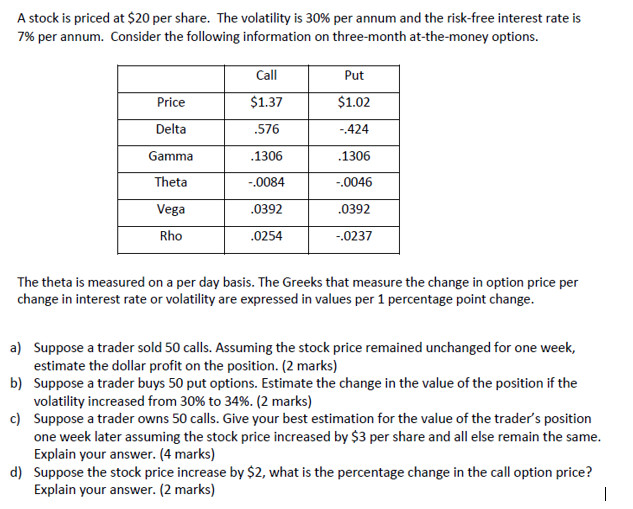

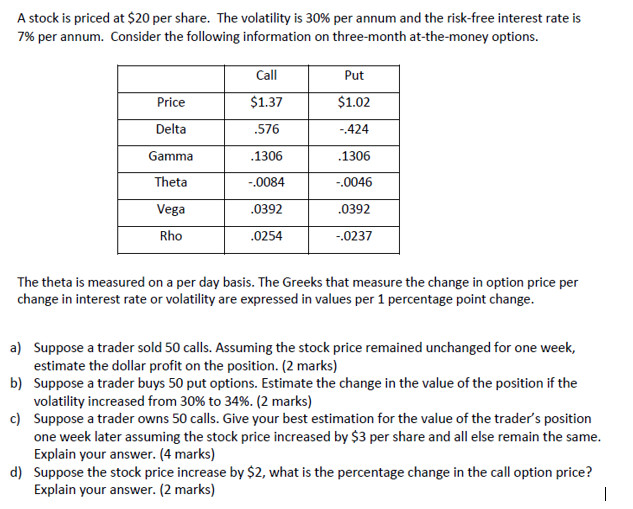

A stock is priced at $20 per share. The volatility is 30% per annum and the risk-free interest rate is 7% per annum. Consider the following information on three-month at-the-money options. Call Put Price $1.37 $1.02 Delta .576 -.424 .1306 .1306 -.0084 -.0046 Gamma Theta Vega Rho .0392 .0392 .0254 -.0237 The theta is measured on a per day basis. The Greeks that measure the change in option price per change in interest rate or volatility are expressed in values per 1 percentage point change. a) Suppose a trader sold 50 calls. Assuming the stock price remained unchanged for one week, estimate the dollar profit on the position. (2 marks) b) Suppose a trader buys 50 put options. Estimate the change in the value of the position if the volatility increased from 30% to 34%. (2 marks) c) Suppose a trader owns 50 calls. Give your best estimation for the value of the trader's position one week later assuming the stock price increased by $3 per share and all else remain the same. Explain your answer. (4 marks) d) Suppose the stock price increase by $2, what is the percentage change in the call option price? Explain your answer. (2 marks) | A stock is priced at $20 per share. The volatility is 30% per annum and the risk-free interest rate is 7% per annum. Consider the following information on three-month at-the-money options. Call Put Price $1.37 $1.02 Delta .576 -.424 .1306 .1306 -.0084 -.0046 Gamma Theta Vega Rho .0392 .0392 .0254 -.0237 The theta is measured on a per day basis. The Greeks that measure the change in option price per change in interest rate or volatility are expressed in values per 1 percentage point change. a) Suppose a trader sold 50 calls. Assuming the stock price remained unchanged for one week, estimate the dollar profit on the position. (2 marks) b) Suppose a trader buys 50 put options. Estimate the change in the value of the position if the volatility increased from 30% to 34%. (2 marks) c) Suppose a trader owns 50 calls. Give your best estimation for the value of the trader's position one week later assuming the stock price increased by $3 per share and all else remain the same. Explain your answer. (4 marks) d) Suppose the stock price increase by $2, what is the percentage change in the call option price? Explain your answer. (2 marks) |