Answered step by step

Verified Expert Solution

Question

1 Approved Answer

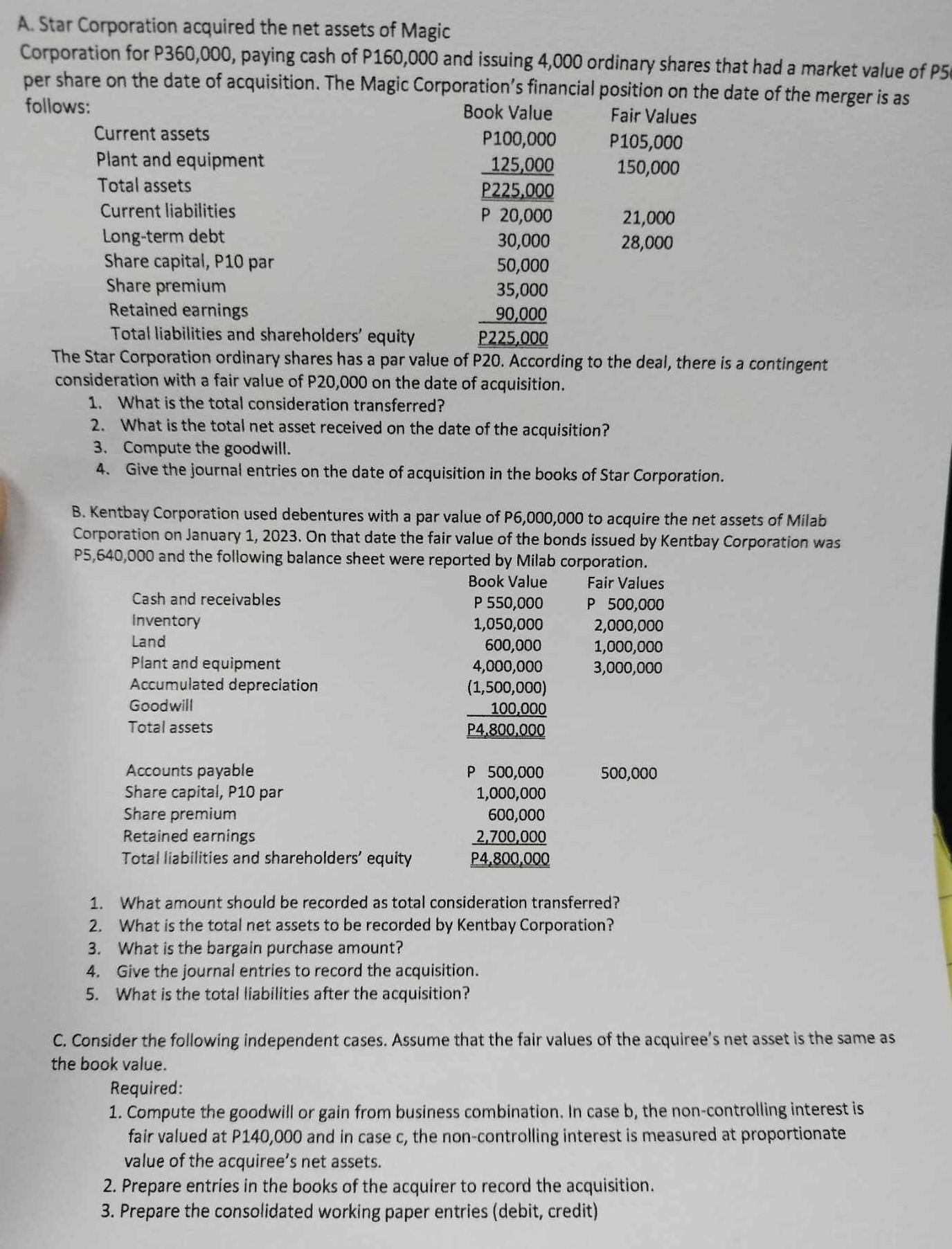

A. Star Corporation acquired the net assets of Magic Corporation for P360,000, paying cash of P160,000 and issuing 4,000 ordinary shares that had a

A. Star Corporation acquired the net assets of Magic Corporation for P360,000, paying cash of P160,000 and issuing 4,000 ordinary shares that had a market value of P5 per share on the date of acquisition. The Magic Corporation's financial position on the date of the merger is as follows: Current assets Plant and equipment Total assets Current liabilities Long-term debt Share capital, P10 par Share premium Retained earnings Book Value Fair Values P100,000 P105,000 125,000 150,000 P225,000 P 20,000 21,000 30,000 28,000 50,000 35,000 90,000 P225,000 Total liabilities and shareholders' equity The Star Corporation ordinary shares has a par value of P20. According to the deal, there is a contingent consideration with a fair value of P20,000 on the date of acquisition. 1. What is the total consideration transferred? 2. What is the total net asset received on the date of the acquisition? 3. Compute the goodwill. 4. Give the journal entries on the date of acquisition in the books of Star Corporation. B. Kentbay Corporation used debentures with a par value of P6,000,000 to acquire the net assets of Milab Corporation on January 1, 2023. On that date the fair value of the bonds issued by Kentbay Corporation was P5,640,000 and the following balance sheet were reported by Milab corporation. Cash and receivables Inventory Land Plant and equipment Accumulated depreciation Goodwill Total assets Accounts payable Share capital, P10 par Share premium Retained earnings Book Value P 550,000 Fair Values P 500,000 1,050,000 600,000 4,000,000 2,000,000 1,000,000 3,000,000 (1,500,000) 100,000 P4,800,000 P 500,000 1,000,000 500,000 Total liabilities and shareholders' equity 600,000 2,700,000 P4,800,000 1. What amount should be recorded as total consideration transferred? 2. What is the total net assets to be recorded by Kentbay Corporation? 3. What is the bargain purchase amount? 4. Give the journal entries to record the acquisition. 5. What is the total liabilities after the acquisition? C. Consider the following independent cases. Assume that the fair values of the acquiree's net asset is the same as the book value. Required: 1. Compute the goodwill or gain from business combination. In case b, the non-controlling interest is fair valued at P140,000 and in case c, the non-controlling interest is measured at proportionate value of the acquiree's net assets. 2. Prepare entries in the books of the acquirer to record the acquisition. 3. Prepare the consolidated working paper entries (debit, credit)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

BreakEven Analysis for Woodstock Company 1 BreakEven Point in Units Calculation Breakeven point units Fixed Costs Contribution Margin per unit Contrib...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started