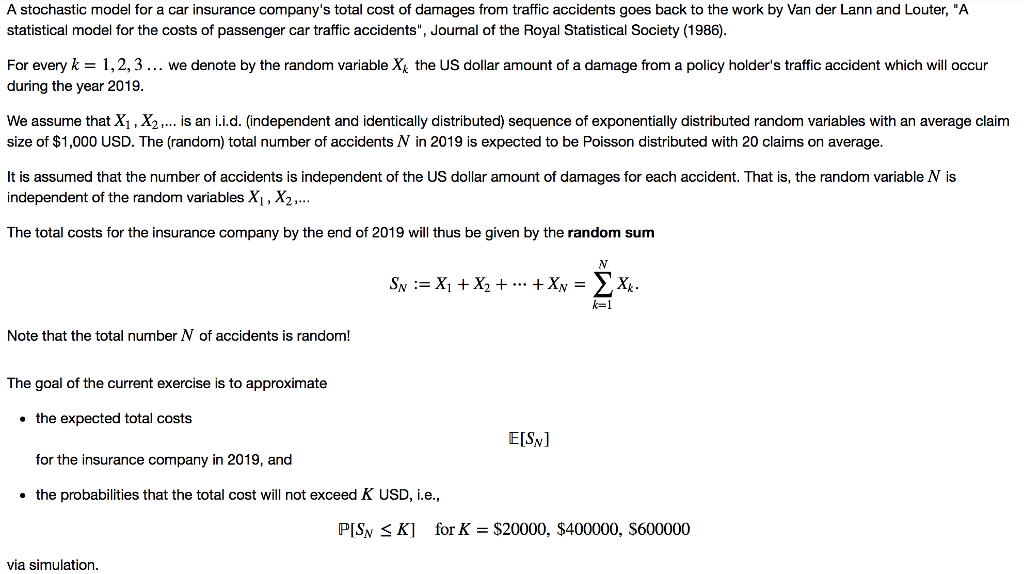

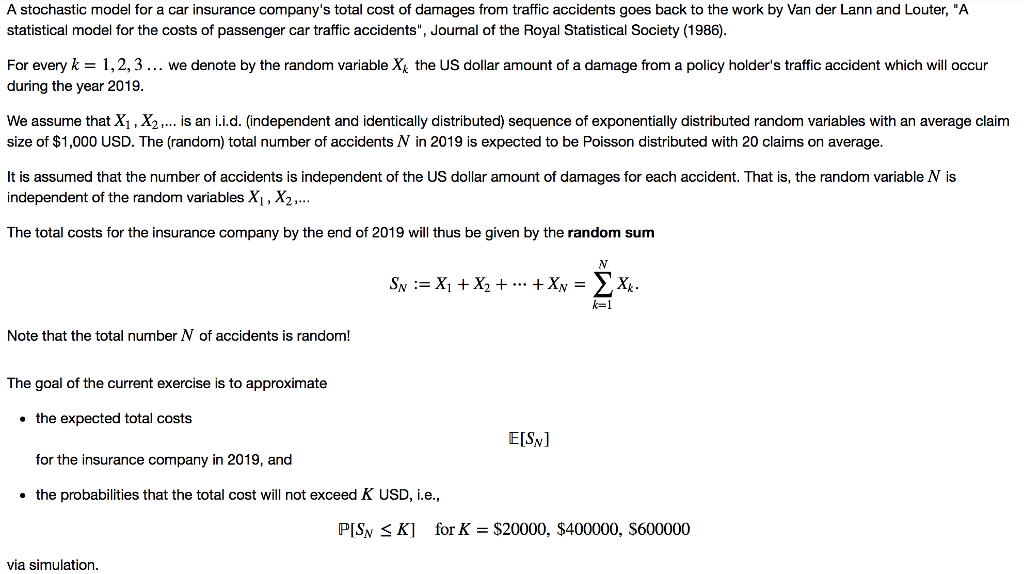

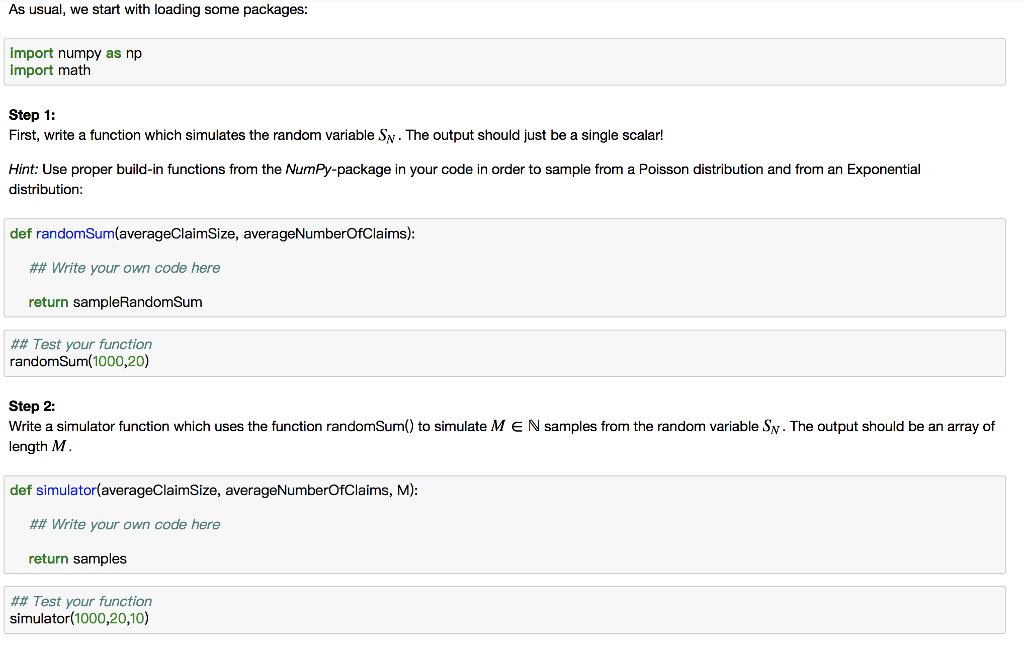

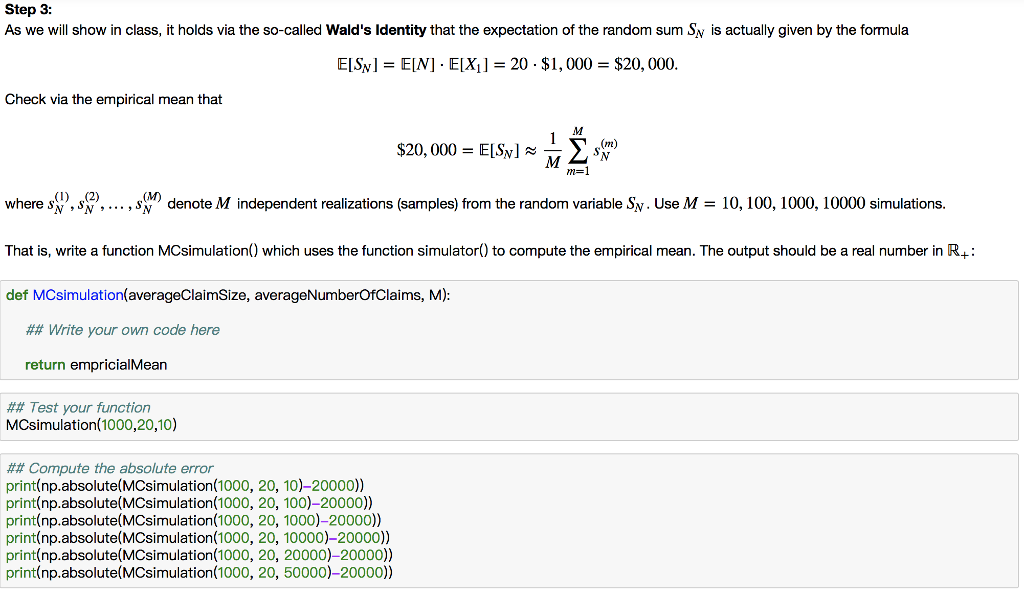

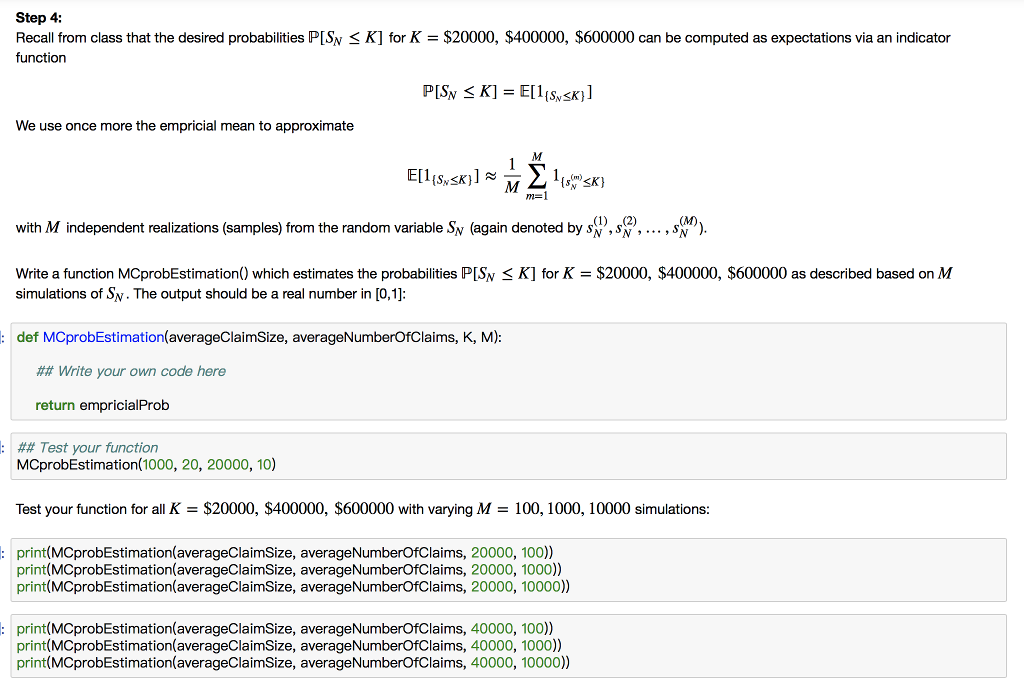

A stochastic model for a car insurance company's total cost of damages from traffic accidents goes back to the work by Van der Lann and Louter, "A statistical model for the costs of passenger car traffic accidents", Journal of the Royal Statistical Society (1986). For every k- 1,2,3.. we denote by the random variable X the US dollar amount of a damage from a policy holder's traffic accident which will occur during the year 2019. We assume that X1, X2,...is an i.i.d. (ndependent and identically distributed) sequence of exponentially distributed random variables with an average claim size of $1,000 USD. The (random) total number of accidents N in 2019 is expected to be Poisson distributed with 20 claims on average. It is assumed that the number of accidents is independent of the US dollar amount of damages for each accident. That is, the random variable N is independent of the random variables Xi, X2,.. The total costs for the insurance company by the end of 2019 will thus be given by the random sunm Note that the total number N of accidents is random! The goal of the current exercise is to approximate the expected total costs E[SN for the insurance company in 2019, and . the probabilities that the total cost will not exceed K USD, i.e., PISN S K] for K- $20000, $400000, S600000 via simulation A stochastic model for a car insurance company's total cost of damages from traffic accidents goes back to the work by Van der Lann and Louter, "A statistical model for the costs of passenger car traffic accidents", Journal of the Royal Statistical Society (1986). For every k- 1,2,3.. we denote by the random variable X the US dollar amount of a damage from a policy holder's traffic accident which will occur during the year 2019. We assume that X1, X2,...is an i.i.d. (ndependent and identically distributed) sequence of exponentially distributed random variables with an average claim size of $1,000 USD. The (random) total number of accidents N in 2019 is expected to be Poisson distributed with 20 claims on average. It is assumed that the number of accidents is independent of the US dollar amount of damages for each accident. That is, the random variable N is independent of the random variables Xi, X2,.. The total costs for the insurance company by the end of 2019 will thus be given by the random sunm Note that the total number N of accidents is random! The goal of the current exercise is to approximate the expected total costs E[SN for the insurance company in 2019, and . the probabilities that the total cost will not exceed K USD, i.e., PISN S K] for K- $20000, $400000, S600000 via simulation