Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A startup company needs GHe 99,507 in 11 years time to commence production of an innovative medical product. If the interest rate is 11.9%,

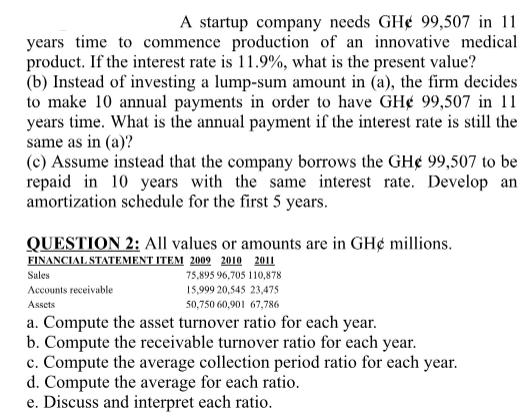

A startup company needs GHe 99,507 in 11 years time to commence production of an innovative medical product. If the interest rate is 11.9%, what is the present value? (b) Instead of investing a lump-sum amount in (a), the firm decides to make 10 annual payments in order to have GHe 99,507 in 11 years time. What is the annual payment if the interest rate is still the same as in (a)? (c) Assume instead that the company borrows the GHe 99,507 to be repaid in 10 years with the same interest rate. Develop an amortization schedule for the first 5 years. QUESTION 2: All values or amounts are in GHe millions. FINANCIAL STATEMENT ITEM 2009 2010 2011 75,895 96,705 110,878 15,999 20,545 23,475 50,750 60,901 67,786 Sales Accounts receivable Assets a. Compute the asset turnover ratio for each year. b. Compute the receivable turnover ratio for each year. c. Compute the average collection period ratio for each year. d. Compute the average for each ratio. e. Discuss and interpret each ratio.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To solve the given questions lets address each one step by step Question 1 a Calculating the present value To find the present value we can use the formula for the present value of a future amount PV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started