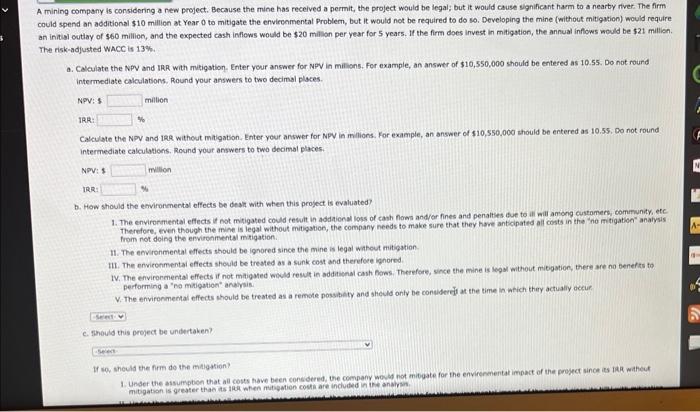

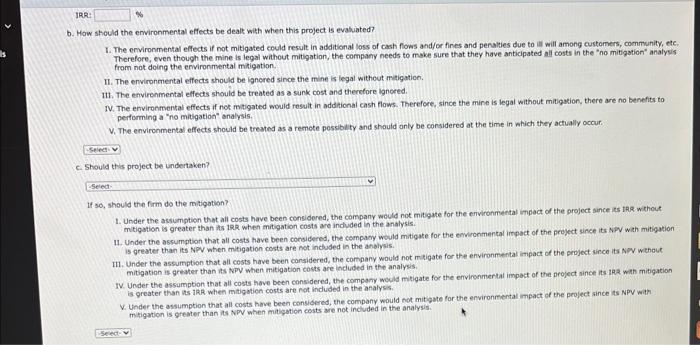

mining company is considering a new project. Because the mine has recelved a permit, the project would be legal; but it would cause sighificant harm to a nearty river. The firm wild spend an additional $10 million at Year 0 to mitigate the envirenmental Problem, but it would not be required to do so, Developing the mine (without mitigation) would require hinitil outiay of $60 million, and the expected cash inflews would be $20 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $21 million. he risk-adjusted wacc is 13 th. a. Caloulate the NPV and IRR with mitigation. Enter your answer for NPV in milions. For example, an answer of $10,550,000 should be entered as 10.55 . Do not rourd intermediate calculations. Round your answers to two decimal places. NPV: 4 milion 1RR: Calculate the NPy and 1RR without mitigation. Enter your antwer for NPV in milions. For example, an answer of 510,5550.000 should be entered as 10.55, Do not round intermediate calculations. Round your answers to two decmol places. NPV: 4 million 1RR: b. How should the emvironmental effects be desit with when this project is evaluated? 1. The envirormental effects it not migated covld tewitt in addaional loss of cash nows and/or fines and penalties due to ili will among customers, community, ete. Therefore. twen though the mine is legal without mitigation, the company needs to make sure that they have anticipated ail costs in the "no in tigation" analysis from not deing the ervironifental migation. 11. The eevironmental effects should be ignored since the mine is legal watrout mitigation. 1II. The environmental effects shoyld be trested as a sunk cost and therefeee ighored. 1v. The environmental effects if not magiged wovld rewl in addikonal cash Gows. Therefore, snce the mine is legsi without mibgation, there are no benefis to pertorming a "no mkigation" anaivais V. The environmental effects should be treated as a remote possbety and sheuld only be considerif at the time in weich thiry actualiy occur. c. Fhauld this project be undertaken? If so, sheuld the firm do the malgation JRR: b. How should the emvironmental effects be dealk with when this project is evaluated? 1. The environmental effects if not mitigated could result in additional loss of cash fows and/or fines and penalies due to ill will among customers, community, ete Therefore, even though the mine is legal without mitigation, the company needs to make sure that they have anticipated all costs in the "no mitigation" analysis from not doing the erivironmental mitigation. II. The environmental effects shoula be ignored since the mine is legal without mitigution. 11. The envirenmental effects should be treated as a sunk cost and therefore lgnored. IV. The environmental effects if not mitigated would rosult in addaional cash flows. Therefore, since the mine is legal without mitigation, there are no benefits to performing a "no mitigation" analysis. V. The environmentai effects should be treated as a remoke possiblity and should only be considered at the time in which they actually occur. c. Should this project be undertaken? Secect If so, should the firm do the mitigotion? 1. Under the assumption that all costs have been considered, the company would not mitigate for the erivironmental ingact of the groject since its iAR without mitigation is greater than its 192 when mitigation costs are induded in the analysis. 11. Under the assumption that all costs have been coroidered, the compacy would mitigate for the emironmental inpact of the project since its Nip wah mitigation is greater than its NPV when mitigation costs are not included in the anblysis II. Under the assumption that all costs have been considered, the company would not mitigate for tfe environmental impact of the project since its NFV wethout mitigation is greater than its NpV when mitigation costs are indided in the analyss. IV. Under the assumption that all costs hove been considered, the compony weuld mitigate for the environmertal impect of the project ance its iaz wath mitigation is oreater than its iRR when mitigotien costs are not induded in the analysis. V. Under the assumption that all costs have been considered, the company would not mitgate for the environmental impact of the project since is NPV wath mitigation is greater than is NPV when mitigation costs are not induded in the analysis