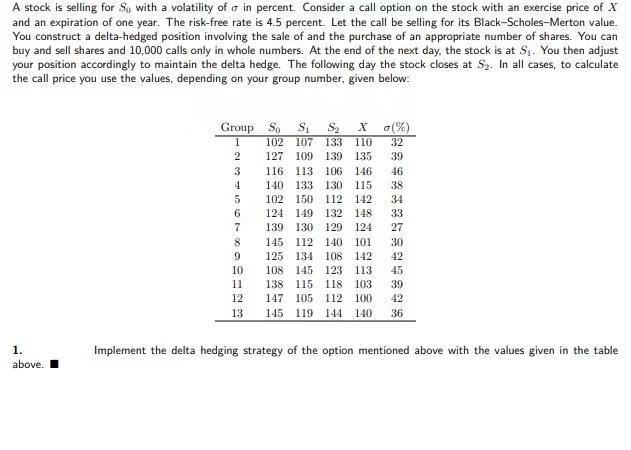

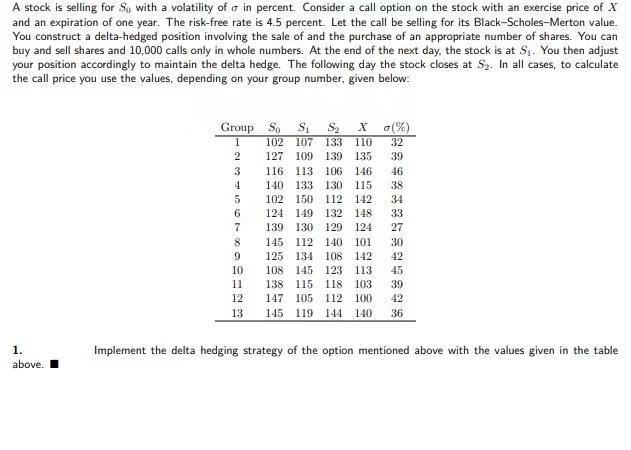

A stock is selling for So with a volatility of a in percent. Consider a call option on the stock with an exercise price of X and an expiration of one year. The risk-free rate is 4.5 percent. Let the call be selling for its Black-Scholes-Merton value. You construct a delta-hedged position involving the sale of and the purchase of an appropriate number of shares. You can buy and sell shares and 10,000 calls only in whole numbers. At the end of the next day, the stock is at Ss. You then adjust your position accordingly to maintain the delta hedge. The following day the stock closes at Sy. In all cases, to calculate the call price you use the values, depending on your group number, given below: Group S. S S2 X 0(%) 1 102 107 133 110 32 2 127 109 139 135 39 3 116 113 106 146 46 4 140 133 130 115 38 5 102 150 112 142 34 6 124 149 132 148 33 7 139 130 129 124 27 8 145 112 140 101 9 125 134 108 142 42 10 108 145 123 113 45 11 138 115 118 103 39 12 147 105 112 100 42 13 145 119 144 140 36 30 1. above. Implement the delta hedging strategy of the option mentioned above with the values given in the table A stock is selling for So with a volatility of a in percent. Consider a call option on the stock with an exercise price of X and an expiration of one year. The risk-free rate is 4.5 percent. Let the call be selling for its Black-Scholes-Merton value. You construct a delta-hedged position involving the sale of and the purchase of an appropriate number of shares. You can buy and sell shares and 10,000 calls only in whole numbers. At the end of the next day, the stock is at Ss. You then adjust your position accordingly to maintain the delta hedge. The following day the stock closes at Sy. In all cases, to calculate the call price you use the values, depending on your group number, given below: Group S. S S2 X 0(%) 1 102 107 133 110 32 2 127 109 139 135 39 3 116 113 106 146 46 4 140 133 130 115 38 5 102 150 112 142 34 6 124 149 132 148 33 7 139 130 129 124 27 8 145 112 140 101 9 125 134 108 142 42 10 108 145 123 113 45 11 138 115 118 103 39 12 147 105 112 100 42 13 145 119 144 140 36 30 1. above. Implement the delta hedging strategy of the option mentioned above with the values given in the table