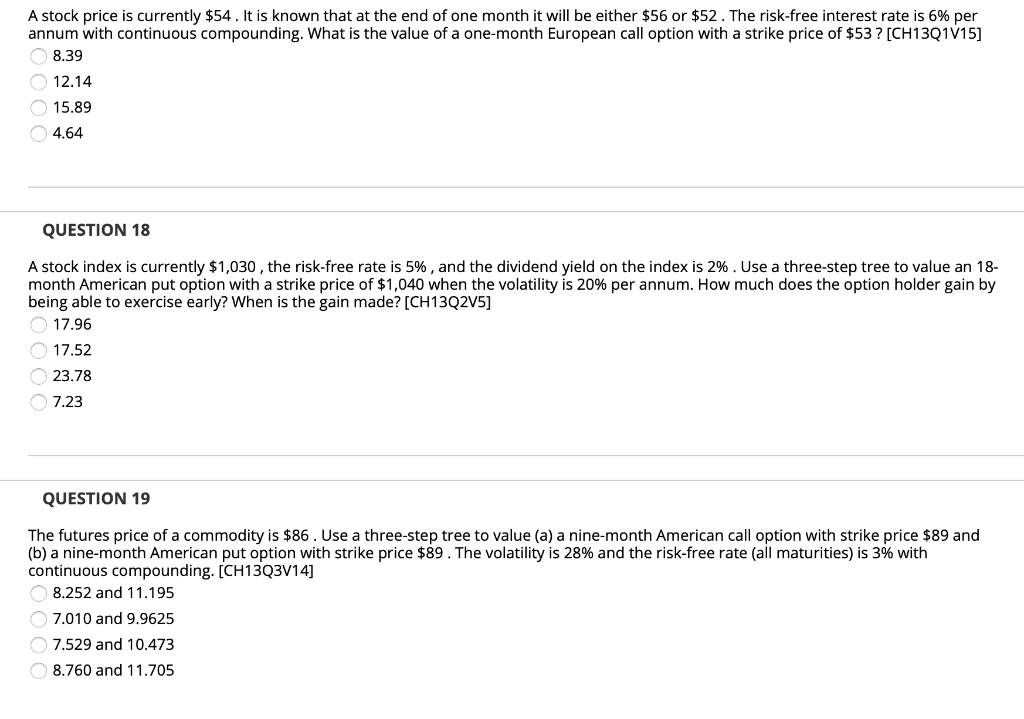

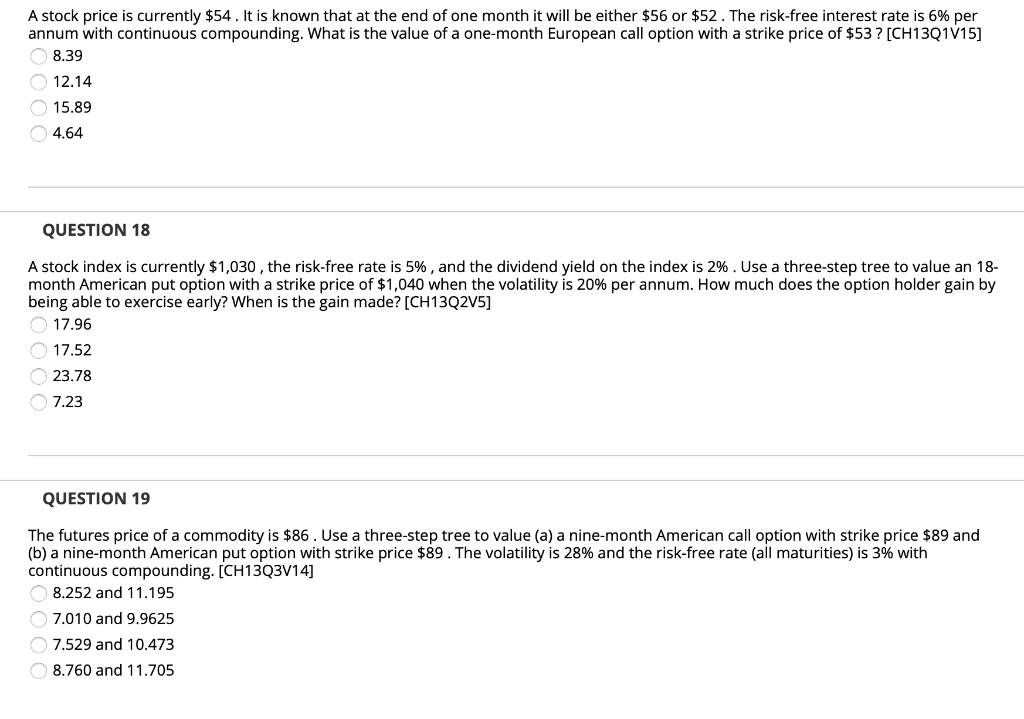

A stock price is currently $54. It is known that at the end of one month it will be either $56 or $52. The risk-free interest rate is 6% per annum with continuous compounding. What is the value of a one-month European call option with a strike price of $53 ? [CH13Q1V15] 8.39 12.14 15.89 4.64 QUESTION 18 A stock index is currently $1,030, the risk-free rate is 5%, and the dividend yield on the index is 2%. Use a three-step tree to value an 18- month American put option with a strike price of $1,040 when the volatility is 20% per annum. How much does the option holder gain by being able to exercise early? When is the gain made? [CH1302V5] 17.96 17.52 23.78 7.23 QUESTION 19 The futures price of a commodity is $86. Use a three-step tree to value (a) a nine-month American call option with strike price $89 and (b) a nine-month American put option with strike price $89. The volatility is 28% and the risk-free rate (all maturities) is 3% with continuous compounding. [CH13Q3V14] 8.252 and 11.195 7.010 and 9.9625 7.529 and 10.473 8.760 and 11.705 A stock price is currently $54. It is known that at the end of one month it will be either $56 or $52. The risk-free interest rate is 6% per annum with continuous compounding. What is the value of a one-month European call option with a strike price of $53 ? [CH13Q1V15] 8.39 12.14 15.89 4.64 QUESTION 18 A stock index is currently $1,030, the risk-free rate is 5%, and the dividend yield on the index is 2%. Use a three-step tree to value an 18- month American put option with a strike price of $1,040 when the volatility is 20% per annum. How much does the option holder gain by being able to exercise early? When is the gain made? [CH1302V5] 17.96 17.52 23.78 7.23 QUESTION 19 The futures price of a commodity is $86. Use a three-step tree to value (a) a nine-month American call option with strike price $89 and (b) a nine-month American put option with strike price $89. The volatility is 28% and the risk-free rate (all maturities) is 3% with continuous compounding. [CH13Q3V14] 8.252 and 11.195 7.010 and 9.9625 7.529 and 10.473 8.760 and 11.705