40 million shares outstanding. (5how work on the "Problem 1' Excel worksheet.) [B] Construct a two-way data table which calculates the value per share in your model in part [A] that varies the terminal growth rate and WACC. (1.5 point) (Show your work on the Excel File.) [C] Your managing director is concerned that calculating the terminal value as a growing perpetuity is unrealistic. Based on the impled EV/EBITDA multiple of your terminal value and the comparable firm(s) in Exch bit 1 in the Excel file, explain whether your estimate seems reasonabie. (1.5 point) (Show work on the Excel fle; write your answer below.) [E] Determine a range of per share stock values for Vaispar based on the comparable firms" EV/EBrDDA multiples from the information in Exhibit 1 in the Excel flle. (2 points) (Show work on the Excel file; write your answer below.) [0] After the acquisition, Sherwin-Wiliamis expects that they will be able to reduce Valspar's SGsA to 10% of sales from year 1 and beyond. Based on your model, what is the most they can justify offering per share when incorporating this operating improvement into the DCF valuation? (1 point) (Show work on the Excel file: write your ans wer below.)