Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A stock options dealer, OD, shorts 1,000 uncovered calls. Every call covers 100 shares. What is the risk OD is facing? OD decides to

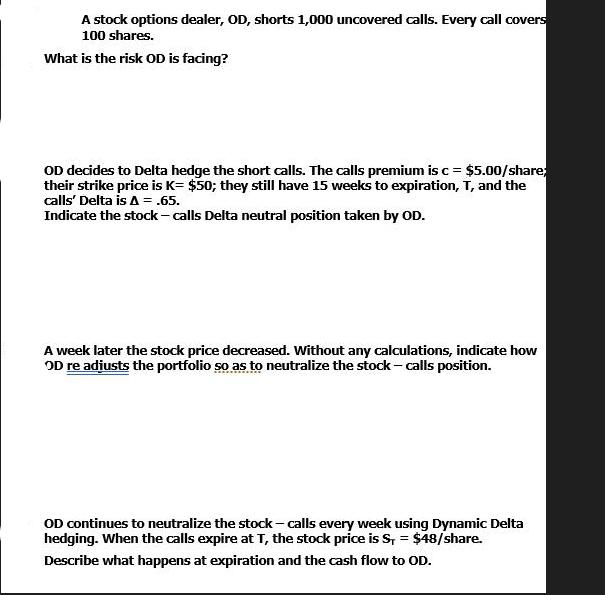

A stock options dealer, OD, shorts 1,000 uncovered calls. Every call covers 100 shares. What is the risk OD is facing? OD decides to Delta hedge the short calls. The calls premium is c = $5.00/share; their strike price is K= $50; they still have 15 weeks to expiration, T, and the calls' Delta is A = .65. Indicate the stock - calls Delta neutral position taken by OD. A week later the stock price decreased. Without any calculations, indicate how OD re adjusts the portfolio so as to neutralize the stock - calls position. OD continues to neutralize the stock - calls every week using Dynamic Delta hedging. When the calls expire at T, the stock price is S, = $48/share. Describe what happens at expiration and the cash flow to OD.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

81 Risk OD is facing When OD shorts 1000 uncovered calls they are exposed to unlimited risk If the s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started