Question

A start-up begins operations in 2012 by investing $400 million in plant and equipment. It expects to increase investment by $40 million each year, indefinitely,

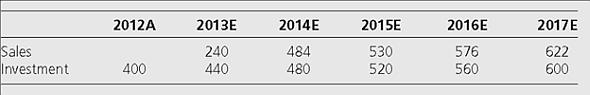

A start-up begins operations in 2012 by investing $400 million in plant and equipment. It expects to increase investment by $40 million each year, indefinitely, depreciating it straight-line over two years. The investment program is expected to generate sales for the next five years, as follows (in millions of dollars):

a. Prepare a schedule of pro forma operating income, return on net operating assets (RNOA), residual operating income, and net operating assets for the years 2013 to 2017. Depreciation of the investment is the only operating expense. The firm has a 10 percent hurdle rate for its operations. Calculate the value of this firm using residual operating income methods.

b. Forecast free cash flow for 2013 to 2017. Do you think that forecasted free cash flow is a good quality number on which to base a valuation? What features in the pro forma explain why the pattern of free cash flows is different from that for residual operating income?

2012A 2013E 2014E 2015E 2016E 2017E Sales Investment 240 484 530 576 622 400 440 480 520 560 600

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started