Answered step by step

Verified Expert Solution

Question

1 Approved Answer

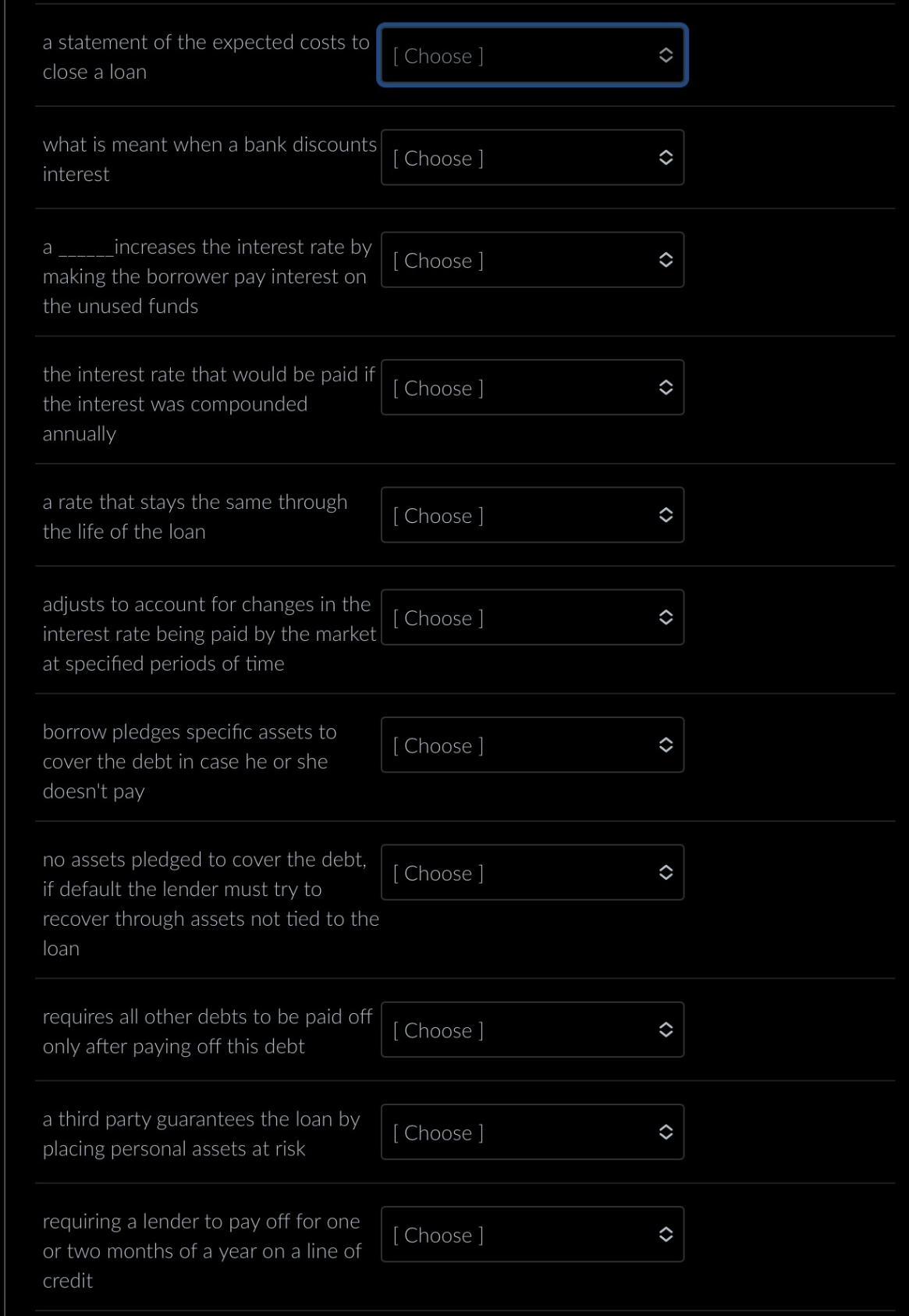

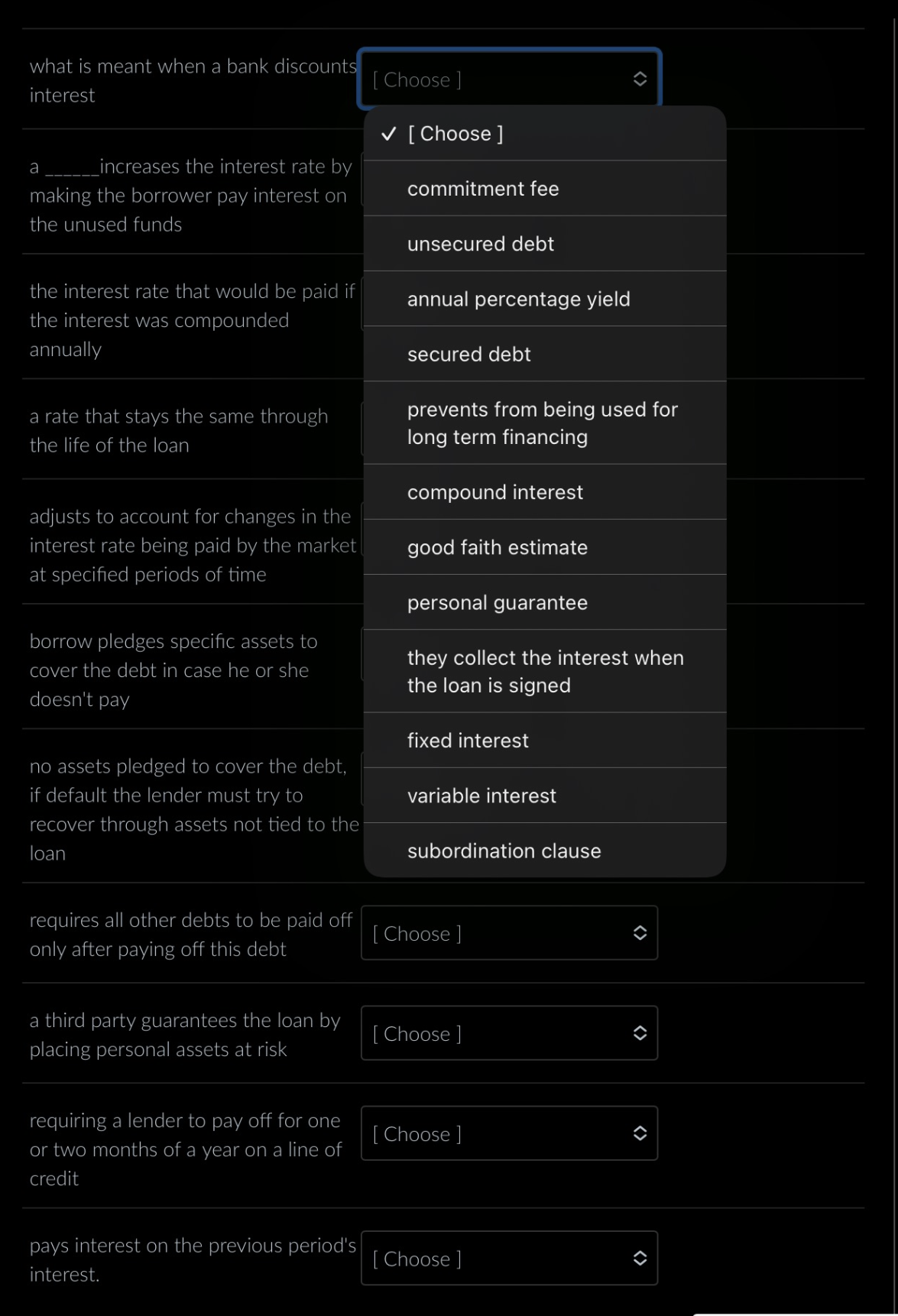

a statement of the expected costs to close a loan what is meant when a bank discounts interest a increases the interest rate by making

a statement of the expected costs to close a loan what is meant when a bank discounts interest a increases the interest rate by making the borrower pay interest on the unused funds the interest rate that would be paid if the interest was compounded annually a rate that stays the same through the life of the loan adjusts to account for changes in the interest rate being paid by the market at specified periods of time borrow pledges specific assets to cover the debt in case he or she doesn't pay no assets pledged to cover the debt, if default the lender must try to recover through assets not tied to the loan requires all other debts to be paid off only after paying off this debt a third party guarantees the loan by placing personal assets at risk requiring a lender to pay off for one or two months of a year on a line of credit what is meant when a bank discounts interest a increases the interest rate by making the borrower pay interest on the unused funds the interest rate that would be paid if the interest was compounded annually a rate that stays the same through the life of the loan adjusts to account for changes in the interest rate being paid by the market at specified periods of time borrow pledges specific assets to cover the debt in case he or she doesn't pay no assets pledged to cover the debt, if default the lender must try to recover through assets not tied to the loan requires all other debts to be paid off only after paying off this debt a third party guarantees the loan by placing personal assets at risk requiring a lender to pay off for one or two months of a year on a line of credit pays interest on the previous period's interest. a statement of the expected costs to close a loan what is meant when a bank discounts interest a increases the interest rate by making the borrower pay interest on the unused funds the interest rate that would be paid if the interest was compounded annually a rate that stays the same through the life of the loan adjusts to account for changes in the interest rate being paid by the market at specified periods of time borrow pledges specific assets to cover the debt in case he or she doesn't pay no assets pledged to cover the debt, if default the lender must try to recover through assets not tied to the loan requires all other debts to be paid off only after paying off this debt a third party guarantees the loan by placing personal assets at risk requiring a lender to pay off for one or two months of a year on a line of credit what is meant when a bank discounts interest a increases the interest rate by making the borrower pay interest on the unused funds the interest rate that would be paid if the interest was compounded annually a rate that stays the same through the life of the loan adjusts to account for changes in the interest rate being paid by the market at specified periods of time borrow pledges specific assets to cover the debt in case he or she doesn't pay no assets pledged to cover the debt, if default the lender must try to recover through assets not tied to the loan requires all other debts to be paid off only after paying off this debt a third party guarantees the loan by placing personal assets at risk requiring a lender to pay off for one or two months of a year on a line of credit pays interest on the previous period's interest

a statement of the expected costs to close a loan what is meant when a bank discounts interest a increases the interest rate by making the borrower pay interest on the unused funds the interest rate that would be paid if the interest was compounded annually a rate that stays the same through the life of the loan adjusts to account for changes in the interest rate being paid by the market at specified periods of time borrow pledges specific assets to cover the debt in case he or she doesn't pay no assets pledged to cover the debt, if default the lender must try to recover through assets not tied to the loan requires all other debts to be paid off only after paying off this debt a third party guarantees the loan by placing personal assets at risk requiring a lender to pay off for one or two months of a year on a line of credit what is meant when a bank discounts interest a increases the interest rate by making the borrower pay interest on the unused funds the interest rate that would be paid if the interest was compounded annually a rate that stays the same through the life of the loan adjusts to account for changes in the interest rate being paid by the market at specified periods of time borrow pledges specific assets to cover the debt in case he or she doesn't pay no assets pledged to cover the debt, if default the lender must try to recover through assets not tied to the loan requires all other debts to be paid off only after paying off this debt a third party guarantees the loan by placing personal assets at risk requiring a lender to pay off for one or two months of a year on a line of credit pays interest on the previous period's interest. a statement of the expected costs to close a loan what is meant when a bank discounts interest a increases the interest rate by making the borrower pay interest on the unused funds the interest rate that would be paid if the interest was compounded annually a rate that stays the same through the life of the loan adjusts to account for changes in the interest rate being paid by the market at specified periods of time borrow pledges specific assets to cover the debt in case he or she doesn't pay no assets pledged to cover the debt, if default the lender must try to recover through assets not tied to the loan requires all other debts to be paid off only after paying off this debt a third party guarantees the loan by placing personal assets at risk requiring a lender to pay off for one or two months of a year on a line of credit what is meant when a bank discounts interest a increases the interest rate by making the borrower pay interest on the unused funds the interest rate that would be paid if the interest was compounded annually a rate that stays the same through the life of the loan adjusts to account for changes in the interest rate being paid by the market at specified periods of time borrow pledges specific assets to cover the debt in case he or she doesn't pay no assets pledged to cover the debt, if default the lender must try to recover through assets not tied to the loan requires all other debts to be paid off only after paying off this debt a third party guarantees the loan by placing personal assets at risk requiring a lender to pay off for one or two months of a year on a line of credit pays interest on the previous period's interest Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started