Question

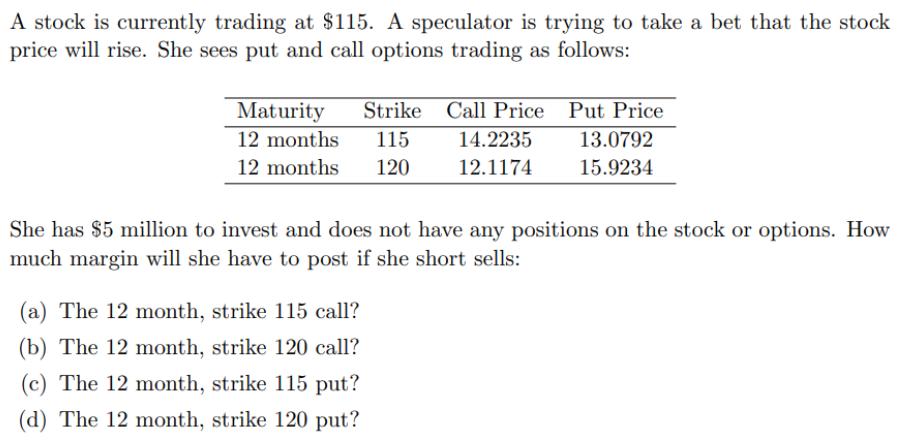

A stock is currently trading at $115. A speculator is trying to take a bet that the stock price will rise. She sees put

A stock is currently trading at $115. A speculator is trying to take a bet that the stock price will rise. She sees put and call options trading as follows: Maturity Strike Call Price 12 months 115 14.2235 12 months 120 12.1174 Put Price 13.0792 15.9234 She has $5 million to invest and does not have any positions on the stock or options. How much margin will she have to post if she short sells: (a) The 12 month, strike 115 call? (b) The 12 month, strike 120 call? (c) The 12 month, strike 115 put? (d) The 12 month, strike 120 put?

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The correct option is a The 12 month strike 115 call because the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App