Question

A stock is expected to pay a dividend of $3.50 in one year, and analysts expect its stock price at that time to be

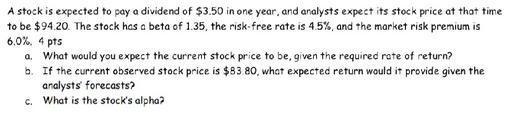

A stock is expected to pay a dividend of $3.50 in one year, and analysts expect its stock price at that time to be $94.20. The stock has a beta of 1.35, the risk-free rate is 4.5%, and the market risk premium is 6.0%. 4 pts a. What would you expect the current stock price to be, given the required rate of return? b. If the current observed stock price is $83.80, what expected return would it provide given the analysts' forecasts? c. What is the stock's alpha?

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

answer Stock Valuation and Analysis We can use the Capital Asset Pricing Model CAPM to address these ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Futures and Options Markets

Authors: John C. Hull

8th edition

978-1292155036, 1292155035, 132993341, 978-0132993340

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App