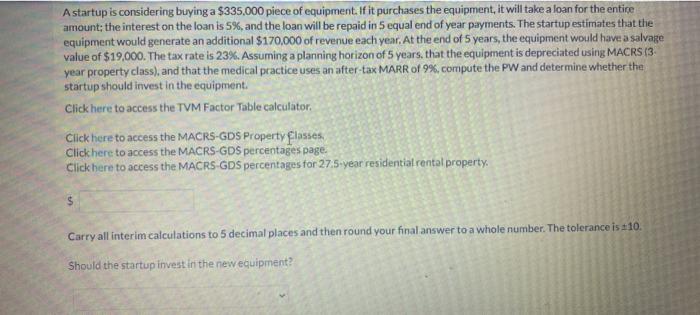

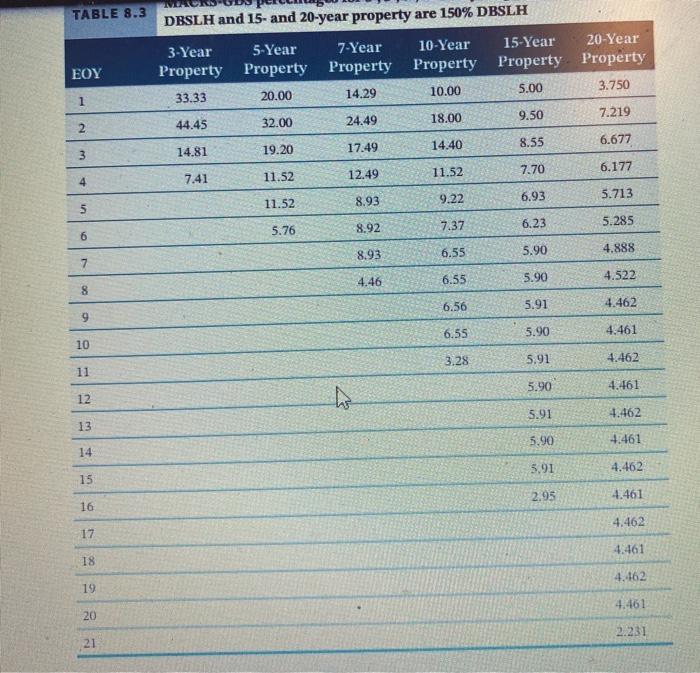

A startup is considering buying a $335,000 piece of equipment. If it purchases the equipment, it will take a loan for the entire amount: the interest on the loan is 5%, and the loan will be repaid in 5 equal end of year payments. The startup estimates that the equipment would generate an additional $170,000 of revenue each year, At the end of 5 years, the equipment would have a salvage value of $19.000. The tax rate is 23%. Assuming a planning horizon of 5 years, that the equipment is depreciated using MACRS (3 year property class), and that the medical practice uses an after-tax MARR of 9%, compute the PW and determine whether the startup should invest in the equipment. Click here to access the TVM Factor Table calculator Click here to access the MACRS-GDS Property glasses Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. S Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is $10. Should the startup invest in the new equipment? TABLE 8.3 EOY DESLH and 15- and 20-year property are 150% DBSLH 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Property Property Property Property Property Property 33.33 20.00 14.29 10.00 5.00 3.750 44.45 32.00 24.49 18.00 9.50 7.219 14.81 19.20 17.49 14.40 8.55 6.677 1 2 3 7.70 6.177 7.41 4 11.52 12.49 11.52 11.52 5.713 8.93 9.22 6.93 5 8.92 7.37 6.23 5.285 5.76 6 8.93 6.55 5.90 4.888 7 8 4.46 6.55 5.90 4.522 6.56 5.91 4.462 9 6.55 5.90 4.461 10 3.28 5.91 4.462 11 5.90 4.461 12 5.91 4.462 13 5.90 4.461 14 5.91 4.462 15 2.95 4.461 16 4.462 17 4.461 18 4.162 19 4.461 20 2.231 21 A startup is considering buying a $335,000 piece of equipment. If it purchases the equipment, it will take a loan for the entire amount: the interest on the loan is 5%, and the loan will be repaid in 5 equal end of year payments. The startup estimates that the equipment would generate an additional $170,000 of revenue each year, At the end of 5 years, the equipment would have a salvage value of $19.000. The tax rate is 23%. Assuming a planning horizon of 5 years, that the equipment is depreciated using MACRS (3 year property class), and that the medical practice uses an after-tax MARR of 9%, compute the PW and determine whether the startup should invest in the equipment. Click here to access the TVM Factor Table calculator Click here to access the MACRS-GDS Property glasses Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. S Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is $10. Should the startup invest in the new equipment? TABLE 8.3 EOY DESLH and 15- and 20-year property are 150% DBSLH 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Property Property Property Property Property Property 33.33 20.00 14.29 10.00 5.00 3.750 44.45 32.00 24.49 18.00 9.50 7.219 14.81 19.20 17.49 14.40 8.55 6.677 1 2 3 7.70 6.177 7.41 4 11.52 12.49 11.52 11.52 5.713 8.93 9.22 6.93 5 8.92 7.37 6.23 5.285 5.76 6 8.93 6.55 5.90 4.888 7 8 4.46 6.55 5.90 4.522 6.56 5.91 4.462 9 6.55 5.90 4.461 10 3.28 5.91 4.462 11 5.90 4.461 12 5.91 4.462 13 5.90 4.461 14 5.91 4.462 15 2.95 4.461 16 4.462 17 4.461 18 4.162 19 4.461 20 2.231 21